The Budget - a great tragic-comedy ?

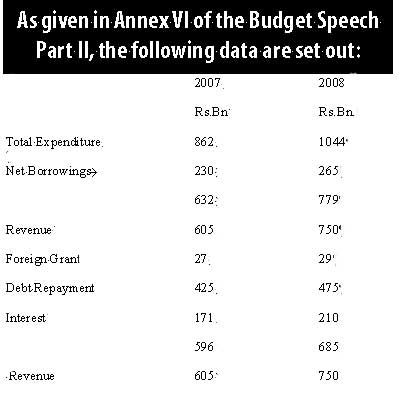

In the absence of proper disclosure of debt repayment, debt repayment has been reckoned, as the difference between the level of borrowings, as per the Appropriation Act No. 47 of 2006 and the Appropriation Bill 2007, less the ‘Net Borrowings’ given in Annex VI of the Budget. This needs correct ascertainment. Accordingly, for 2007 re-payment of loans and interest amounts to Rs. 596 billion i.e. 98% of estimated revenue for 2007. For 2008 re-payment of loans and interest is reckoned at Rs. 685 billion i.e. 91% of budgeted revenue for 2008. This would be so, if the estimated and budgeted revenues for 2007 and 2008 are, in fact, achieved. On the other hand, the revenue up to October 31, 2007 has been Rs. 445 billion, as reported by the Central Bank. Therefore, would not the likely revenue for 2007 be around only Rs. 540 billion ? Hence, how could a revenue of Rs. 605 billion be achieved for 2007, as had been estimated in the Budget presented on November 7, 2007? Would not such situation result in further borrowings of over Rs. 60 billion, with the expenditure having to be incurred ? Would not then the re-payment of loans and interests for 2007 reckoned at Rs. 596 billion, be well above the total likely revenue of Rs. 540 billion for 2007, with the Appropriation Act No. 47 of 2006 having provided for borrowings of Rs. 655 billion, with the actual borrowings undisclosed ? In this likely realistic scenario of revenue of around Rs. 540 billion for 2007, how could the 2008 budgeted revenue ever be Rs. 750 billion, an increase of over 38% over 2007 ? Would not the revenue of 2008 likely to be in the region of Rs. 600 - 625 billion ? The additional net revenue from 21 new Revenue Proposals in the Budget for 2008 has been estimated at Rs. 24.9 billion. Ought not the revenue for 2008 of Rs. 600 – 625 billion be compared with the reckoned re-payment of loans and interest of Rs. 685 billion for 2008 and the approved borrowings in the Appropriation Bill 2007 of Rs. 740.9 billion ? Furthermore, with the prevalent current situation of an internal ‘undeclared’ or ‘declared’ war, the business sector development would be thwarted impacting upon the level of State Revenue. Therefore, would not there have to be further borrowings, in the region of Rs. 100 – 150 billion in 2008, over the limit in the Appropriation Bill 2007 of Rs. 740.9 billion, with the borrowing levels becoming well above the likely revenue levels of Rs. 600 - 625 billion for 2008? How long could this go on? Ought not the debt service be compared with revenue levels? As per the Central Bank, the total debt as at October 31, 2007 stood at Rs. 2994.7 billion, without taking into reckoning the indirect debts of the government through corporations, such as CEB and CPC. The ‘accuracy’ of financial data is in question, since the audited Government Accounts for 2006 gives materially different figures in certain instances in respect of 2005, when compared with the audited Accounts of 2005. Director General State Accounts for 2006 has certified his own Accounts, as the Auditor General in 2007, suppressing the ‘scathing’ Special Report submitted by the former Auditor General to Parliament in July 2006, on the appalling Revenue Administration and the scandalous VAT Fraud. Though Article 153 of the Constitution stipulates that the Auditor General shall hold office during ‘good behaviour’, and that the Office of Auditor General shall become vacant on his attaining the age of 60 years, the present Auditor General, who thus vacated Office on December 13, 2007, obviously ill-advisedly, has been temporally re-appointed, in violation of such constitutional stipulation ! As per the Central Bank, the remittances from the poor workers in the Middle East, undergoing ‘social trauma’ and grave hardships, up to August 2007 has been US $ 1763 million, and for the 10-years to December 31, 2006 had been US $ 13,800 million. What would have been the plight of the country, if not for such remittances? On the other hand, cognisable export proceeds are blatantly permitted to be kept and expended abroad, as revealed by a ‘survey’ by the Controller of Exchange and highlighted as reported by the Auditor General, in the 2005 COPE Report, intriguingly without any action being taken thereon ! As per Annex II of Budget Speech Part II giving 21 new Revenue Proposals further ‘burdening the people’ for 2008, an increase of Net Revenue of Rs. 24.9 billion is estimated. Ought not this be compared with the cognisable losses caused to the State reckoned in the region of Rs. 30 to 40 billion by the two scandalous privatisations of LMSL and SLIC alone, which are now before the Supreme Court? The stance taken on LIOC saved around Rs. 4,000 billion, with the stoppage of the continuity of a ‘dubious subsidy! Ought not the colossal losses to the State and the people caused by ‘dubious’ privatisations be investigated, with remedial and equitable action taken thereon, and those responsible held accountable? Budget Speech Part II at paragraph 20 refers to the repeal of the ‘Tax Amnesty’ of 2003, stating that many state taxes to which such ‘amnesty’ applied are now recoverable. In fact, would not the revenue levels of 2006 and 2007 be as a direct result of this, consequent to the repeal of the ‘Tax Amnesty’ in October 2004? This was as a result of sustained efforts, amidst severe obstructions, obstacles and indifference by those interested, affected and others, vis-à-vis such perverse ‘Tax Amnesty’, which was declared by the Supreme Court, inter-alia, as fraudulent, defrauding public revenue causing extensive loss to the state. In the absence of achievement of estimated and budgeted revenue levels, and if borrowings are not raised, how is the budgeted expenditure to be met? |

|

||

| || Front

Page | News

| Editorial

| Columns

| Sports

| Plus

| Financial

Times | International

| Mirror

| TV

Times | Funday Times || |

| |

Reproduction of articles permitted when used without any alterations to contents and the source. |

© Copyright

2007 | Wijeya

Newspapers Ltd.Colombo. Sri Lanka. All Rights Reserved. |