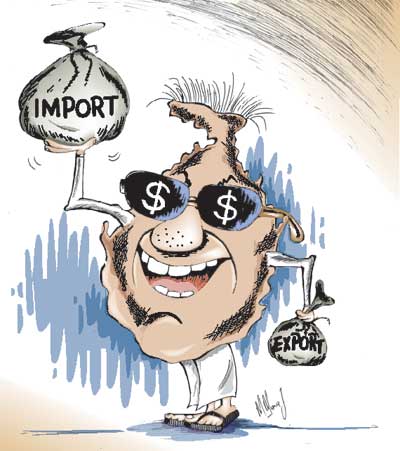

In borrowed plumes, we relish

In fact these statistics are deceptive. The state of the economy and external finances are far from what the balance of payments statistics and the foreign exchange reserves indicate. There are fundamental weaknesses in our external finances that are masked by these favourable statistics. The danger lies in their being considered reasons in not worrying about our trade and balance of payments performance. The only glaring statistic that is discomforting to the government is the high rate of inflation. The ever rising cost of living is certainly a headache, though several of the real causes for it remain hidden and not acknowledged. The country’s foreign exchange reserves at the end of the year was a high US $ 4510 million, enough to finance about 4.8 months of imports. This is 22 percent higher than a year ago and one of the highest levels achieved recently. What is more, the country is expected to register a balance of payments surplus of between US$ 200 to 300 million. In fact the country has had balance of payments surpluses in the three previous years as well though trade deficits have been increasing progressively. Although these balance of payments surpluses appear to indicate that the external finances of the country are sound, there are serious concerns. Despite the balance of payments surplus and the high level of foreign exchange reserves, the country is running a huge trade deficit. In 2007 we recorded the highest ever trade deficit. Last year the deficit reached US $ 3560 million surpassing the trade deficit of US $ 3371 in 2006. This massive deficit was incurred in spite of an export growth of 12.5 percent. The trade gap widened as imports have grown by much more than exports. Imports grew by US $ 1047 million while exports grew by US $ 857 million. Consequently we suffered the highest trade deficit ever. Last year the deficit reached US $ 3560 million exceeding the trade deficit of US $ 3371 in 2006 by a further 5.6 percent. Despite this adverse trade balance, the balance of payments is estimated to show a surplus owing to the large amount of remittances, the considerable amount of foreign borrowing and investment capital inflows. The balance of payments surplus is counter balanced by an increase in foreign borrowing. The recently borrowed funds can prove a particularly serious strain on the balance of payments in three years’ time when it requires to be repaid. The foreign debt of the country rose to Rs.1364 billion by November last year from Rs.1082 billion a year before and is now 45 percent of the total public debt. This is high, especially as the recent debts that have been incurred are at high commercial rates of borrowing and at terms that require repayment in a few years. What the external financial accounts of the country indicate is that the balance of payments surplus and adequate foreign exchange reserves are owing to factors that are not due to developments in the country. On the one hand, much of the offsetting of the trade deficit is owing to foreign remittances from nationals living abroad. The other significant way in which we have achieved a balance of payments surplus and increased our foreign reserves is by foreign borrowing. The recent amount of foreign loans far exceeds the amount of the balance of payments surplus of 2007. This is the deception that should not lull us into thinking that our external finances are healthy. The other aspect is that the foreign debt and debt servicing is increasing sharply and the capital and interest repayments would be a burden in future years. When a country’s external finances are sound it is likely that the internal economy is also well managed and healthy as the external financial statistics more often than not reflect a country’s economic performance. This is more so with respect to the Sri Lankan economy that is highly dependent on trade with a trade dependence of around 70 percent. What this means is that the value of exports and imports of the country expressed as a percentage of its GDP is as much as 70 percent. It gives an indication of the degree of trade dependence. However this is not so for the reasons adduced earlier. In reality we are living beyond our means and borrowing funds to finance the trade deficit. We are also depending on persons working abroad to finance most part of the deficit. The important point that requires to be realised is the vulnerability of the economy when the balance of payments deficits are financed in this manner. There must be an effort to contain imports on the one hand, and increase exports on the other. The current levels of increases in exports are inadequate to meet the country’s escalating import costs. The smugness that has arisen owing to the balance of payments surplus generated in this manner and the increases in foreign reserves achieved by large scale costly borrowing are dangerous. The external accounts are a reflection of internal economic performance. Our export supply elasticity is low on the one hand, while the competitiveness of our products in the international markets could also be hampered by the increasing costs of production owing to the rise in energy costs and costs of inputs. Further the current recession in the country’s main export market for industrial goods is a serious concern. It is vitally important to recognise the weaknesses in our trade account rather than be lulled into comfort by the misleading statistics of the balance of payments surplus and foreign exchange reserves. |

|

||||||

|| Front

Page | News | Editorial | Columns | Sports | Plus | Financial

Times | International | Mirror | TV

Times | Funday

Times || |

| |

Reproduction of articles permitted when used without any alterations to contents and a link to the source page.

|

© Copyright

2008 | Wijeya

Newspapers Ltd.Colombo. Sri Lanka. All Rights Reserved. |

The massive trade deficits that the country has been incurring in recent years is not viewed with any anxiety or concern as there have been small balance of payments surpluses and the foreign reserve position is good. Yet these have been achieved in a manner that should not lead the country to complacency about the state of our external finances. An ample level of foreign exchange reserves, a balance of payments surplus and an economic growth of between 6 and 7 percent are masking some fundamental problems in the economy. A country that has a foreign exchange reserve of the level Sri Lanka has and the fact that the country has been able to record balance of payments surpluses in the last several years supports the view of a healthy economy.

The massive trade deficits that the country has been incurring in recent years is not viewed with any anxiety or concern as there have been small balance of payments surpluses and the foreign reserve position is good. Yet these have been achieved in a manner that should not lead the country to complacency about the state of our external finances. An ample level of foreign exchange reserves, a balance of payments surplus and an economic growth of between 6 and 7 percent are masking some fundamental problems in the economy. A country that has a foreign exchange reserve of the level Sri Lanka has and the fact that the country has been able to record balance of payments surpluses in the last several years supports the view of a healthy economy.