Columns

Prerequisites for attracting foreign direct Investment

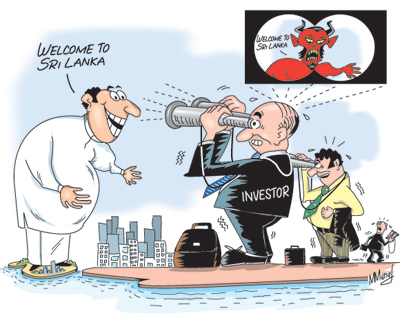

View(s):Despite the importance of foreign direct investment (FDI) for sustained economic development discussed last week, the country has failed to attract an adequate amount of the right type of FDI over many years. All forms of FDI have not reached US$ 1 billion.

The flow of FDI has been inadequate and not of the types that would develop the country’s industry and export earnings. In contrast, many Asian countries, especially in South East Asia, have propelled their economic growth with FDI. More recently India too has attracted enormous amounts of FDI. Why has Sri Lanka failed to attract FDI?

Historical perspective

Until 1977, the political and economic environments were not conducive to attracting FDI. Regular changes in government, parties and governments espousing nationalization of private enterprises and hostile to foreign investment were disincentives to foreign investment. This was especially so from 1956 to 65 and again from 1970-77. Many private enterprises were nationalised during these two periods. These sent clear signals to foreign investors not to invest in Sri Lanka.

This was an era when other South East Asian countries attracted much FDI to lay a foundation for rapid industrial growth based on outward oriented economic policies that favoured exports. Sri Lanka, on the other hand, adopted inward oriented policies favouring import substitution that discouraged export industries. These economic policies deterred FDI that is a base to create a fast growing export growth led economy all over the world.

Policies conducive to FDI

The liberalisation of the economy in 1977 and the outward oriented economic policies seeking foreign investments and adopting policies that were friendly to foreign investors was a break from the past. Various economic incentives, guarantees of security of foreign investments and institutional devices to attract FDI were introduced. Some were even in excess of the needs to attract FDI.

Foreign investment 1978-83

In 1978-83, several foreign investors established manufacturing plants on their own or in collaboration with local partners. At this time there were prospects of large international companies establishing industrial complexes in Sri Lanka for exports. Motorola, Harris and several other international giants were considering establishing industries in Sri Lanka. The July 1983 ethnic violence put an end to their interest in Sri Lanka.

What Sri Lanka lost went to other countries in South East Asia like Malaysia, Singapore, Thailand and Indonesia that had already attracted much foreign investments since the 1960s. Sri Lanka was left behind owing to the subsequent spread of terrorism, the prolonged war and the consequent insecurity.

New expectations

The end of the war in 2009 raised hopes of a revival in FDI. Foreign investors signalled intentions to invest in Sri Lanka. However the initial expectations of such investments have not been realised. The pertinent question is why Sri Lanka failed to attract large foreign investors into the country after peace conditions.

The answer to this question is complex. Economic policies that neglect economic fundamentals, new security concerns, deterioration in law and order and the rule of law, are among the causes for the inability to attract FDI.

Positive features

There have been positive features that could attract FDI. The improvement in infrastructure is a clear example. The development of roads and transport facilities as well as the attractiveness of the metropolis and its suburbs are positive developments even though all such investments do not necessarily support private sector investment. On the other hand, social infrastructure of relevance to foreign investors, such as improved private hospitals with state of the art technology, international schools teaching in foreign languages and frequent flights from Sri Lanka to other cities are distinct improvements.

The labour force is literate and easily trained though no longer considered cheap. There are fairly stable electricity supplies though the costs of power are high.

Disincentives

Despite these improvements, the negative features of the country’s economic policies appear to be disincentives for foreign investors. In the past few years, economic policies have been hostile to private investors. Several enterprises that had been privatised or partially privatised were re-nationalised. An act to take over 29 private companies including some owned by foreign interests was a distinct disincentive to attracting FDI. There was once again an overhang of a threat to take over private enterprises.

There has also been an expansion of state ownership in commanding heights of the economy. Several commercial banks are now under state control and are directed to lend to loss making state enterprises and finance state expenditure. Consequently there is a crowding out effect of bank credit to private enterprises. The banking and financial sector shows cracks with high rates of non-performing loans.

The lack of law and order and weak macroeconomic conditions have resulted in the instability of the currency and increased cost of production. Sri Lanka’s loss of GSP+ status and its decline in international competitiveness, clearly evident in the downward trend in exports, are indicators that discourage FDI. Conversely, low FDI is a significant reason for slow and declining export growth.

The UN assessment that the country’s democratic system of government has deteriorated and law and order undermined is not a good advertisement for large multi-national companies to invest in Sri Lanka.

Conclusion

International competition for FDI is intense. Being a small country with limited natural resources and a small domestic market, it is vital that the attractiveness for FDI is better than those of comparable competitors for FDI.

To attract a much larger amount of foreign investment there must be much more stability in macroeconomic fundamentals, certainty in economic policies, a strong commitment to encourage private enterprise and lesser state control of business and the commanding heights of the economy. Law and order and human rights too play a vital role in decision to setup enterprises in the country.

Is the country on the right path to make it attractive for FDI?

comments powered by Disqus