Columns

Trade deficit: Light at the end of the trade tunnel?

View(s):The reduction in the trade deficit in February and in the first two months of the year lends a glimmer of hope that there could be a significant reduction in the trade deficit this year.

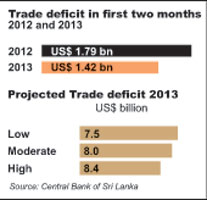

The trade gap decreased by 20 percent in the first two months this year -it was US$ 1.79 billion during the first two months of 2012 and US$ 1.42 billion during the corresponding period this year. It is also significant that the trade gap was US$ 100 million less in February than in January: US$ 650 million in February compared to US$ 750 million in January. If this trend continues it augurs well for the balance of trade and the balance of payments (BOP) this year.

Projected trade deficit

If the trade deficit continues to be at the first two month’s level in the remaining ten months, the projected trade deficit would be US$ 8.4 billion, about 1 billion dollars less than that of last year. If the lesser trade deficit of February of US $ 650 million is projected for the remaining ten months, then the trade deficit could be lower than US$ 8 billion.

If the decline in the trade deficit is a trend and it could be brought down to a monthly average of about US$ 600 million in the next ten months, then it would be possible to reduce this year’s trade gap to around US$ 7.4 billion.

The government must work towards a trade deficit of this magnitude that could result in a significant balance of payments surplus this year. The continuous reduction of imports is essential to achieve this objective.

A BOP surplus

For two successive years, the country suffered massive trade deficits of more than US$ 9 billion. With a trade deficit of US$ 9.7 billion in 2011, the balance of payments (BOP) registered a deficit of US$ 1,042 million. Although the trade deficit was reduced marginally last year to US$ 9.3 billion, the balance of payments was able to register only a small surplus of US$ 151 million.

This surplus was possible owing to higher inflows of foreign investment, higher earnings from tourism and above all the massive amount of workers’ remittances of nearly US$ 6 billion that offset nearly two thirds of the trade deficit. Tourist earnings and workers’ remittances have continued to grow this year though there are signs that their rate of growth may decelerate.

The trade deficits of the last two years were far too high and strained the balance of payments, even though a small balance of payments surplus was achieved last year. Large trade deficits are at the core of the country’s weakness in the external finances. Bringing down the trade deficit would make a significant contribution towards achieving a balance of payments surplus and strengthening the external reserves.

Expectations

What is hoped for this year is that the improvement in the trade balance in the first two months would continue into the next ten months of the year and that the trade deficit would be brought down to below US$ 8 billion. If this could be achieved, the earnings from services, capital inflows and workers’ remittances could more than offset such a trade deficit to bring about a balance of payments surplus of over US$ 1 billion. An optimistic, but attainable, target should be US$ 2 billion.

A significant trade surplus is needed as the country’s commitments to repay loans and interest costs are high: Probably more than US$ 1.5 billion. A large trade deficit implies further need for foreign borrowing that would increase the foreign debt to more than US$ 30 billion from its current US$ 28.5 billion. A trade deficit that brings about a balance of payments surplus of at least US$ 1.5 billion is needed to remain at the current level of indebtedness.

Decline in imports

To achieve this target, it is important to ensure that imports continue to be restrained. A significant development this year is the decreases in all three categories of imports. The decrease of imports by 15.6 percent in the first two months was achieved by a curtailment of consumer imports by 15.4 percent, intermediate imports by 11.3 percent and investment goods by 18.3 percent. It is vital that this trend continues, especially as export earnings are continuing to fall.

While a decrease in consumer imports has been witnessed since the policy changes in the early part of 2012, the decrease in intermediate and investments goods imports have been sluggish. The decline in both these categories this year is therefore encouraging.

With respect to intermediate imports, the drop in textile imports have been due to lower needs of decreasing garments exports. If oil prices decrease in the coming months, it would greatly ease the costs of intermediate imports. However there is concern that the decline in intermediate imports may be reversed owing to higher prices of vital intermediate imports like oil and fertiliser. Although there have been decreases in oil prices to below US$ 100 per barrel recently, international prices of oil are volatile and difficult to predict.

The reduction of investment goods imports is especially significant as their curtailment was difficult last year, as much of investment goods imports are related to public spending on large infrastructure projects. There must, therefore, be a continuing restraint on public expenditure to ensure that this trend is not reversed. The value of investment goods imports is very much dependent on government policy rather than the autonomous decisions of consumers.

It is important for the government to recognise the need for curtailing public investment programmes that have large import content. Otherwise the gains in the first two months could be undone. If intermediate and investment goods imports increase, then the trade gap is likely to surpass US$ 8 billion

Export decline

The disappointing feature of the trade balance was the continuing decline in exports. In the first two months export earnings of both agricultural and industrial exports declined.

There is little prospect of much improvement on exports due to the slow economic growth in western countries that matter for our exports, the unrest in the Middle East and the Iranian embargo that has affected tea exports. In such unfavourable export conditions, a significant curtailment of imports is needed to achieve a lesser trade deficit.

Summing up

The declining trade deficit of the first two months must be maintained, and if possible reduced further to achieve a trade deficit below US$ 8 billion. With declining exports that are not likely to be reversed soon, the reduction of the trade gap would have to come through a further reduction in imports. The reduction in consumer, intermediate and investment goods must continue to achieve this.

If a significant balance of payments surplus is not achieved by a reduction in the trade deficit, the foreign reserves would decline to critical levels and would require replenishment by an increase in foreign borrowing. This would in turn result in an increase in foreign debt to an unhealthy level.

Follow @timesonlinelk

comments powered by Disqus