News

IMF gives final tranche but Govt. wants $500 m. more

View(s):Negotiations for a fresh $500 million (Rs. 65.8 b) loan under the Extended Fund Facility (EFF) of the International Monetary Fund (IMF) is likely to begin in September when a Fund mission would do an annual review of the Sri Lanka’s economy, Central Bank Governor Ajith Nivard Cabraal said yesterday.

“No dates have been set but a mission is likely in September for their annual review and the new facility would be discussed at that time,” he said, adding that details on interest rates or length of programme were yet to be discussed.

His comments came a day after the Fund cleared Sri Lanka’s final $415 million (Rs. 54.6 b) instalment under its Stand-By Arrangement (SBA).

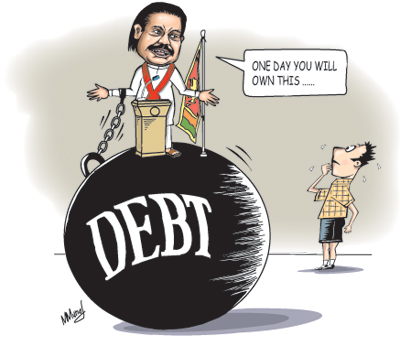

With the $ 415 million dollar payment, the IMF’s $2.5 billion loan programmeto Sri Lanka has been completed.

Mr. Cabraal said this tranche which had been deposited in the Central Bank account together with the $1 billion that was raised by the successful bond issue this week, would substantially enhance the country’s foreign reserves.

The positive sentiment over the bond issue and the impeding IMF money saw the rupee appreciating on Friday in the money markets. The dollar was traded at Rs 131.50 on Friday against an average Rs 133 during the rest of the week.

Bankers also said the rupee gained because HSBC had been pumping in dollars in the market — according to one estimate it was $250 million — since July 13 from foreign investors seeking to buy rupee-denominated bonds issued by the Central Bank. “The HSBC was converting these dollars to rupees to purchase these bonds, raising the demand for rupees in the market,” one banker said, adding that the sovereign bond interest rate of 5.8 per cent was also a good rate that moved the market.

Mr. Cabraal said the $1 billion bond issue was oversubscribed 10.5 times (receiving subscriptions of $10.5 billion) and attracted the best interest rates. “The rate of 5.8 per cent is lower than the expected 6.2 per cent and countries like Spain (has floated bonds) at 7.2 per cent interest,” he said.

Meanwhile in a statement announcing the decision to grant Sri Lanka the final installment, the IMF noted that there is a slowdown in economic activity and declining imports have ‘adversely’ affected (tax) revenues.

Naoyuki Shinohara, Deputy Managing Director and acting Chair (of the Fund) said the Sri Lankan authorities have undertaken substantial macroeconomic policy adjustments to stabilise reserves. “It will be important to continue macroeconomic stabilisation and structural reforms efforts, in particular maintaining exchange rate flexibility while building international reserves, given the uncertain global outlook. A successor arrangement with the Fund would provide valuable support to the authorities in these endeavours,” he said.

The statement said that while ‘headline’ inflation has increased, core inflation remains relatively stable and tighter monetary and credit policies had begun slowing credit and import growth. The external current account deficit was narrowing, and international reserves had stabilized, it added.

comments powered by Disqus