News

Another large-scale VAT fraud uncovered

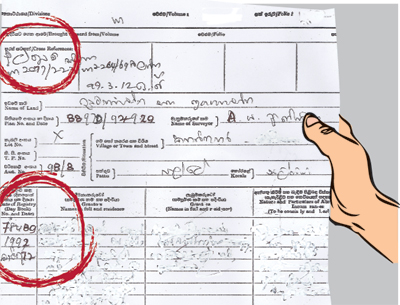

Another large-scale Value Added Tax (VAT) fraud, amounting to Rs. 180 million, has come to light after a senior Inland Revenue Department officer detected tampering of VAT data in the department’s computer system.

The Criminal Investigation Department (CID) has taken over the case, following a complaint lodged by Inland Revenue Department Commissioner General Mallika Samarasekera.

Ms. Samarasekera confirmed that an investigation was under way, and that the fraud had begun in 2010. Just recently the tax chief had asked the Public Accounts Committee (PAC) what action had been taken to prevent such frauds.

A special CID team visited the IRD head office in Colombo and recorded statements from senior IRD officers on VAT data deleted or altered.Another VAT scam, running to Rs. 500 million, was reported in 2010 when K. M. S. Kandegedera was the IRD Commissioner General.

There have been six cases of fraud, involving up to 20 people charged with fraudulently obtaining VAT refunds. Nothing has come out so far from the CID probe of a large-scale VAT fraud in which forged documents and fake identity cards were used to claim refunds.

In another VAT scam, amounting to Rs. 60 million, the CID has handed over evidence to the Attorney-General’s Department. In this case, the owner of a textile factory is under investigation.

The main suspect in a Rs. 3.9 billion VAT scam from 2006 is said to be still in hiding. The suspect, Kamil Kuthubdeen, is reported to be living in a hotel he owns in Dubai. Six persons who played a part in that fraud are in custody. The CID has requested the Interpol to issue red notice warrants for the arrest of other suspects believed to be living overseas.

A Presidential Commission was appointed in 2007 to look into this fraud. No report has yet been submitted, sources say.

Follow @timesonlinelk

comments powered by Disqus