Columns

Massive trade deficit despite declining imports

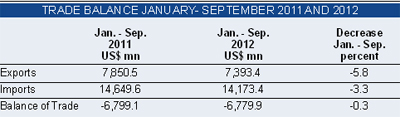

The country is heading towards a massive trade deficit this year too despite declining imports in recent months. The decrease in imports in the last few months has not improved the trade balance in the first nine months as exports declined by US$ 457 million during this period. The trade deficit has risen to US$ 6.8 billion in the first nine months of the year even though there are some favourable features on the import side.

The 3.3 per cent drop in imports in the first nine months of the year compared to the same period last year has helped the trade deficit to decrease. However the decrease in the trade deficit has been a mere 0.3 percent compared to the first nine months of last year owing to export earnings during this period declining by as much as 5.8 per cent. This year’s trade deficit is likely to be of the same magnitude as last year’s US$ 9.7 billion.

Improvements in September

September 2012 was the first month since December 2009 when the trade deficit declined. In September 2012 expenditure on imports declined significantly by 25.4 per cent compared to that of September 2011. However, the decline in imports for the first nine months of this year compared to the first nine months of last year was only 0.3 per cent.

September witnessed a steep decline in imports of all three categories of imports for the first time. Investment goods imports that had been large and increasing during the year, decreased by as much as 36 per cent in September compared to September of last year. Intermediate goods imports decreased by 18.8 per cent, while expenditure on imports of most consumer goods also declined, resulting in a decrease of consumer imports by 32 per cent.

Reasons for decreased imports

The Central Bank attributes the decline in imports to the policy stance adopted since February. It points out that “import expenditure on non-food consumer items declined responding to the depreciation of the rupee since February this year as well as the tightening of credit conditions over the past several months. Motor vehicle imports being subject to the imposition of higher taxes since March 2012, contributed the most to the decline in expenditure on consumer goods imports.”

The reasons for the decrease in intermediate and investment goods imports are different. “The decline reflected both a weakening of demand for certain industrial exports as well as lower prices. Expenditure on textile imports declined as both global cotton prices and import volumes were lower than in 2011. Lower global demand for jewellery meanwhile, resulted in lower import expenditure on diamonds and gold during September 2012.”

In contrast expenditure on wheat imports increased as world wheat prices increased due to drought conditions in major wheat producing countries. With respect to imports of petroleum products, despite expenditure on refined petroleum increasing in September, total expenditure on petroleum products declined as crude oil was not imported during September.

The most conspicuous decline in imports in September 2012 was on investment goods with expenditure on machinery and equipment, building material and transport equipment declining. The reasons for this sharp decrease are not clear.

This declining trend in imports in recent months is attributed by the Central Bank to the “tighter policy environment”. The depreciation of the currency that increased the cost of imports, as well as an increase in tariffs on imports and increased costs of borrowing were responsible for the curtailment of these imports.

Next three months

This trend lends hope to a continuing decline in imports in the last quarter of the year. However the festive season and year end increases in demand may arrest this to some extent. Furthermore, the shortfall in rice production due to drought and floods may result in higher expenditure on rice imports. On the other hand, petroleum prices that are volatile have decreased owing to the prospect of global demand decreasing.

Export decline

Despite these favourable developments on the import side, there is every reason to be concerned with the trade balance as exports have been declining this year. At the end of the first nine months of the year export earnings were 5.8 per cent less than that of the first nine months of last year. Agricultural and industrial export earnings had declined by 8.2 and 6.9 per cent respectively with the main export in each of these two categories declining significantly. Tea exports decreased by 6.6 per cent while garments exports declined by 4.3 per cent. While tea exports improved in September, garments exports declined by a higher amount in September.

Trade deficit in 2012

Despite the decreased import expenditure, the declining trend of export earnings is likely to result in a trade deficit of around US$ 9 billion. This is a trade deficit of a magnitude that will create serious balance of payments difficulties and an erosion of the foreign exchange reserves that are mostly borrowed funds. Workers’ remittances that have played an important part in offsetting the trade deficit will bridge a significant proportion of the trade gap this year too. At the end of September workers’ remittances had increased by nearly 17 per cent and offset 65 per cent of the trade deficit as at September this year.

The important issue is whether a substantial proportion of the remaining 35 per cent of the trade deficit would be offset by tourist earnings, service receipts and capital inflows. Indications are that about 21 per cent would be met by these, while the rest would have to be met by borrowings as was the case last year. However, the Central Bank is confident that these earnings and capital inflows would result in a balance of payments surplus.

Earnings from tourism and workers’ remittances are expected to increase during the last quarter of 2012, as there is a pattern of higher inflows of remittances and tourist earnings at the end of the year. An increase in portfolio investments that would result in higher net inflows to the stock market are also expected o assist in bridging the gap.

Foreign borrowing

Foreign borrowing has been an important means of meeting the balance of payments deficit. According to the Central Bank, there has been a significant increase in foreign investments in government securities and net investments in Treasury bills and Treasury bonds during the first nine months of 2012 amounting to US $ 820.7 million. Long-term loans during the first nine months of 2012 amounted to US $ 2,404 million. In addition, long-term borrowings by commercial banks during January-September 2012 amounted to US $ 927.5 million. All these are contingent liabilities and increase the foreign debt that is extremely high.

Conclusion

Despite the recent decreases in imports, the trade deficit is likely to be about US $ 9 billion. Irrespective of whether this is offset by workers’ remittances service receipts and capital inflows, declining exports, especially of manufactures, is of serious concern. While global economic conditions have much to do with this decline, there is a need to ensure that conditions are conducive to export competitiveness.

Follow @timesonlinelk

comments powered by Disqus