Columns

Fiscal targets commendable, achievement difficult

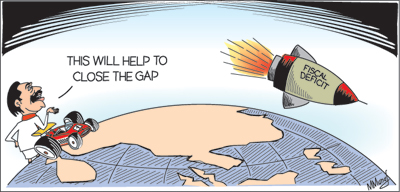

View(s):The Budget Speech reiterated that this year’s fiscal deficit target of 6.2 per cent of GDP would be achieved and that the government expects to reduce it to 5.8 per cent of GDP in 2013 and bring it down further by 2015.

If these targets are achieved, they would bring about economic stability and foster long term growth. They are, however, difficult to achieve. These fiscal targets are an acknowledgment of the importance of containing the fiscal deficit. The achievement of these desirable targets is difficult and demanding. However difficult these targets are, it is essential that the government maintains a strong political will and resolve to achieve them.

Importance of containing fiscal deficit

Treasury Secretary P.B. Jayasundera has been quoted as saying that one of his difficulties is to make people understand that containing the fiscal deficit is vital for development. In fact, most popular discussions of the budget do not make reference to the fiscal deficit; they focus on the relief measures, salary increases, benefits and burdens of the budget proposals. Containing the fiscal deficit to reasonable amounts is the critical issue in budgetary management.

Containing the fiscal deficit is vital for stabilisation of the economy and economic growth. Inflationary pressures generated by large fiscal deficits increase the cost of living and cause severe hardships, especially to the lower wage earners, pensioners and fixed income earners. They also lead to strikes with demands for higher wages and industrial unrest. Wage increases add to the costs of production and reduce export competitiveness. The consequent need for depreciation of the currency to restore export competitiveness leads to further inflation and increased hardships to people. Large fiscal deficits lead to borrowing and in turn to huge debt servicing costs.

For these reasons the containment of the fiscal deficit to a reasonable level is vital. The Fiscal Management Responsibility Act (FMRA) passed in parliament in December 2002 makes it mandatory for the Government to take measures to ensure that the fiscal deficit is brought down to 5 per cent of GDP in 2006 and kept at that level thereafter. As it turned out, the fiscal deficit was 8 per cent of GDP that year and averaged 8 per cent of GDP in the five years (2004-2008). In 2011 it was brought down to 6.9 per cent of GDP.

Fiscal deficit targets

Bringing down the fiscal deficit to 6.2 per cent in 2012 is difficult due to shortfalls in Government revenue, the overshooting of expenditure and the lower GDP expected this year. In the first eight months of 2012 alone the deficit was 5.7 per cent of projected GDP. On this experience the projected deficit would be 8 to 9 per cent of GDP. Despite this the Government expects to keep the fiscal deficit to the original goal of 6.2 per cent of GDP from 6.9 per cent in 2011. This is commendable but difficult to achieve.

On the basis of Treasury fiscal performance figures in the first eight months of this year it is difficult to contain the fiscal deficit at 6.2 per cent of GDP as it is running at a higher amount than that of last year when it reached 6.9 per cent of GDP. However, the Treasury expects to bring down the deficit in the next four months as there are revenue lags and expenditure leads. The Treasury explained that “the fiscal performance during the first eight months indicates the impact of revenue lags and expenditure leads. Hence, with the higher revenue and moderation of expenditure expected in the remaining part of the year, the fiscal operations in the year as a whole are expected to remain consistent with the targeted deficit of 6.2″.

We hope that this is the case and there would be a significant containment of the fiscal gap. In fact a reversal of some figures in the remaining eight months is needed to achieve this target. Given the inevitable lower performance of the economy due to external and internal shocks, even an overshooting of this target to between 6.2 to 7 per cent should be viewed as realistic.

To achieve this target, revenue has to increase substantially and the curtailment in expenditure must be significant. Revenue for the remaining four months of 2012 (Sep-Dec 2012) has to increase by 17.4 per cent compared to the final months of 2011 to reach the revenue target. On the expenditure side, total recurrent expenditures increased by 13.2 per cent in the first eight months of 2012 but are estimated to rise by only 5 per cent in the remaining months of 2012. Capital expenditure which increased by 32 per cent in the first eight months of 2012, should fall by 31.4 per cent in the remaining four months of 2012. Only a steep fall in the revenue expenditure gap in the last four months of the year could achieve the 6.2 per cent fiscal deficit in 2012. Given the fiscal performance in the first 8 months this appears to be virtually impossible.

Demanding task

The containment of large fiscal deficits is undoubtedly difficult to achieve in the current fiscal and political context. Nevertheless, it is a fundamental requirement for economic stabilisation and growth. Fiscal consolidation is difficult due to the limited revenue base; large debt servicing costs; huge expenditure on public service salaries and pensions; big losses in public enterprises; a large defence expenditure that increased in the post war years; wasteful conspicuous state consumption and expenditure on poorly targeted subsidies and welfare. Many of these expenditures have rigidity and are difficult to reduce.

Paradoxically, these difficulties are pointers to where the resolution of the problem lies. Now that the war is over, there should be a curtailment of defence expenditure. Military hardware expenditure could be brought down and fresh recruitment of personnel should be minimal. If the expenditure on defence can be brought down by even 1 per cent of GDP, then its burden on the public finances could be eased significantly. There is a difficulty in assessing defence expenditure as it is pooled with urban development which appears to absorb a significant amount of funds.

Losses incurred by public enterprises are a huge fiscal burden. Reforms of these public enterprises to reduce public expenditure provide a significant means of reducing expenditure. The Government must take immediate and substantial steps to reform public enterprises and should not expand public ownership to incur further losses. Reduction of public expenditure cannot be achieved without cutting losses in public enterprises.

The other area of fiscal consolidation is in increasing government revenue. The revenue to GDP ratio of 14.3 per cent is below levels of countries with Sri Lanka’s per capita income. This is due to inefficiencies in the tax administration, tax avoidance and tax evasion. It is also likely that the country’s tax to GDP ratio is particularly low owing to a blown up figure of the GDP in recent years. Tax reforms should reduce past fiscal slippages significantly to increase revenue.

The reform in trade and excise taxes, a broader tax base and more effective tax collection could achieve higher revenue collection that would reduce the fiscal deficit. Increasing revenue depends very much on the realistic nature of the tax reforms, the administrative capacity of the Department of Inland Revenue and the honesty of its officers.

Although reducing the fiscal deficit to the targets specified is difficult, a strong resolve on the part of the Government to undertake reforms and spend public money prudently is needed to achieve these vital goals. Reform of public institutions and reduction of wasteful government expenditure are needed. The road to the realisation of a reduced fiscal deficit is not an easy one. Nevertheless it is imperative.

Fiscal deficit as Percent of GDP

2010 8.0

Targets

2011 6.9

2012 5.8

Follow @timesonlinelk

comments powered by Disqus