Columns

Fiscal imperatives compel electricity tariff increases

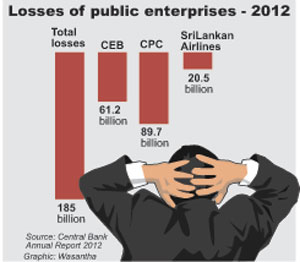

View(s):The increase in electricity tariffs is directly related to the large fiscal deficit that needs to be contained. Last year’s losses of public enterprises of an astounding Rs. 185 billion were an important reason for the large fiscal deficit. The Ceylon Electricity Board (CEB) recorded a loss of Rs. 61.2 billion last year, an increase from the Rs. 19.3 billion loss in 2011. The loss is mainly attributed to the rise in electricity generation costs due to higher thermal power generation.

The policy of increasing prices of loss-making enterprises has been mooted as a means of decreasing the fiscal burden. The latest Central Bank Annual Report makes it clear that the pricing of public enterprises should reflect their costs of production.

“Improving the financial viability of state owned enterprises would be crucial towards strengthening macroeconomic stability and financial system stability. Continuous operational losses at the two key state owned enterprises (SOEs), i.e., the Ceylon Electricity Board (CEB) and the Ceylon Petroleum Corporation (CPC) have led these entities to rely heavily on bank borrowings to cover their losses and to continue operations. While revisions to energy prices are a step in the right direction, measures need to be taken to improve the operational efficiency of these entities and introduce a cost reflective flexible pricing policy to transform these enterprises into commercially viable entities and to reduce pressure on commercial banks, thereby making available more resources to the private sector.”

In last week’s column I disagreed with the view that revisions of energy prices are a step in the right direction. My basic position was that measures to improve the operational efficiency of public enterprises should be the priority and should precede price increases.Furthermore, the increase in electricity prices would increase the costs of living and costs of industrial production. These could hamper industrial exports that are already declining.

Basic issue

The fundamental issue is that when a public enterprise incurs losses year in, year out, these losses have to be financed by the government. The government has to either increase taxes that the public have to bear or resort to borrowing that is inflationary. Either of these means that the public pay through taxes or by general price increases.

Consumers, on the other hand, are subsidised in their use of electricity but pay indirectly though taxes and inflation. However consumers of electricity may not be bearing the full costs of their electricity consumption as the burden of the tax increases would fall on direct and indirect tax payers unrelated to the amount of electricity consumed. There is therefore an issue of equity. Should the losses be borne by tax payers or by users according to their consumption?

Inefficiencies

The pricing issue is compounded by the question as to whether the losses are because of increased production costs due to inefficiencies in the public enterprise. If it is so then it is more rational for the general public to bear the costs through increased taxation than increased electricity prices.

There have been much discussion and debate about the efficiency of the CEB. The general consensus appears to be that the high costs of electricity generation is for the most part due to inefficiencies and that the costs of electricity could be brought down if the CEB is efficiently run.

Public enterprises are usually inefficient. They have larger number of employees than needed, recruitment is often not on the basis of efficiency, discipline of workers is much to be desired and the productivity of workers is low. Apart from these weaknesses, energy specialists have pointed out technical deficiencies and administrative mistakes. They point out that CEB has not operated in the most cost effective manner.

For instance it is pointed out that the hydroelectricity plants have not been operated in an optimum manner even in years of normal rainfall, when their use has been lower than their potential. The optimum use of hydroelectricity generating plants would have reduced the average costs of production of a unit of electricity and saved billions of rupees during years of normal rainfall.

Furthermore, the operation of CEB’s key thermal plant at low efficiencies for long periods without taking prompt remedial measures has increased costs of electricity generation. There is potential to save several billions of rupees annually by switching from auto-diesel to imported naphtha for the operation of CEB’s combined cycle gas turbine (CCGT) plant. Similarly, the Kerawalapitiya CCGT plant could switch from furnace oil to naphtha for cheaper and cleaner operation.

In addition to these, it is suggested that the efficiency of the system could be improved by breaking the present monopoly vested with the CPC for importing petroleum fuel for bulk users.

These and other issues indicate that there is a need to explore possibilities of improving the efficiency of the CEB. It is necessary to assess the operational weaknesses of the CEB and reform its administration to ensure that electricity generation is at least cost. The increase in tariffs should have been after a thorough study of the CEB’s costs of producing electricity and only after the issues regarding cutting down losses, improving plant efficiencies and switching to more economic fuels are considered.

Fiscal perspective

From a fiscal policy perspective either strategy that reduces losses would benefit the fiscal outturn. However reforming the CEB would take time and will not mitigate this year’s fiscal problem. It is essentially a longer term strategy. Besides this, reforming public enterprises in the country’s political milieu and cultural context is a Herculean task for which the political will is week.

A pragmatic option would be to privatise at least some of the operations of the CEB. Unfortunately this option is avoided owing to a strong ideological position of the Government. May be it is not a popular option either, as the public may consider it a means of increasing prices further. In fact the efficient private operation of electricity generation under the guidelines of a government regulatory authority could reduce electricity tariffs as well as eliminate the fiscal burden

In the debate over electricity pricing, there has been little said about the need for conserving electricity use.

May be increased tariffs would induce some reduction in electricity consumption, but in a context when additional electricity generation is expensive, conservation of electricity consumption is a cost reduction strategy. There is a considerable capacity to cut down electricity consumption by government and public bodies as well as commercial establishments.

In conclusion

In spite of the increase in tariffs, the CEB is likely to incur a loss of about Rs. 45 billion in 2013. The increase in tariffs would tend to increase costs of living and costs of production.

If the losses are financed by taxes or inflationary financing, the public may not realise the burden borne by them. Consumers would be benefitted if improved efficiency in the CEB reduces losses. The bottom line is that inefficiencies in public enterprises are a cost that people have to bear, one way or the other.

Follow @timesonlinelk

comments powered by Disqus