Columns

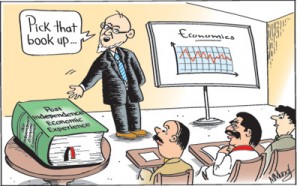

Lessons from past economic development experience

View(s): The economic development experience of post-independent years provides ample lessons and guidelines for economic policies for the future. Ignoring these, as well as the development experiences of other countries, could limit the country’s development potential. Pragmatic economic policies based on economic development experience rather than ideology and political populism is vital for economic development.

The economic development experience of post-independent years provides ample lessons and guidelines for economic policies for the future. Ignoring these, as well as the development experiences of other countries, could limit the country’s development potential. Pragmatic economic policies based on economic development experience rather than ideology and political populism is vital for economic development.

Healthy macroeconomic fundamentals, pragmatic economic policies that create adequate incentives for the private sector, economic and administrative reforms, correct prioritisation of public expenditure, investment in social infrastructure, especially education, are vital for sustained high economic growth.A rule-of-law-based society where laws are enforced without fear or favour and human rights and property rights are ensured is vital for economic development. Above all there must be national unity and harmony among ethnic and religious communities for economic development.

The foremost lesson to learn from our own history, and that of other multi- ethnic and multi-religious societies, is that national unity and ethnic and religious harmony are the most important prerequisites for economic development. Second, there is ample evidence and reasoning to demonstrate that outward-looking, export-led economic policies have been the successful economic strategy for the country. Third, state ownership and control of economic enterprises have been a fiscal burden and source of inefficiency and consequently a drag on development.

Fourth, there must be fiscal consolidation, the public debt must be reduced to less than 65 per cent of GDP, foreign debt must be curtailed by increasing export incomes and reducing the high trade deficit and the domestic savings ratio must be enhanced. Without these, the economic growth momentum achieved in recent years cannot be sustained.

Fourth, there must be fiscal consolidation, the public debt must be reduced to less than 65 per cent of GDP, foreign debt must be curtailed by increasing export incomes and reducing the high trade deficit and the domestic savings ratio must be enhanced. Without these, the economic growth momentum achieved in recent years cannot be sustained.

Foremost lesson

The single most hindrance to economic development has been the ethnic conflict, terrorism and the civil war. These destroyed national assets, hampered economic activities, deterred foreign direct investment, increased public expenditure, distorted priorities in expenditure, caused large fiscal deficits that in turn led to a large public debt and economic instability.

Terrorism ruined the tourist industry that was being developed by 1983, deterred foreign investment, disrupted agriculture, fishing and trading and production activities in the North and East. These well known facts have to be recognised now that peace has been restored. There has to be strong resolve and effective policies to prevent any recurrence of ethnic and religious tensions.

The democratically elected leadership of the Northern Provincial Council provides the means for ensuring ethnic harmony. The divisive tendencies in the country must be contained to ensure that there are no eruptions of ethnic or religious violence. The success of such restraint of ethnic and religious hatred, as well as measures to consolidate ethnic and religious harmony through community-based efforts, government initiatives and development efforts is vital for economic development.

Violence disrupts growth

The years of lowest economic growth were during the ethnic violence and insurgencies. The economic growth of 8 percent in 1978-84 fell sharply to 2.2 percent in 1987-89 due to ethnic riots, terrorism and the insurgency of 1988-89. The economy performed much below its potential, during the nearly three decades of war. This experience makes it clear that ethnic and religious violence should not be allowed to emerge. Policies towards national harmony must be pursued resolutely to ensure that the country’s economic development is not hampered.

Liberal economic policies

Liberal economic regimes achieved higher rates of economic expansion than those with greater state control of the economy. Outward-looking economic policies achieved much better economic performance than those that relied on import substitution.

An overall import substitution strategy, as in 1970-77, failed as small countries with limited resources and restricted domestic markets were unable to produce economically. They can neither save nor earn adequate foreign exchange. A return to an import substitution strategy could once again set back the economy.

An outward-looking export-led liberalised trade regime is the way forward. While import substitution in a few products that could be efficiently produced in the country may be sound economics, an overall import substitution strategy could be disastrous. Even such selective import substitution must be based on rational considerations of resources and capacities.

State ownership of enterprises

State ownership and control of economic enterprises have been a fiscal burden and drag on development. Their inefficient administration and large losses are a significant reason for fiscal deficits, increase in public debt and distortion of investment priorities and economic difficulties. The failure of state enterprises is more or less the experience of developing countries around the world and point to the need for economic enterprises to be left to private enterprise for most part and for the government to perform an effective regulatory function.

Policies with less state intervention in the economy are likely to spur investment. International experience underscores that certainty and predictability of economic policies are vital for foreign and domestic investment. Sri Lanka’s own experience demonstrates that policy uncertainty has been a key deterrent to attracting foreign direct investment.

Concluding reflections

The country is at a stage in its economic development when economic and administrative reforms are imperative for sustained economic development. Unless these are implemented speedily economic development would be constrained. The Institute of Policy Studies, State of the Economy 2013 Report pointed out clearly that “Without a reform effort, sustained economic stability would prove elusive.” The IPS contends that “To achieve more rapid economic growth Sri Lanka will need to introduce a series of economic reforms that will tackle major structural/supply bottlenecks. The critical initiatives needed include education reforms to enhance access to, and the quality of education, reforming labour markets to reduce rigidities, deregulating and/or restructuring public utilities sector, especially the energy sector; and overhauling the country’s tax system.”

It is also important for the government to change its strategy of achieving higher growth through massive foreign funding for infrastructure projects. Achieving high economic growth through foreign debt based consumption and on low productive investments that don’t increase tradable goods is not a sustainable strategy.

It is an opportune time to rethink economic policies, adopt sustainable economic strategies and undertake reforms that would enable healthy economic growth.