Columns

Economic growth amidst serious apprehensions

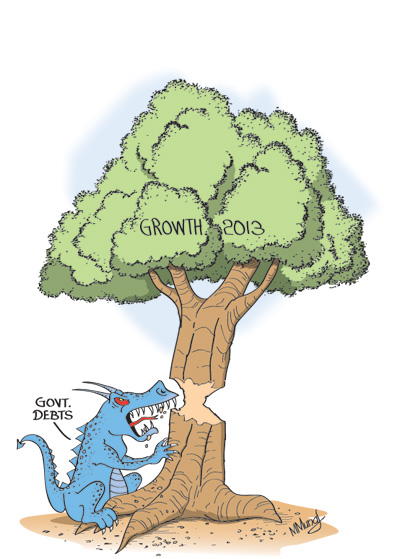

View(s):The economic performance of 2013, as revealed by the Central Bank Annual Report, was for the most part a positive one. However, somewhat concealed were serious concerns in public finances and debt that threaten economic stability and growth.

The economy revived from its dip in 2012 to register a growth of 7.3 per cent, one percentage point higher than of the previous year. There was growth in all sectors of the economy, though the growth in agriculture was lower than in 2012. The growth in manufacturing coupled with increased industrial exports; a decreased trade deficit of US$ 7.6 billion and a balance of payments surplus of nearly US$ one billion were the bright spots in the economic performance.

The economy revived from its dip in 2012 to register a growth of 7.3 per cent, one percentage point higher than of the previous year. There was growth in all sectors of the economy, though the growth in agriculture was lower than in 2012. The growth in manufacturing coupled with increased industrial exports; a decreased trade deficit of US$ 7.6 billion and a balance of payments surplus of nearly US$ one billion were the bright spots in the economic performance.

Last year’s economic growth of 7.3 per cent was significant as there was growth in all three sectors although agricultural growth declined to 4.7 per cent compared to a 5.2 per cent growth in 2012. Industrial growth of 9.9 per cent in 2013 is indeed good as it has been achieved by a growth in output of textile and apparels by 8.9 per cent, much higher than the 4.9 per cent in 2012. The export recovery in the last six months leads to expectations of a resuscitation of manufactured exports this year. Construction that is a component of the industrial sector continued to be an important contributor to industrial growth last year.

Services that contributed 56.8 per cent to GDP grew by 6.4 per cent compared with 4.6 per cent in 2012. Increase in trade contributed much to this growth with export trade growing at 6.7 per cent and internal trade by 6.9 per cent. Transport and communication grew by 9.4 per cent with post and telecommunications that have been dynamic in recent years growing by 11.4 per cent. The growth in tourism is mainly responsible for hotel and restaurants growing by 7.1 per cent.

Services that contributed 56.8 per cent to GDP grew by 6.4 per cent compared with 4.6 per cent in 2012. Increase in trade contributed much to this growth with export trade growing at 6.7 per cent and internal trade by 6.9 per cent. Transport and communication grew by 9.4 per cent with post and telecommunications that have been dynamic in recent years growing by 11.4 per cent. The growth in tourism is mainly responsible for hotel and restaurants growing by 7.1 per cent.

Economic concerns

These achievements are, however, counterbalanced by serious concerns in public finances and increasing foreign and domestic debt that threaten the stability of the economy and sustained economic growth. Serious weaknesses in the fiscal balance, growing public debt, high debt servicing costs, the large foreign debt whose servicing costs are straining the external finances and policy stance with respect to exchange and interest rates are among the fundamental weaknesses of the economy.

These are not highlighted, though mentioned, in the Central Bank Annual Report. Inadequate public expenditure on education and health is another basic weakness in prioritisation of public expenditure that will bear heavily on long term growth. These vital areas of economic concern threaten the long-term viability of the economy.

Weak public finances

As revealed by the Annual Report, the fiscal deficit to GDP ratio has been brought down to 5.9 per cent in 2013, only marginally higher than the target of 5.8 per cent. This reduction has been achieved by government expenditure being passed on to state banks. If these expenditures of the government are taken into account, the public debt to GDP ratio is likely to have increased.

In spite of this, the weaknesses in the public finances are revealed by the onerous debt servicing costs. The servicing of the public debt is the highest expenditure of the government that accounted for nearly one half (49.6) of government expenditure in 2013 and soaked up all of government revenue. The fact that the servicing of the public debt exceeds last year’s revenue (102 per cent) means that the government required borrowing to even service the debt. The large debt servicing burden is itself a cause for increasing public debt as other government expenditures have to be met by borrowing. Meanwhile government revenue has declined from 13.9 per cent of GDP in 2012 to just 13.1 per cent in 2013.

Increasing debt

Total outstanding government debt increased by 13.2 per cent from Rs. 6 trillion in 2012 to reach Rs. 6.8 trillion in 2013. While domestic debt increased by nearly 19 per cent from Rs. 3.2 trillion in 2012 to Rs. 3.8 trillion in 2013, foreign debt increased by about 7 per cent from Rs. 2.76 trillion in 2012 to Rs. 2.96 trillion in 2013.

The servicing of the rising foreign debt is becoming progressively more serious. Foreign debt service payments required 16 per cent of export earnings last year. The absorption of as much as 16 per cent of export earnings to service foreign debt is a burden on the external finances and could lead to a vicious cycle of a debt trap when we have to keep borrowing to repay debt. The extent of foreign borrowing should be kept to a limit based on the projected export earnings.

The servicing of the rising foreign debt is becoming progressively more serious. Foreign debt service payments required 16 per cent of export earnings last year. The absorption of as much as 16 per cent of export earnings to service foreign debt is a burden on the external finances and could lead to a vicious cycle of a debt trap when we have to keep borrowing to repay debt. The extent of foreign borrowing should be kept to a limit based on the projected export earnings.

Declining FDI

Time and again this column has emphasised the need for higher foreign direct investment (FDI) of the right types that would propel industrial exports and transfer technology and management skills. In 2013 FDI declined by 2.7 per cent to US$ 916 million with most investments being in hotels. The inability to attract FDI is a constraint on higher rates of investment for growth and leads to greater dependence on foreign debt that exacerbates the debt problem.

Priorities

In this context of fiscal constraints when there are inadequate finances for even essential recurrent expenditures, such as payment of salaries and pensions, developmental needs are being compromised. Prioritisation of public expenditure is distorted away from the needs for future development. As pointed out previously in these columns, and recently highlighted by Verite Research, the Government was sacrificing public investment on critical areas for development such as health, education, transport, communication and welfare.

It is not increases in year to year economic growth rates that matter; it is the level and type of investments that sustain growth that must be looked at. Some of the infrastructure development meets this requirement but social infrastructure and institutional reforms remain neglected.

Growth apprehensions

The growth in GDP has been achieved by undermining macroeconomic fundamentals. It is time to focus on how sustainable economic growth could be achieved within a stable macroeconomic framework rather than be obsessed with annual growth rates that have been achieved by increasing foreign and domestic debt and cutting developmental expenditure.