Columns

Developmental and populist budget, but concerns remain

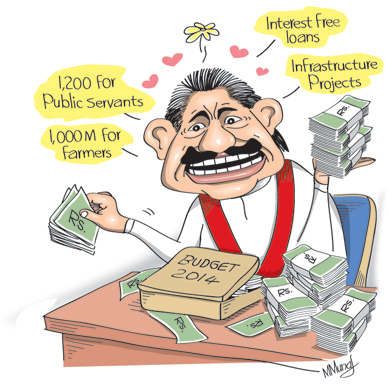

View(s):The 2014 Budget presented by President Mahinda Rajapaksa as Finance Minister has been described by some as a developmental budget, and by others as a populist budget. No doubt these were two of the defining themes in the budget presented on Thursday.

The 2014 Budget contained an extensive list of proposals to develop agriculture, dairying, the rural economy and infrastructure, small and medium industry, women’s enterprises and projects to benefit a wide range of community interests. Investments in new health facilities and universities were announced.

Improvement of infrastructure that has been a cornerstone of the government’s development strategy would get more funds. The one thousand bridges programme in rural areas is indeed a big benefit to the rural poor. An unmistakable thread that ran through the President’s Budget Speech was the upliftment of the livelihood of farmers and conditions in rural and remote areas.

Benefits

Most promises were to benefit rural areas, farmers, self-employed people, the elderly and women entrepreneurs. There were also benefits to workers in the state sector with an additional cost of living allowance of Rs. 1,200 per month from next year. University lecturers were given a further increase of 5 per cent in the academic allowance. There were benefits to everyone that mattered to the Government.

The analysis of government expenditure in the estimates is an indication that the Government’s priorities are much the same as for 2013. A change in expenditure prioritisation that was urged by many has not been realised.

The total government expenditure for 2014 has been increased by 30 per cent from Rs. 1,335 billion this year to Rs. 1,542 billion in 2014 with the highest allocation of Rs. 253 billion to the Ministry of Defence and Urban Development. This is somewhat less than the current year’s Defence-Urban Development budget of Rs. 289 billion. What this implies is that this ministry would continue to be responsible for much of the reconstruction and physical infrastructure development.

The allocation for the President has been increased by nearly 15 per cent to Rs. 85 billion from Rs. 74 billion this year, while that for the Prime Minister decreased a little to Rs. 300 million from Rs. 320 million in 2013. The allocation for the Finance Ministry is Rs. 164 billion.

Health and education

The allocations for health and education have been increased. Health has been allocated Rs. 117.6 billion compared to Rs. 93.5 billion for 2013. Given the unsatisfactory condition and facilities at government hospitals a much higher allocation than this was expected.

The votes for education and higher education have been increased marginally. Education has been allocated Rs. 38.8 billion compared to Rs. 37.9 billion for 2013. Despite several proposals for universities in the Budget Speech, the expenditure on higher education has been increased slightly by only Rs. 1.6 billion from Rs. 27.9 billion to Rs. 29.5 billion next year.

Other higher financial outlays for ministries for the next year include Rs. 144 billion compared to Rs. 131.4 billion for Ports and Highways for the current year and Rs. 106 billion for the Ministry of Economic Development.

Public expenditure pattern

Regrettably the public expenditure pattern for next year shows no reforms in the structure of government expenditure. There was an expectation that the large expenditure on physical infrastructure would be modified and that social infrastructure that is vital for long term economic development would be given a boost.

Regrettably expenditure on education is only about 2 per cent of GDP and expenditure on health less than even 2 per cent. In contrast, the expenditure on Defence and Urban development has once again been increased.

Infrastructure

The large expenditure on infrastructure not only results in the fiscal deficit not being contained, but also strains the trade deficit. In recent years the trade deficit has expanded owing to the large expenditure on infrastructure projects that have huge import content. Investment goods imports and the expenditure on petroleum imports have been an important reason for the large trade deficits of US$ 9 billion. The public expenditure pattern in 2014 too is likely to increase import expenditure and be an important reason for increasing the trade deficit.

Concerns

The list of development projects, concessions, increases in wages and allowances were so extensive that one wonders whether sufficient financial provisions have been made for them. Even though government expenditure has been increased by as much as 30 per cent from that of 2013, these commitments could exceed budgeted expenditures.

Another concern is that the implementation of several of the announced benefits requires an efficient, honest and non-politicised administrative machinery to ensure that the benefits reach the intended beneficiaries. This has proven an impracticable task as the former Janasavia and the current Samurdhi programme has demonstrated.

Under these programmes a large number of the needy have not obtained Samurdhi benefits, while a high proportion of those who do, are not the deserving poor. The very fact that as many as over a third of the country’s households obtain Samurdhi benefits, though the poverty count is only 9 per cent makes this self-evident.

Will much of the financial outlays of the budget actually benefit the intended beneficiaries or will they end up as handouts to a selected few?

The third concern is whether the expenditure allocation reflects a better prioritisation of government expenditure. There has been a concern that while economic infrastructure has been excessive, expenditure on social infrastructure has been inadequate. This is especially so with respect to health and education expenditure.

Although the 2014 budget proposed certain specific projects in health and education that could be beneficial, the total expenditure in these two vital areas, though increased, may be inadequate to offer quality health and education for the less affluent that cannot access private services.

Summing up

The Budget for 2014 clearly exemplifies the Government’s continuing thrust towards infrastructure development and strengthening the rural economy and society. Yet the efficacy of these programmes would depend very much on an efficient and non-politicised administration. Despite the rhetoric in the budget, the prioritisation of expenditure remains the same, with a bias towards infrastructure development and inadequate resources for health and education.

The Government’s objective of containing the fiscal deficit to 5.2 per cent of GDP is laudable but difficult to achieve. This and other fundamental fiscal issues will be discussed next week.