Columns

Towards reducing the fiscal deficit

View(s):The importance of containing the fiscal deficit and progressively decreasing it to a manageable level is an accepted government policy objective. There is no better expression of this resolve than the Treasury’s reiteration that, despite a fiscal deficit of 4 per cent in the first half of this year, that it would achieve the targeted fiscal deficit of 6.2 per cent of GDP this year.

With the slowing down of the economy, reduced tax revenues and expenditure overruns, this would be a daunting task. Nevertheless every effort must be made to contain the fiscal deficit to around the target this year and reduce it further in 2013.

It is to the credit of the government that the fiscal deficit has been brought down in recent years. In 2011 the deficit was reduced to 6.9 per cent of GDP, marginally lower than the targeted 6.8 per cent. However, bringing down the fiscal deficit to 6.2 per cent this year is difficult due to shortfalls in government revenue, the overshooting of expenditure and the lower GDP expected this year.

Increasing deficit

In the first half of this year, the budget deficit was 4 per cent of projected GDP. The slowing down of the economy has resulted in lower tax revenues. On the other hand, the lower GDP as denominator makes it more difficult to achieve a lower proportion. In fact in the recent past the fiscal to GDP ratio has been lowered owing to the growth in GDP. The current official expectation is that the economy would grow at around 7 per cent, down from the earlier forecast of 7.5 per cent. Most unofficial estimates place economic growth to be about 6.5 per cent owing to the reduction in manufactured exports, drought conditions and restrictive credit policies depressing investment. These factors and falling import revenues have reduced revenues though government expenditure has increased.

In the first half of the year, the budget deficit increased by 39.6 per cent to Rs. 302.9 billion that is estimated to be 4 per cent of projected GDP. While tax revenue grew 14.0 per cent to Rs. 496.8 billion, recurrent expenditure grew 17.4 per cent to Rs. 563.8 billion and capital expenditure grew 40.9 per cent to Rs. 235.8 billion. The sharp increase on expenditure in a context of declining revenue was responsible for this widening deficit.

Prospects

It is unlikely that expenditure would be restrained in the second half of the year. However, there is a possibility that tax collection would increase, especially in the final quarter when most tax revenues flow in. Additional taxes too could increase revenue. If government revenues are to increase, there is a need to increase taxation.

Perhaps the real reason for the increased import duties on potatoes and canned fish this week was to increase the flagging tax revenues. Now that the Provincial Council elections are over, it is likely that there would be further hikes in taxes soon to make up the shortfall in revenue. It is most likely that petroleum prices would be increased owing to the need for increasing revenue and the rise in international oil prices.

Containing the deficit to 6.2 per cent at the end of the year is a daunting task. Yet reducing the fiscal deficit is vital for stabilisation of the economy and economic growth. Inflationary pressures generated by large fiscal deficits increase the cost of living and cause severe hardships, especially to lower wage earners, pensioners and fixed income earners and increases the costs of production that reduces export competitiveness.

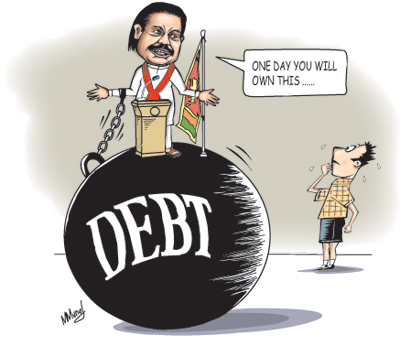

The depreciation of the currency to restore export competitiveness would lead to further inflation and increased hardships. Large fiscal deficits lead to borrowing and in turn to huge debt servicing costs. For these reasons, it is important to find ways and means of reducing the fiscal deficit.

Policies to reduce fiscal deficit

The containment of the fiscal deficits is undoubtedly difficult to achieve in the current fiscal and political context due to the limited revenue base, large debt servicing costs, huge expenditure on public service salaries and pensions, big losses in public enterprises; a large defence expenditure and wasteful conspicuous state consumption.

However these very difficulties are pointers to where the resolution of the problem lies. These large expenditures provide the opportunities for expenditure reductions that would trim overall government expenditure. Now that the war is over, there should be a curtailment of defence expenditure. Military hardware expenditure could be brought down and fresh recruitment of personnel should be minimal. If the expenditure on defence can be brought down by even 1 per cent of GDP, then the deficit could be reduced significantly.

Losses incurred by public enterprises are a huge expenditure. Reforms of these public enterprises to reduce public expenditure provide a significant means of reducing expenditure. In the past the privatisation of loss making enterprises, such as the estates, provided both relief to public expenditure as well as revenue from the privatisation proceeds to offset the deficit. This option is no longer available due to the ideological position of the government that it will not sell public enterprises. Given this policy framework, the government must take immediate and substantial steps to reform public enterprises and should not expand public ownership to incur further losses.

It is neither feasible nor practical to reduce public expenditure on salaries of public servants and pensions, subsidies on fertilizer and Samurdhi payments. In fact the salaries bill may once again increase next year due to both salary increases and further recruitment to the public services. Increases in these must be contained as much as is practical.

Increasing government revenue is vital to reduce the deficit. The current revenue to GDP ratio of 14.3 per cent is below levels of countries with Sri Lanka’s per capita income. This is due to inefficiencies in the tax administration, tax avoidance and tax evasion. It is also likely that the country’s tax to GDP ratio is underestimated owing to a blown up figure of the GDP.

Tax reforms should reduce past fiscal slippages significantly to increase revenue. The reform in trade and excise taxes, a broader tax base and more effective tax collection should be put in place to achieve higher revenue collection that would reduce the fiscal deficit. Increasing revenue depends very much on the realistic nature of the tax reforms and the administrative capacity of the Department of Inland Revenue.

Strong resolve

Bringing down the fiscal deficit to 5 per cent of GDP in the near future requires a strong resolve on the part of the government to undertake reforms and to spend public money carefully.

The road to the realisation of a reduced fiscal deficit is not an easy one.

Follow @timesonlinelk

comments powered by Disqus