The Benefits of a Master of Laws Programme for Accountants

View(s): It was in the late 1970s, that the Institute of Chartered Accountants of Sri Lanka (ICASL) took a significant step forward by establishing a Business School- described as “an important watershed in the history of the Institute” (Lal Nanayakkara and Lakshman Perera, Saga of an Enduring Journey: Our History, 1959-2009, ICASL, 2010, p. 85). Under the dynamic leadership of the then President of the ICASL, Mr D. C. Wijesekera, a group of us from different disciplines worked tirelessly to negotiate with a foreign university (University of Wageningen in The Netherlands) to run a collaborative post-graduate Diploma in Business and Financial Administration.

It was in the late 1970s, that the Institute of Chartered Accountants of Sri Lanka (ICASL) took a significant step forward by establishing a Business School- described as “an important watershed in the history of the Institute” (Lal Nanayakkara and Lakshman Perera, Saga of an Enduring Journey: Our History, 1959-2009, ICASL, 2010, p. 85). Under the dynamic leadership of the then President of the ICASL, Mr D. C. Wijesekera, a group of us from different disciplines worked tirelessly to negotiate with a foreign university (University of Wageningen in The Netherlands) to run a collaborative post-graduate Diploma in Business and Financial Administration.

We developed a syllabus tailored to the emerging needs of the country and conducted lectures following a more inter-active dialogue with emphasis on problem-solving than in the traditional university or professional education classroom format. For the Business and Commercial Law modules, even moot trials were organized- at that point of time even many of the universities teaching law did not organize such an activity. This was perhaps the first or certainly one of the first ever collaborative partnerships between a Sri Lankan tertiary level educational institution and a foreign university for the award of a foreign qualification for a programme run in Sri Lanka with foreign and local Faculty. However, much water has flown under the bridge since then.

Among those who successfully completed the post-graduate Diploma in Business and Financial Administration are persons who are now heading leading audit firms or who work as C.E.Os or CFOs of multinational companies. Some have left for greener pastures where this qualification would have given them a competitive advantage. Several chose law-related subjects for the 15, 000 word dissertation which was part of the examination requirements. Lawyers and members of other accountancy professional bodies such as CIMA were among those who enrolled for the annual diploma programme.

The accountancy profession worldwide has evolved over the years. It is no longer a profession that deals with figures and data generated by different business units and consolidate them into what is presented under different labels such as profit and loss account, consolidated statement of accounts, balance sheet etc. Whilst its core functions and responsibilities remain focused on accounting and auditing and taxation, the profession now engages in a range of management consultancy and advisory services. Transaction services relating to mergers and acquisitions; structuring corporate financial deals; restructuring and the handling of cross-border insolvency proceedings; participation in arbitration and mediation proceedings; IT advisory services including the development of measures to counter cyber security threats; corporate governance advisor services; and, regulatory compliance and reporting are among the key features of the large portfolio of matters that increasingly come within the purview of large and medium-size accounting firms. To remain competitive, even smaller size firms strive to offer value addition services to their clients.

Members of the accountancy profession often encounter situations where legal, regulatory and compliance issues have to be addressed. Situations which require bargaining and negotiating skills, accountants who are conversant with English, European, US and other international requirements and developments are better placed to assess strategies and promote their clients interests. An old adage is that ‘Knowledge is Power”; this is increasingly proving to be true in a globalized economy with new issues and challenges.

In the past, opportunities for accountants who did not possess a law degree or a professional qualification in law to enrol for a LL.M. programme in a recognized university werefew and far between. However, a view which is gaining currency is that doors to higher continuing education must be open to those who wish to aspire to reach new heights in their professional career by enhancing their knowledge and skills.

ANC which completed its tenth anniversary recently launched its School of Postgraduate Education. The Ealing Law School of the University of West London (UWL) offers a LL.M. programme on International Banking and Finance Law and a LL.M. in International Business and Commercial Law. The Guardian has ranked the UWL as the No. 1 Modern Law School in London. The Vice Chancellor of UWL Professor Peter John and the head of the Ealing Law School Professor Malcolm Davies were both over here to launch the event.

The LL.M. in International Banking and Finance Law is structured around four major modules, namely

- International Banking Law

- Securities Regulations

- International Commercial Law

- International Commercial

- Arbitration and Mediation

- Law

- The LL.M. in International Business and Commercial Law has the following major modules:

- Legal Aspects of International Finance

- Laws on International Business Structures

- International Commercial Law

- International Commercial

- Arbitration and Mediation

- Law

Both LL.Ms have a requirement for an essay and a written examination at the end of each module of 60 hours of lectures and a 10,000 word dissertation. Research Methodology is a subject that is designed to help in the preparation of the dissertation with the active support of local and foreign tutors.

Both LL.M.s will focus on UK, European, US and other international regulations and standards (e.g. IOSCO, Basel Committee). Visiting UWL Faculty as well as leading academics and industry practitioners will conduct lectures and inter-active workshops. As a value addition to Sri Lankan audiences, the ANC School of Postgraduate Education will arrange lectures and networking sessions with a focus on Sri Lankan legal aspects. These will be optional lectures but the subject-matter for the dissertation can be a topic relevant to Sri Lankan law (e.g. a comparative study of insider dealing provisions in the U.K. and Sri Lanka).

There will be 9 hours of lectures for a week. Each of the two semesters will last approximately 4 months. Work on the dissertation can commence at the end of the first semester or the second semester. The University will award an “internal” UWL LL.M. Lectures that will be conducted locally will basically ‘mirror’ what is being taught in the U.K. at the corresponding time.

The UWL uses the ‘Blackboard’ which is the Virtual Learning Environment (VLE) software used extensively in higher education institutions. The VLE has the unique feature of enabling students to have access to programme resources and key information whenever they need them at their convenience from anywhere with a web connection, including mobile devices. Written assignments and feedback can be submitted on-line These two LL.M. programmes have been successfully run in London since 2008.

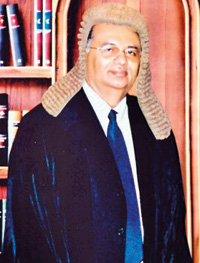

The UWL-ANC partnership now enables the LL.M. programmes to be completed in Colombo without the necessity to spend time overseas. More importantly, members of the accountancy profession whose studies (for courses conducted by ICASL or CIMA, for example) have included law subjects (e.g. business or commercial law; company law) and have practical experience in dealing with legal matters will be eligible to be enrolled. Their applications will be screened on a case-by–case basis. It is hoped that just as much as the Post-graduate Diploma in Business and Financial Administration offered by ICASL in 1980 provided a new window of opportunity to expand one’s horizons, these LL.M programmes would also offer yet another significant opportunity to a profession that is increasingly under pressure to broader their knowledge base and sharpen forensic skills. – Dr Dayanath Jayasuriya P.C.

comments powered by Disqus