News

Aged farmers, widows destitute

View(s):While the powers that be live it up the old, the feeble and the disabled face starvation as farmers’ pension fund begun in 1987 goes bust thro’ Govt. mismanagement

![]()

Seventy-four-year-old H.P. Babe, a farmer’s widow, was totally dependent on the monthly allowance she received from the farmers’ pension scheme to which her late husband had contributed. “My husband contributed to the scheme for more than 10 years, before his death.

He was happy with the system, as he believed it would help our family one day,” the woman from Saliyawewa, Puttalam said.

“After my husband’s death, I was drawing a monthly pension of Rs. 1,000. We were happy with it, as it was some relief to us. I was buying my medicines with that money,” she said.

H.M. Nandawathi: With no pension from last March her only solace is the pass book

However, for more than a year, she has not received her pension benefits. She is not alone, with some 85,000 others too affected by the Government’s non-payment of the pension benefits due to lack of funds.

The Farmers’ Pension and Social Security Benefit Scheme was introduced by former Agricultural Minister Gamini Jayasuriya, in 1987, in a bid to ensure the farmers have an income in old age, and with the hope of it being upgraded in a manner to make it sustainable.

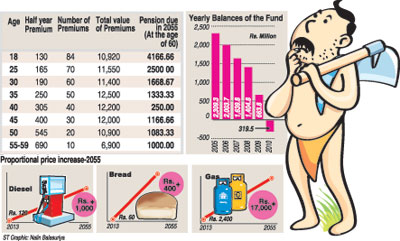

Instead, the pension fund has dried up, and in 2010, was in the red for Rs. 319.5 million, from a credit balance of Rs 2.3 billion in 2005. Since then the authorities have been struggling to make payments to the beneficiaries.

“Sometimes, the payments have been made from funds from the Treasury or from loans obtained,” an official from the Agricultural and Agrarian Insurance Board (AAIB) disclosed. “The Treasury is currently drawing up a new scheme so that the benefits could be sustained,” said Pensions Director R.B. Wijekoon, without elaborating.

He explained that, among the problems in sustaining the pension scheme had been the decision to increase the benefits without introducing any changes in the premium collected. “The minimum payment was increased to Rs. 500 in 1992 and to Rs. 1,000 in 1995. And initially, the scheme did not provide to pay the pensioner’s widow, but in 1995, the widow too was provided the benefit,” he added.

Some 959,000 farmers have contributed to this scheme, despite it offering low benefits. Under the scheme, a farmer who joins at the age of 18 years, by paying the Rs. 130 half-year premium, will have to contribute a total of Rs. 10,920 until age 60 years, to receive a monthly pension of Rs. 4,166.66.

However, the payment is unlikely to benefit a farmer in 42 years time, with the rising cost of living and inflation. One of the main failings of the authorities has been to change the pension scheme to meet the needs of the farmers. Former JVP Kurunegala Member of Parliament Namal Karunaratne said, “Despite assurances by Ministers that the scheme will be revived, the Government has not made any effort to do so, due to lack of funds in the Treasury.”

H.P. Babe: A widow sho hasnt received pension benefits for more than a year. Pix by Karuwalagawewa Jayarathne

“We want to question the Government as to what happened to the premia collected. We want to complain to the Police Fraud Bureau and to the Human Rights Commission,” he said. “Though the amounts paid were small, farmer families looked forward to the payments, as they certainly benefited from the scheme. But now, they are severely affected by the hardship,” he said.

Former UPFA Agriculture Minister Hemakumara Nanayakkara said that the Government will make payments to the beneficiaries as the premia have been paid. “The Government was contributing a certain amount to the scheme through the funds received from the Govisetha lottery. It was mainly the farmers who purchased these tickets. Despite this, the fund is virtually bankrupt as the Government has wasted the money,” he said.

He said, “During the last North-Central Provincial Council elections, President Mahinda Rajapaksa himself handed over benefits to some 100 farmers, saying that the scheme had been revived, but this has been found to be a false claim, as the farmers have not received their benefits thereafter.”

“There is no shortcoming in the scheme, just that the money has been wasted by the Government,” he pointed out. Despite claims by AAIB officials that the scheme ran into problems due to changes effected in the mode of payments, the Auditor General last year revealed how certain frauds too have affected the fund.

In one instance, 48 cheques totalling Rs. 2.7 billion and Bank drafts totalling Rs. 7.1 billion had been misappropriated in 2008 by two Directors and one Assistant Director of the AAIB. The Board had filed action in Courts.

“We have been told by agricultural officers in the area that a new scheme is being drawn up to increase the benefits, but the problem is that farmers who have made their full contributions have not received their benefits’,” Kurunegala farmer Gunasena Wanniarachchi pointed out.

H.M. Nandawathi, 70, from Ihala Puliyankulama told the Sunday Times that she had been receiving the pension for eight years but it had ceased from March last year. “I am partially paralysed, and this money helped cover part of my expenses. But now, I am only left with the pass book,” she said.

Follow @timesonlinelk

comments powered by Disqus