An email and street poll jointly conducted by the Business Times and the Colombo-based Research Consultancy Bureau (RCB) on the controversial pension scheme found a majority of the respondents rejecting the scheme.

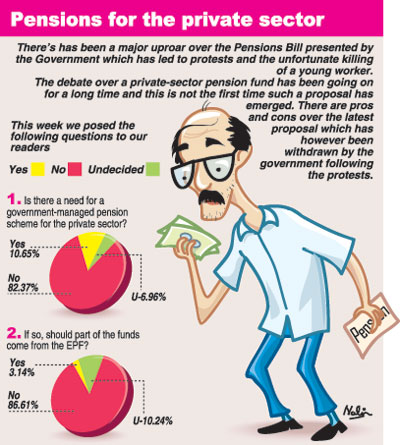

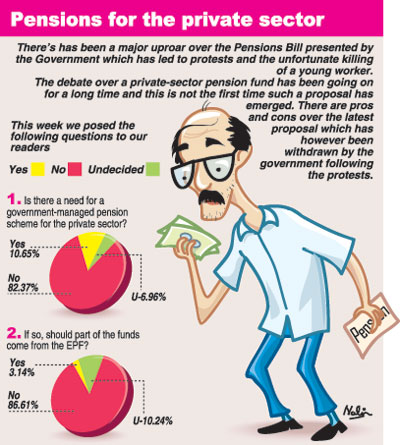

Asked whether there is a need for a state-managed pension scheme for the private sector, 82.37 % of the respondents said NO while another 6.96 were Undecided. Only 10.65% responded with a YES answer.

In response to the second question, “If so (agreable to such a pension scheme), should part of the funds come from the EPF?”, 86% of the respondents said the EPF should ‘not’ be touched. While the Pension Bill only refers to a contribution from the ETF, doubts have been expressed in many quarters that some funding may be drawn in (later) from the EPF. In response to the second question, “If so (agreable to such a pension scheme), should part of the funds come from the EPF?”, 86% of the respondents said the EPF should ‘not’ be touched. While the Pension Bill only refers to a contribution from the ETF, doubts have been expressed in many quarters that some funding may be drawn in (later) from the EPF.

More than 800 people – both from street interviews and through email – responded to the poll with the respondents ranging from CEOs, office workers, professionals and young people. The Business Times and RCB have jointly conducted many polls in the past on important economic, political and social issues.

Street respondents told RCB researchers that they were happy that such a poll was being conducted. “They said this is the first time the public is being asked for their views on the pension issue,” one RCB official said.

While the poll gives a thumbs-down for a pension scheme, many of the comments from the poll implied that though a pension scheme is necessary, people have lost faith in the government managing a transparent, property-run scheme.

“This government is saying something and doing something else. We have voted for them and now we are afraid; they are trying to take our hard earned money,” said one street respondent. Another respondent in the email poll said: “ I do not trust the government (or any government) to manage a pension fund for the private sector.”

Here are excerpts of other comments from the poll:

- Government is trying to do something without transparency.

- The Government says it won’t touch the EPF but they are doing the ground work to use these funds.

- Slowly they are trying to grab our money.

- There is a pension scheme in America. But they (authorities) are not deducting from one and giving it to another.

- If this bill works properly, the Government can get Rs 1.6 billion per month. For 10 years they can get this money every month and pay the HSBC (bond) loan which they have taken.

Despite ho ha, pension scheme for migrant workers on course

Despite the Government withdrawing the Pension Bill for the private sector, the authorities are determined to go ahead with the pension scheme for migrant workers which has generated little discussion or debate.

The Overseas Employees’ Pensions Benefits Fund was presented to Parliament in April along with the Employees’ Pension Benefits Fund, the latter triggering a majority controversy and clashes between protestors and police, leaving one dead.

“There is no issue (or controversy) over this Bill. The hon. Minister is keen to go ahead with it,” Sri Lanka Bureau of Foreign Employment (SLBFE) General Manager H. Batagoda told the Business Times.

According to the proposed Act, membership is voluntary for migrant workers who may opt to join by contributing not less than Rs 12,000 per annum for a minimum two consecutive years before reaching 55 years. They are entitled to a pension when reaching 65 years. |

|

In response to the second question, “If so (agreable to such a pension scheme), should part of the funds come from the EPF?”, 86% of the respondents said the EPF should ‘not’ be touched. While the Pension Bill only refers to a contribution from the ETF, doubts have been expressed in many quarters that some funding may be drawn in (later) from the EPF.

In response to the second question, “If so (agreable to such a pension scheme), should part of the funds come from the EPF?”, 86% of the respondents said the EPF should ‘not’ be touched. While the Pension Bill only refers to a contribution from the ETF, doubts have been expressed in many quarters that some funding may be drawn in (later) from the EPF.