Columns

Achieving BOP surpluses in 2013 and after

View(s): The Central Bank expects a “comfortable” balance of payments surplus this year. Could this be achieved? Given the structural weaknesses in trade discussed last week, it is difficult to achieve a much lower trade deficit this year than that of last year.

The Central Bank expects a “comfortable” balance of payments surplus this year. Could this be achieved? Given the structural weaknesses in trade discussed last week, it is difficult to achieve a much lower trade deficit this year than that of last year.

However, if there is some reduction in the trade gap; increased earnings from tourism; higher workers’ remittances; net service receipts and higher investment flows; a balance of payments surplus could be achieved. The Central Bank’s most recent Monetary Review Statement said: “So far during the year, the balance of payments has continued to record a surplus, and a comfortable overall surplus is anticipated in 2013.”

The Central Bank is confident that private transfers, tourist earnings and capital inflows would result in a balance of payments surplus: “In fact, although the Central Bank has purchased US dollars 486 million on a net basis from the market this year, greater stability of the exchange rate has been observed owing to increased foreign exchange inflows to the government securities market, and from tourism and private transfers.”

The Central Bank is confident that private transfers, tourist earnings and capital inflows would result in a balance of payments surplus: “In fact, although the Central Bank has purchased US dollars 486 million on a net basis from the market this year, greater stability of the exchange rate has been observed owing to increased foreign exchange inflows to the government securities market, and from tourism and private transfers.”

For these reasons, the Central Bank expects the balance of payments to be in surplus this year. It is not unusual for the Central Bank to predict a balance of payments surplus at the beginning of the year and then to give reasons why it is not turning out to be as expected. A balance of payments surplus has been a mirage in recent years.

Trade deficits

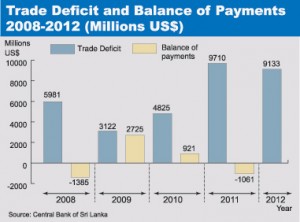

There were balance of payments deficits in three of the last five years (2008-2012). The two years when there were balance of payments surpluses were years when the trade deficit was somewhat low. In 2009 the trade deficit of US$ 3,122 million was offset by workers’ remittances and other service earnings to result in a balance of payments surplus of US$ 2,725 million. However, in the following year the trade deficit increased to US$ 4,825 million and consequently there was a deficit in the balance of payments of US$ 921 million. In 2011 the trade deficits increased to US$ 9,710 million that resulted in a balance of payments deficit of US$ 1,061 million. The trade deficit was US$ 9,313 million last year.

These balance of payments deficits are primarily due to the large trade deficits. With large trade deficits of more than US$ 9 billion in 2011 and 2012 it is difficult to achieve balance of payments surpluses even though a high proportion of the deficit is offset by workers’ remittances, tourist earnings, other service receipts and capital inflows. The crux of the issue is whether the trade balance could be reduced to about US$ 8 billion in 2013 so that these worker remittances, service receipts and capital inflows would more than offset the trade deficit.

Challenging task

Challenging task

Containing the trade deficit to these proportions is a challenging task. This is partly due to the structure of the country’s exports that do not give much scope to increase in a global economy that is growing slowly with some key markets even in depression. Reducing imports has also become difficult due to public expenditure that has a high propensity to import. This is especially so in respect of investment goods imports that has been difficult to contain.

Investment imports

Investment goods imports have been increasing in recent years. In 2011 investment goods imports increased by 16 per cent to US$ 4.3 billion, about 22 per cent of total import expenditure. These imports increased further in 2012 by 4.8 per cent to US$ 4.5 billion to absorb 26 per cent of imports. Imports of machinery, transport equipment and building materials absorbed almost one half of the country’s export earnings. Without a significant curtailment of these imports, it is difficult to bring down import expenditure.

Intermediate imports

There is a possibility of bringing down intermediate imports if the rise in prices of petroleum products results in a lower demand. The generation of thermal power is likely to be reduced this year as current water levels and normal rainfall this year could increase hydrogenation of electricity. International price of oil, the other determinant of import expenditure, is difficult to predict. The international oil market is notoriously volatile being driven not only by supply and demand but speculation about supplies in particular.

While the long term solution is the conservation of petroleum use and greater dependence on cheaper sources of energy, it is difficult to reduce the use of oil appreciably. Last year 26 per cent of import expenditure was on oil. There is a need to bring this down by at least 10 per cent to reduce the trade deficit. Consumer imports account for only 15.7 per cent of total imports and the possibilities of further reduction are marginal.

Export prospects

Export prospects appear bleak though perhaps slightly better than that of last year. This is especially so with respect to tea exports where increased production this year would enhance the exportable surplus of tea. However the political obstacles to exporting tea to two of the country’s main markets- Iran and Syria– remain a constraint. Manufactured exports continue to face depressed demand condition in the main markets of the US and Europe with the lack of the GSP Plus status withdrawal being an additional disadvantage.

Worker remittances

Worker remittances, earnings from tourism and other capital inflows have contributed towards reducing the deficit in the merchandise account or turning it into a surplus in the current account of the balance of payments. For instance in 2010, some 70 per cent of the trade deficit of US$ 5.2 billion was offset by worker remittances. As a result it was possible to achieve a lower current account deficit that was offset with earnings from services and other capital inflows to achieve a balance of payments surplus of US$ 921 million. In 2011, the trade deficit reached an unprecedented gap of US$ 9.7 billion that could not be offset by capital inflows. Worker remittances that increased by 25 per cent were able to offset only 53 per cent of this large trade deficit of last year. Accordingly a balance of payments problem emerged. There was a balance of payments deficit of US$ 1061 million.

The reduction in the trade deficit to US$ 9.3 billion last year, increased worker remittances by 16 per cent and increased tourist earnings by 25 per cent has reduced the balance of payments deficit last year. The latest estimate is that there would be a small balance of payments surplus of US$ 100 million.

New perspective

A new perspective in the management of external finances is vital for the country’s economic growth and development. The imbalance in the trade account requires to be corrected. The increased flow of remittances and higher tourist earnings must be utilised to achieve balance of payments surpluses consistently. Workers’ remittances, other service incomes and tourist earnings should be used to generate a balance of payments surplus. If the country achieves balance of payments surpluses consistently, then further international borrowing could be avoided and the debt service payments of the large foreign debt could be met through the surplus.

The offsetting of the trade deficit by remittances should not lead to inaction to improve the country’s trade balance. Corrective actions should be taken to reduce the trade deficit and increases in remittances and tourist earnings should enable a balance of payments surplus. It is by generating surpluses in the balance of payments that the country could reduce the rapidly increasing foreign debt and increasing debt servicing costs that are a strain on the balance of payments. It is by ensuing balance of payments surpluses that the country can avoid a debt trap.

Follow @timesonlinelk

comments powered by Disqus