Columns

Are we heading towards a balance of payments crisis?

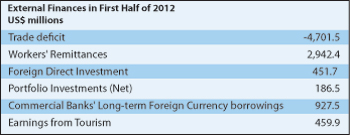

View(s):Last year’s massive trade deficit of US$ 9.8 billion led the country to a serious balance of payments crisis. Indications are that this year’s trade deficit would exceed it, unless some drastic measures are taken or there is an unexpected favourable upturn in the global economy.

With only three and a half months to the end of the year, a global upturn favourable to the country’s trade is unlikely, and too optimistic to expect.

However, the inflow of worker remittances, enhanced tourist earnings, net positive portfolio investments and foreign direct investment inflows are expected to bridge the trade deficit to some extent. Would these be adequate to wipe out the trade deficit completely?

Would the deficit result in the depletion of the country’s mostly borrowed foreign exchange reserves? Will we face another balance of payments crisis at year’s end?

Trade prospects

The prospect of the trade balance improving is bleak. Although there is a decreasing trend in consumer imports, this is inadequate to offset the decreasing export earnings. What’s more, while consumer imports had responded to the policy measures adopted by the government, intermediate and investment imports continued to increase. Petroleum imports increased by 20 per cent and investment goods imports increased by as much as 27 per cent in the first half of this year compared to these imports in the first half of last year. Consequently the trade deficit increased despite the decline in consumer imports. This trend is likely for the rest of the year.

Unless efforts to reduce intermediate and investment goods imports are adopted, the reduction in imports will not be sufficient to avoid a large import bill that is the core cause of the trade imbalance. This is a daunting task as the curtailment of petroleum import expenditure is easier said than done, as international oil prices are rising and not likely to decline in the foreseeable future. An increase in oil prices would make a serious dent in the trade balance, as more than one fourth of import expenditure is on oil. Furthermore, the drought has cut down hydropower generation drastically to about 15 percent and thermal generation requires larger imports of oil.

Favourable developments

Although the trade deficit is likely to rise to US$ 10 to 11 billion, worker remittances, tourist earnings and investment inflows are likely to offset a high proportion of the deficit. Worker remittances that were nearly US$ 3 billion in the first half of this year are likely to be about US$ 6 billion, while tourist earnings are expected to be about US$ 1 billion this year. If net investment inflows contribute another US 1.5 billion, the trade deficit would be reduced from about US$ 10.5 billion to US$ 2 billion.

This remaining deficit is still large and the reserves that are at the highest point at present may dwindle by a significant amount. Since most of the reserves are derived through borrowing, this means that we are importing considerably more than our export earnings and other capital inflows and financing it through foreign borrowing.

Reserves to the rescue

The current reserves in the country are at a high level owing to large scale foreign borrowing by the government and commercial banks. The expected large trade deficit is likely to be financed by running down the reserves to some extent. Gross official reserves that amounted to US$ 6.04 billion by end June 2012, increased to nearly US$ 7.1 billion at the end of July. In the event that there is a deficit in the balance of payments, these reserves are likely to be used to finance the trade deficit.

Debt servicing costs

This developing scenario has serious long-term implications for the economy. The public debt will increase and debt servicing costs would be an increasing burden in the future. One of the reasons for the foreign debt and its servicing costs increasing is the unsustainable trade deficit.

The rising foreign debt would be a future strain on the balance of payments. The debt servicing ratio that was 12.6 per cent of export earnings in 2011 is likely to rise appreciably in 2012. This means that a significant proportion of the export earnings has to be earmarked for debt servicing. This in turn strains the balance of payments of future years.

The foreign debt is a part of the country’s public debt. With the depreciation of the currency, the public debt has increased by about 13 per cent in terms of rupees.

The public debt increased by 23 per cent to Rs. 5.95 trillion at end June 2012 from Rs. 4.82 trillion a year earlier. While domestic borrowings grew 15 per cent to Rs. 3.15 trillion, foreign borrowings grew twice as fast at 34.3 per cent to Rs. 2.79 trillion. This means that a high proportion of government revenue has to be spent on debt servicing.

In fact the accumulated debt of the country over several decades has resulted in the debt servicing costs being the highest item of public expenditure. There have been some years in the past when the debt servicing costs absorbed more than the total government revenue.

In conclusion

The fact that the country has reserves should not blind policy makers to the adverse consequences of financing the trade deficit through foreign borrowing. The use of foreign borrowing to meet the balance of trade deficit is costly as foreign borrowings are a contingent liability and their use to bridge the balance of payments deficit could lead to a strain in the balance of payments in the future.

It is vital that the trade balance is reduced to the extent that the country does not have to borrow to finance its imports. Although containing the trade deficit is a challenging task, it is imperative that further policy measures are put in place to contain import expenditure. This is especially so with respect to intermediate and investment goods imports which have risen sharply.

Increasing export earnings is not a realistic option immediately. In the long-run the country’s exports must be expanded, while in the short-term there should be a curtailment of imports. An economic policy framework that provides incentives for exports is a precondition to increasing exports. A wide range of economic policies is needed to achieve this. Meanwhile a tightening of the belt to reduce import expenditure is needed. This must encompass a reduction in government expenditure on imports.

Follow @timesonlinelk

comments powered by Disqus