14th January 2001

News/Comment|

Editorial/Opinion| Plus| Sports|

Mirror Magazine

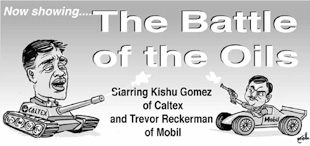

The battle of the oils

The liberalisation of Sri Lanka's lubricant industry last year saw

the entry of six new players with motorists being offered a wide range

of brands, all claiming to be superior than the other. Despite the competition

however, market leader Caltex continues to enjoy a more than 95% share

of the market and as the first (monopoly) entrant is protected by various

measures. The other lubricant players including Mobil complain of an

uneven playing field - facing restrictions on manufacturing rights

and having to pay high import duties - with their foreign principals losing

faith in the Sri Lankan market. The Sunday Times Business spoke to the

key officials involved in the Sri Lankan operation of US multinationals,

Caltex and Mobil on vital segments of the market. Excerpts from the interviews.

By Chanakya Dissanayake and Akhry Ameer

Trevor Reckerman, Director, Mobil

The playing field is not even

The liberalisation of the lubricant industry last year, saw six new players entering it. Do you think the market

is large enough for seven players including Caltex?

market

is large enough for seven players including Caltex?

The market is not large enough. The growth is lower than we initially expected. The market is mainly determined by the car population, which will not grow dramatically. The aviation and marine sectors are also slowing down. I don't see any room for six or seven players to operate. Caltex will most probably dominate the market with a 95 percent plus market share.

The rest of us will have to share the remaining five percent. Many players will drop out, but of course I don't intend to be one of them!

Caltex is confident of maintaining is giant market share. So how do you plan to win market share from Caltex?

I am concentrating more on keeping us viable and operating on the quality end of the spectrum. I do not intend to get involved in a market share battle. If I am to go for market share, then I'll have to buy it at an enormous cost. Mobil is not prepared to do that. We have to maintain our profitability in order to remain in the market.

Since you have to import, stock and sell, inventories play a major role in the cost structure. What is your strategy towards minimising the inventory cost while maintaining a viable operation?

We are maintaining a high level of efficiency to minimise stock costs. We get our stocks from Singapore.

Since it is a joint venture with Mobil of Singapore, the lead time for stocks is only the shipment time. Which is only about four weeks. We also carry an inventory here in Sri Lanka. We have revised our expectations of the Sri Lankan market and we are adopting a practical approach.

After liberalisation do you see an even playing field?

The playing field is definitely not even. This has been one of the main concerns of the marketers who entered the lubricant market in Sri Lanka.

We have made many representations to PERC. We believe that PERC should be responsible for maintaining a fair playing field as the premier state privatisation agency.

But we are disappointed with the PERC's response. Our representations to PERC have been ignored. Mr. Mano Tittawella, PERC Director-General, gave us a patient hearing but we were later informed that all our requests have being rejected by the treasury.

I firmly believe that we deserve a hearing from the government. If this situation continues, our principals will lose all confidence in the Sri Lanka market.

Caltex has the massive advantage of having the "Lanka" brand to cater to the lower and the middle markets.

Does Mobil plan to introduce an economical brand to the lower end?

We have a product to compete with the DS 40. We call it HD 40. But it will not be priced the same as DS 40 since it is not manufactured here. We are using HD 40 as a strategic product to enter the market.

We do not want to get involved in a pricing war, which will finally be fought on the streets. There is a time you should wait and watch how the playing field performs.

The lubricant manufacturing sector is set to be liberalised in 2004. Do you intend to enter into manufacturing?

I don't think so. It will not justify the investment, the way things are going.

Traditionally lubricant marketing campaigns were woven around motor sports.

Do you intend to introduce any innovative promotion campaigns to the Sri Lankan market?

What we are concentrating right now is on distribution and being strong on the ground. For me the rest is fanciful. Motor racing is a way of maintaining a profile. Mobil has been involved in motor racing both here and abroad. Right now we want to build up a relationship with the service stations.

We have about 300 steady accounts, which we are nurturing as a long term strategy.

As you can see, Mobil has not resorted to media (advertising). Without islandwide distribution there is little justification in spending on the media. I may have a TV spot on air, but if our distribution is limited to 200 outlets only, it will not bear any results. Therefore we are spending more time to approach the people in the industry, carry out training programs and push the quality aspect.

If you take the other players, they are all tied up with motor car dealerships. Do you intend to tie up with one?

That is the strength of Mobil as a brand. We are the manufacturer's choice of many leading car makers including Mercedes Benz, BMW and Toyota.

Globally Mercedes and Mobil conduct R&D together. But for some reason, Mercedes' local agent Dimo has tied up with Shell.

We have exclusivity with BMW. We are also tied up with many car companies that include Carmart and Stassens.

All the players in the lubricant industry except Caltex have been complaining about the import duty structure. What are your comments?

This has being a major issue. We have made a number of representations

to the government and we need short term support to be viable. Currently

we pay 25 percent duty on the end product with GST added on top of it.

Kishu Gomez, Director and General Manager, Caltex

We are the technology leader

Six firms have entered the Sri Lankan market after liberalization. Do you think that the Sri Lankan market has potential to support an increase number of players?Though 6 players got the approval to enter this market, only 5 players are in operation. Indian Oil Company namely Servo has not entered the market and it is too early for us to know as to what their strategy or plans are going to be for this market. Obviously the other 5 players have put in a lot of energy into this market and tried various strategies and tactics. I don't know how they perceive their own performance. With regard to the market size, actually it depends on what your objective is. If a company is looking at 30 to 40% market share it might be a little too optimistic. If you take any competitor coming into the market it will not have a second brand as such, only we will have the second brand so to speak. Most of these products are premium products and they all have the latest specifications, and that is very much similar to the range we have, though we have unique advantages over competitors. So that's the market for them. Right now, that market is not big enough for six players. Most of these companies haven't invested that much of resources in this market. Therefore they only have to meet operational assets for which they might be aiming at a particular volume. In the short term, profitability wise I don't think it will be that good for them, but obviously they must be having medium term and long term plans.

Your market share is as much as 90%. How will the new entrants affect your share and what is your strategy to maintain this level?

Actually the market share stands at 98% for us. The 5 competitors have taken a 2% share. Before the market liberalization was announced we knew for what period we would have the monopoly rights. So we came out with a very strong integrated multi-tiered strategy, covering all segments, and there we looked at two different strategies for Caltex and Lanka separately.

We also believe in intellectual assets. We as an organization think that people matter the most. In our case we looked at the required number of people with the right level of competencies well in advance, recruited them and gave them proper training. In terms of performance of competitors, I don't think they have achieved their objectives, whereas we have. We set ourselves an objective of maintaining 97% market share and we have in fact defended 98% market share. Apart from the volume achievement we also have achieved our profitability objectives. As you know 49% of the shares are traded and we are answerable to the shareholders. We have declared the same dividends this year as well keeping the shareholders really happy.

In terms of the product strategy, right now we are the technology leader both in this market and also in the world, and if you go through some of the product launches we have done in this market most of them were new technology that we introduced to the world, for e.g. Havoline Energy. So in terms of all strategies we lead the market dynamics. We never expected to be driven by the market dynamics. We made the change to our advantages, not looking at any other criteria but purely looking at what the customer requires. In doing so, we never waited for the market to change for us to move, we moved quietly and did things right.

Other companies will be able to start manufacturing in Sri Lanka after 2004. In your opinion, do you think any other firms will go into manufacturing?

Once again it depends on their strategy. My personal view is that for somebody to start local manufacturing one should have at least a 30% market share. Obviously one will have to work out what volume level is profitable for them to start local manufacturing. Who can think of a 30% market share as an individual company during the next 3 to 4 years? As you have already seen during the first year they have just got a 2% share and that's for all companies.

Are there any plans of using Sri Lanka as a manufacturing base and exporting Caltex products to other countries like India?

We have already started exporting to Maldives and Mauritius. We have only started that. We are also doing contract blending to one competitor. We are open for that, but that's mainly for marine lubricants. We don't have big cost advantages to fight with countries like India, not in the short term, but long term that might be a possibility. We will be concentrating on that, not India, but may be other countries where opportunities exist.

Inventories play a major role in holding costs. What is your strategy to minimize these stock costs?

More than 80% is blended locally. We also get down some products like coolants, power steering oils and some industrial products, which cannot be blended locally; because to blend these products you need chemical plants and our market size is not enough for us to make that investment.

Unlike any other competitor we don't have to keep on guessing. We know what the market needed during the last six years. We know what the potential is for each product segment, each pack size, each float. Therefore we can be very cost effective in maintaining the inventory, where as the competitor is not in a position to do that. The competitor might know what the market potential is, but the competitor might not know what potential he has for it. Therefore they tend to make mistakes. In that sense I can say that our inventory management has been very effective.

What is Lanka Lubricants' distribution strategy at present and in the future taking into consideration the competition?

We only have the exclusive selling rights at the CPC outlet channels. All the other channels are open for competition. In our case, our distribution network is as such, that we always channel most of our products through the CPC dealers. What is consumed at the CPC dealer level is not healthy. Among the CPC dealers we have appointed distributors and they take the products to the service stations, spare parts outlets, fleet owners and to all customer segments. During the period of the monopoly rights they were doing a big job for us, so we just want to continue with that. But it doesn't mean that we are confined to the traditional way of doing business. If you look at our distribution strategy we ourselves are looking at new innovative channels. For example we have developed 50 "Lube" outlet channels right round the country in main towns where the customers have to go a long distance to make their purchases. We have gone closer to them and made their purchases so much easier. Though our competitors basically blame Caltex for dominating channels, it is not the case. During the day a customer goes to more than 20 different places. Wherever they go we see an opportunity and we have to be smart and innovative enough to reach the customer.

The CPC filling station is just one destination which the customer patronises. These is nothing that prevents others from approaching the same customer elsewhere? It depends on how you look at the market, what your mindset is and what you want to really do with it. When it comes to the commercial and industrial segments the products directly go to the end customer.

Competitors before entering the market were talking about growing the high street channel. What have they actually done to grow the channel?

If you do a survey, you will find that we have a better share than the competitors including the high street channel.

What are the separate marketing strategies for the two brands that you are operating, i.e. Caltex and Lanka brands for the future?

We treat the two brands as two separate markets and we have different strategies. Lanka is a trusted brand. That brand has been in the market for the last 35 years. People have very good experiences with it. People haven't had any problems with that brand. We go on the trusted platform. Therefore they don't have any reason to evaluate any other product or proposition by competitors. We have started building on the brand "Lanka", it was not a brand earlier but only a product. We will build on that and add more and more value.

On the other hand Caltex is technology. In the Caltex brand you will find the latest technology available in the world. We are making constant improvements to the quality and we have been working on getting the latest specifications from the American Petroleum Corporation and we will be the first to get that. Caltex is a premium quality product. It is the target market that insists on the best quality. It has been perceived really well in this market. We have achieved very good results and even the Caltex share is growing.

We have heard of Lanka Lubricants planning to enter into other area like gas and bunkering. What is the scope of your expansion plans?

We are very much positive about any opportunity in this market. We have a lot of assets in this market. We have retained profits to make any future investments. LPG is under review. We have got the approval from the government and PERC. We haven't finalised plans as yet, we are still working on that. Within the next two weeks or so we will communicate our plans to you. With regard to bunkering a decision was made I think to privatise. I don't think it will be open to everybody. We will definitely have an opportunity there. It is too early for me to say anything more than that.

We understand that your revenue cash reserve of around Rs 1.2 billion has not been remitted outside the country. Have you identified any area for further investment?

We have to basically see what our business strategy is going to be for the new industry or markets. Gas is one opportunity, which we are working on. Bunkering is one another. The other product is aviation fuel. We are supplying aviation fuel to some of the airlines, since we started one and a half years ago. We will see what opportunities are available in that area. Exports is obviously one, but you will not be requiring that much.

Apart from new businesses we are also looking at investing the retained profits to offer a better service to the customer in the lubricants industry itself. For example we made Rs 70 million investment in a computer software package and we are much more effective now. We are looking at introducing a new service concept in Sri Lanka mainly for vehicle servicing. This will be a new experience to our market.

What is the perception one has of the Service Centre?

If you have a choice you wouldn't go there. Here the environment is

going to be totally different where we will provide internet services,

TV, airconditioned waiting rooms, etc. Then we are looking at a customer

service centre not only looking at the dealer network but also the actual

customer.

Shipping & Aviation

China approves freight forwarders association

China's rapidly expanding freight forwarding industry has received approval from Beijing to set up its own freight forwarders associa-tion, China International Freight Forwarder's Association (CIFA).The new body has meanwhile elected Luo Kaifu, board chairman and president of Sinotrans (China National Foreign Trade Transportation Group Corp) as its first president.

The new organisation will act as a bridge between government and freight forwarders in China, the China Daily newspaper reported.

The newspaper quoted Mr. Kaifu as saying that CIFA's "main work will be to communicate with the government, serve enterprises it represents and promote the industry's development."

China currently has over 2,000 international freight forwarders registered with the Ministry of Foreign Trade and Economic Co-operation and more than 430 companies have meanwhile registered as CIFA's members, the paper added.

In a related development, the Hong Kong Association of Freight Forwarding

Agents (HAFFA) announced that a second conference for freight forwarders

from Beijing, Shanghai, Hong Kong, Macau and Taiwan will be held on October

30 - November 1, 2000 in Macau. Delegates attending the event will discuss

issues related to doing business in China with Chinese forwarders. CIFA

members are expected to join the conference for the first time in their

new capacity.

BES fulfils profit and growth targets

Back in April last year, "K" Line Europe's Short Sea Division decided to introduce its own chartered Ice Class vessel onto the competitive North Baltic route to replace the use of commercial feeders. The objective? To improve service reliability, guarantee line-haul relay conne-ctions, and reduce slot costs. Four months later, the resulting combination of increased volumes and cost savings to K Line means that the Baltic Express Service has exceeded expectations, propelling BES into profit and playing a major role in supporting K Line's European growth." K" Line has been active in the Finnish market for many years and, thanks to a close relationship with long-serving agency partner Oy Viktor Ek in Helsinki, we have developed an excellent standing with paper and forestry product shippers which make up 90% of Finland's exports. This has led to the EURCO Far East service becoming one of the largest conference carriers out of Finland and a healthy share for the IBESCO service of Portuguese cargoes.

Traditionally cargo has been exported through a variety of the country's many small ports, such as Rauma, Mantyluoto, Kotka, Turku and Hamina, as well as Helsinki itself. However, growing volumes, increasing enthusiasm among shippers for long-term service contracts with "K" Line, and a steady concentration of cargoes using Rauma and Mantyluoto ports created the ideal opportunity to review the way we served our customers and led to the introduction of our own dedicated feeder.

The 508 TEU 'Jan Fabian' is an ideal ship for the service. Built in 1998, her 15.5 knot service speed enables her to maintain a highly reliable, fixed-day weekly schedule between Rauma, Man-tyluoto and Breme-rhaven, where cargo connects to EURCO, TASCO and IBESCO services. Operating our own feeder has allowed "K" Line (Europe) Ltd., to offer our deep-sea customers a vastly superior operation, targeted towards an ongoing commitment to deliver an ever more reliable service. Despite early problems due to Finnish strikes, BES volumes and profits are increasing and the good service connections are driving further growth to the Far East, USA and Iberia. In addition to BES, the short sea services of IBESCO link Sweden, Denmark, the UK and the Northwest Continent with Portugal (Lisbon and Leixoes) and Spain (Bilbao). The Short Sea Division is always looking to extend "K" Line's connections by developing profitable services into other areas. And, as the example of BES shows, if it makes commercial sense to deploy our own chartered vessels rather than utilize commercial feeders, " K" Line is ready and able to respond in the best interests of our customers, as well as for the financial benefit of

" K Line as a whole.

E-Commerce: nine lines in web challenge to Inttra

The continuing battle for supremacy among shipping portals is heating up with the launch of a new venture between a Silicon Valley company and a substantial portion of the east Asian and North American carriers.Nine lines have joined forces with Tradiant, a pure technology company, to launch a neutral technology platform expected to come on stream early next year.

The multimillion dollar product, code-named Global Transportation Network, creates a significant second centre of gravity in the shipping internet world and encompasses a substantial portion of global tonnage.

The carriers involved include API., CP Ships and its affiliates, Hanjin, Hyundai, KLine, Mitsui OSK Senator, Yang Ming and Zim.

The product is a combination of transportation and technology expertise aimed at simplifying containerised transport through easy transactions across the chain of international trade.

GTN will use Tradiant's e-commerce platform which includes booking, track and tracing, and scheduling and will add tailored capabilities for shippers and lines such as rate and contract mana-gement, cargo forecasting and allocation.

Commentators, especially in eastern markets, feel GTN represents a potentially exciting new product, well thought-out commercially with a particularly good yield management component.

Cost and time saving benefits are a central benefit of the service.

The execution of transportation is a highly critical component of global supply chain management and many e-business offerings are rushing to offer e-logistics solutions.

To date most of the B2B models in the shipping industry have been narrowly focused, using auctions or exchanges, and have failed to completely meet the underl-ying needs of customers which want unified internet-based platforms that simplify interaction with carriers globally.

In a statement announcing the formation of GTN the shipping lines jointly indicated that partnering with a high-powered technology organisation is what will set their product apart from others.

GTN expects the involve-ment of Tradiant as the major shareholder to guarantee neutrality and security for the various lines and cargo owners.

This is seen as one of the strongest selling points for the product in an industry fraught with paranoia, often legitimate. over the possible theft of vital customer information and market share.

Together, the founding carriers will have a significant equity stake in the new venture, but not a majority holding. "Tradiant will hold the rest, thereby creating the necessary 'trusted third party' to ensure neutrality," the lines said.

There is room in the GTN stable for additional players and indications are that it is negotiating with other lines to join its party.

Competitors in the market include Inttra, which comprises Maersk Sealand, P&O Hamburg Sud, MSC and CMA-CGM. Inttra has highlighted its neutrality and the inter-line access to track and trace, scheduling and booking services.

Inttra's main competitor, Hutchison Whampoa's PortsnPortals, has been rebranded as Line.net in an attempt to reposition the service as a carrier and shipper tool.

![]()

Front Page| News/Comment| Editorial/Opinion| Plus| Business| Sports| Mirror Magazine

Please send your comments and suggestions on this web site to