News

Click – and tricked

Two companies that take money from the public and promise hefty returns to those who view advertisements on their websites are being investigated by the Central Bank of Sri Lanka (CBSL).

The regulator has requisitioned for the accounts of Panora Advertising (Pvt) Ltd. and Luminous Advertising (Pvt) Ltd. to determine whether they are being run as Ponzi schemes, a senior official said. The CBSL has learnt of other companies conducting similar operations and hopes to broaden the scope of the inquiry.

Between them, the two companies have already collected well more than Rs. 100 million in “subscription fees” alone, said H. M. Ekanayake, director of the Supervision of Non-Bank Financial Institutions Department. Panora Advertising is based in Ambalantota while Luminous Advertising is in Tissamaharama.

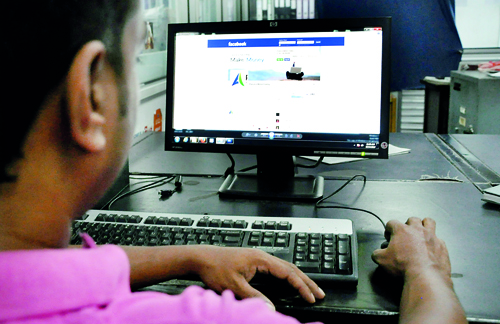

Click money: The website’s Facebook page says “we have many ways to make money and always more”

The CBSL was first alerted to their activities around six months ago. Since then, the regulator has received calls from persons wanting to know whether these firms were safe to invest with. The companies carried out rigorous publicity campaigns to attract subscriptions. It is not known how many customers they already have or whether these include people abroad.

Panora Advertising claims on its website that members can earn money “simply by viewing all the advertisements we display”. It also says “we have many ways to make money and always more”.

The website of Luminous Advertising did not work last week. Neither company was contactable; their numbers were either engaged, switched off or invalid. But their modus operandi is already known. Claiming to be advertising companies, they invite the public to choose one of their membership packages on the payment of a fee.

At Panora, for instance, the starter package costs US$ 10 or Rs. 1,300; the standard package US$ 600 or Rs. 78,000; and the advanced package US$ 1,200 or Rs. 156,000. Depending on the option customers chose, they would be told to click on a certain number of advertisements displayed on the Panora website.

The company promises to pay a starter member US$ 4 for clicking on four advertisements per week, a standard member US$ 40 for 10 advertisements per week and an advanced member US$ 80 for the same number of advertisements. More money can be earned through clicking on “offer advertisements,” it says. “Get paid to promote panoraadvertising.net,” it adds.

Interestingly, the Panora website created on July 24, 2013 expires on July 24, 2014. It does not indicate whom the site is registered to, who created it or the domain servers. Managers, directors or other employees are not named.

The CBSL has copies of the agreements entered into between customers and the suspect firms. They state that the initial payment is non-refundable. Membership is renewable after one year on the payment of a fresh deposit.

“Our main concern is that these companies promise to give much larger returns in comparison with the amount each person pays to become a member,” said Mr. Ekanayake. “For instance, if you pay Rs. 65,000 at the outset and watch five advertisements, you can earn Rs. 5,000 a week. That works out to Rs. 240,000 a year. How does the company pay this amount annually?”

The regulator will look into whether these companies have bypassed laws and regulations to set up a deposit-taking business. “These cannot be run forever,” Mr. Ekanayake said. “If subscribers stop paying their fees and new members dried up, the system could die. The early members may get their money back but those who join later may not be able to recover their subscriptions.”

“We cannot immediately define these operations as unauthorised until we look at their accounts and legal documents,” he continued. Among other factors, the CBSL will investigate what other sources of income these companies have —such as revenue generated from advertising and from clicks on adverts.

Panora invites clients to advertise their products on its website “to help increase your sales and traffic and the ability to reach out to thousands of potential customers you always wanted”. It does not disclose that many of those viewing these adverts are people who are promised payment in return for doing so.

“These companies are hiring people and getting them to click on advertisements of their clients, thereby manipulating the system,” said Jayantha Wijesinghe, a Google AdSense publisher. “Google is very smart now and have tracking devices to address these kinds of issues. It is unclear whether the companies in question have circumvented such protection to carry out this business. In return, those who click are paid a percentage of the income. This is unethical.”

Mr. Wijesinghe pointed out that there were many others marketing similar ventures on local media. “Earn money on the internet,” they say.

| I got Rs. 20,000 only once for my Rs. 78,000 fee and then it all stopped

The Sunday Times contacted a Panora member via Facebook. He declined to be identified saying he was a public official. He said he had paid Rs. 76,000 into Panora’s bank account. “They promised to pay me Rs. 5,000 a week for two years but I got only Rs. 20,000 or a month’s payment,” he said. “They stopped after that. When I call their phone number, it’s always busy.” If payments to other members have also ceased, it could be that the company is duping them while earning money from at least three sources —the subscriptions, the clicks on advertisements and from clients who use their website to market their products. His membership number was in the 20,000s. “I joined about three months ago,” he said. “Now, they might have around 30,000 members. I know that some people who have deposited more than Rs. 150,000. They are also suffering.” “I think this is a fraud,” he continued. “As far as I know, people go to their office in Ambalanthota every day to complain that they didn’t receive their money. But the company says something and gets away with it. Furthermore, we have no idea who or where the owner is.” “There is a big demand in the market for high interest rates and there people who supply these services,” said Central Bank Director H.M. Ekanayake. |