Columns

Containing fiscal deficit: The tough task ahead

The Finance Ministry’s resolve to achieve the fiscal deficit target of 6.2 per cent of GDP is indeed a tough task. It is likely to increase to more than 7 per cent of GDP this year. Recurrent expenditure is continuing to increase significantly, while revenue expectations are not likely to be realised. The fiscal deficit of Rs. 139.8 billion for the first four months when annualised indicates a deficit of 11.5 per cent of GDP, according to the Finance Ministry.

Despite these fiscal results, the Treasury is of the view that “the fiscal operations in the year as a whole are expected to remain consistent with the targeted deficit of 6.2 per cent of GDP.” It is difficult to understand how the fiscal deficit could be contained at 6.2 per cent. Even before the fiscal performance for the first four months were known, the fiscal deficit was expected to be high. The fiscal outturn in the first four months substantiates this expectation of a high fiscal deficit this year.

Fiscal outturn

The fiscal outturn in the first four months indicates that it would be extremely difficult to contain the deficit this year within the target of 6.2 per cent of GDP. The shortfall in revenue is understandable in a context of economic downturn.

In the face of the adverse economic performance, expenditure is expected to be contained. However, government expenditure continued to increase beyond the levels originally anticipated. The adverse economic developments and increased government expenditure would undoubtedly increase the fiscal deficit this year. Containing the fiscal deficit in the second half of the year is a tough task but vital for the country’s economic stability and long-term economic growth.

Fiscal performance

In the first four months of this year, the fiscal deficit doubled with current spending growing at twice the rate of tax revenues. While revenue grew by 7.2 per cent to Rs. 305.5 billion, current spending increased by 23.4 per cent to Rs. 445.3 billion. The fiscal deficit has doubled in the first four months of this year, with current spending growing at twice the rate of tax revenues. Tax revenues grew 10.7 per cent to Rs. 276.4 billion, while non-tax revenues fell 17.5 per cent from a year earlier to Rs. 29 billion. The gap between total revenue and current expenses rose 86 per cent to Rs.139.8 billion equal to 1.8 percent of projected gross domestic product.

Despite the Treasury’s intent of containing the fiscal deficit to its target of 6.2 per cent of GDP, adverse economic developments are making it difficult to achieve it. Revenues have fallen and will continue to decline as the economic growth this year is likely to fall below 6 per cent. Several sectors that contribute tax revenue are likely to not increase output thereby decreasing revenue. One of the activities that are likely to have a lower growth is imports and internal trade.

Economic repercussions

An increase in the fiscal deficit would have serious repercussions on inflation and increase the public debt significantly. Containing the fiscal deficit is vital for the country’s economy. A large deficit means that it would generate inflationary pressures. Inflationary pressures mean that the cost of living increases and causes severe hardships especially to the lower end of wage earners and pensioners. This in turn leads to strikes with demands for higher wages and social unrest.

Wage increases would increase the costs of production and erode the country’s competitiveness in international markets. This necessitates the depreciation of the rupee to remain competitive with lower rates of inflation in other countries. Otherwise the lesser export earnings would increase the trade deficit that would be a strain on the balance of payments.

Reduced export earnings imply loss of employment and lower incomes to workers in the industries affected, as has been experienced recently in the garments industry due to decreased export demand owing to the global recession. The depreciation of the currency to restore export competitiveness would lead to further inflation and increased hardships to people.

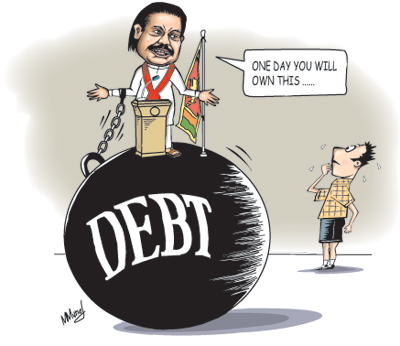

Large fiscal deficits harm the economy in other ways too. They lead to borrowing and in turn to huge debt servicing costs. The large accumulated public debt is as a result of persistent deficits over the years. In 2011 the public debt was 78.5 per cent of GDP. It is likely that this year the public debt would be more than 80 per cent of GDP owing to the large foreign and domestic borrowing and slower growth in GDP. Furthermore, debt servicing costs have risen to mammoth proportions and distort public expenditure priorities and hampers economic development.

The current situation is very much like the situation in 2008/9. The Institute of Policy Studies (IPS) in its State of the Economy 2009 report stressed the importance of fiscal consolidation in responding to external shocks like what we are facing this year. “The constraints that weak public finances impose on the ability of governments to respond with appropriate policy flexibility to external shocks — such as the current global economic downturn — are clear from Sri Lanka’s experience.”

Reduction of deficit essential

The Pathfinder Foundation has pointed out that “the budget could come under further strain from a revenue shortfall with the slowing down of the economy and expenditure pressures to provide relief for those affected by the drought and the contractionary stabilisation measures”. It has advised the government of the “need to monitor carefully not only the country’s external account but also its fiscal operations to determine whether further stabilisation measures become necessary”.

The intent of the Finance Ministry to contain the deficit to the targeted level is indeed commendable. It is hoped that in the context of falling revenues that an effort would be made to curtail public expenditure. New taxation measures may also be needed to increase revenue. It is imperative that the fiscal deficit is kept below 7 percent at least.

The Finance Ministry’s resolve to contain the fiscal deficit must be backed by policy measures that enable the cutting down of expenditure and new measures that would increase revenue. Both these tasks are admittedly difficult. It would be realisable only if all ministries recognise the need to cut expenditure to reduce the fiscal deficit.

Fiscal consolidation is of significance for good economic management and good governance. In the current difficult economic situation political will, courage and resolve are needed to follow prudent fiscal policies to reduce the fiscal deficit. This year and the next may be particularly vulnerable years in as far as the fiscal deficit is concerned. Despite the difficulties containing the fiscal deficit is vital. Failing to do so may put the country on a dangerous course to an economic catastrophe.

comments powered by Disqus