Columns

Projections, prospects and prerequisites for growth

View(s): The Central Bank expects the economy to grow by 7.8 per cent this year. The IMF projects a lower growth of 7 per cent and the World Bank 7.3 per cent. The common consensus is that it will grow by at least 7 per cent which is satisfactory. What is more important than the annual growth rate is the impact of the growth process on long-term development of the economy and whether policies that ensure increased investment and improves efficiency are in place.

The Central Bank expects the economy to grow by 7.8 per cent this year. The IMF projects a lower growth of 7 per cent and the World Bank 7.3 per cent. The common consensus is that it will grow by at least 7 per cent which is satisfactory. What is more important than the annual growth rate is the impact of the growth process on long-term development of the economy and whether policies that ensure increased investment and improves efficiency are in place.

The discussion on economic growth should focus on the quality and implications of the growth strategy and the prerequisites for sustaining a high-growth momentum. Interestingly, while the Central Bank is forecasting a growth of 8.2 per cent for 2015 and 8.3 per cent for 2016, the IMF projection for 2015-19 is a much lower average of 6.5 percent. This forecast has no doubt taken into account the direction of economic policy, developments in macroeconomic fundamentals and global economic expectations.

Short-term growth

This year’s growth could be adversely affected by internal and external shocks like drought and oil price increases. Even though short-term economic growth is easier to predict than long-term growth, unexpected internal and external shocks can upset the calculations. At present the extent of the impact of the drought on the economy remains uncertain. Already the drought has affected agricultural output and power generation, but its continuation could affect growth adversely. There is much uncertainty in global economic developments owing to the US-Russian confrontation over Ukraine and economic sanctions. Economic implications of the Geneva resolution for the Sri Lankan economy remain uncertain. A 7 per cent economic growth this year depends on growth in manufactured exports and increased foreign exchange earnings from tourism that would increase output of goods and services.

Short-term growth could be achieved in many ways, some of which could undermine longer-term economic growth. It is the manner in which recent growth has been achieved that casts a shadow on the prospects for sustaining the growth momentum. Much of the large infrastructure investments that have been made are not likely to bring significant economic returns for some time, though some would in the fullness of time. Debt incurred on these investments is a severe burden on public finances and have weakened macroeconomic fundamentals.

Short-term growth could be achieved in many ways, some of which could undermine longer-term economic growth. It is the manner in which recent growth has been achieved that casts a shadow on the prospects for sustaining the growth momentum. Much of the large infrastructure investments that have been made are not likely to bring significant economic returns for some time, though some would in the fullness of time. Debt incurred on these investments is a severe burden on public finances and have weakened macroeconomic fundamentals.

Debt servicing costs that exceed revenue implies further borrowing to even finance recurrent expenditure and distorts priorities in public expenditure by constraining long-term developmental expenditure. Foreign debt servicing absorbs 16 per cent of export earnings and strains external finances. Furthermore, government spending through proxy foreign borrowing by banks and state banks financing government expenditures through guarantees could destabilise the state banks and ultimately require the government to expend huge sums to capitalise them, as happened before. These fundamental weaknesses in economic fundamentals affect the development capacity of the country in the long run.

Economic policies matter

In as much as macroeconomic fundamentals bear heavily on investment and economic growth, they also lead to economic and financial policies that undermine economic stability and growth. Policies have an important bearing on the capacity of the economy to attract investments, the productivity of investments and long-term economic growth. The manner in which growth has been achieved recently raises serious questions in economic stability, investment priorities and financial and fiscal management.

The manner in which the macroeconomic situation is being handled is a concern. Current policies tend to keep exchange and interest rates unchanged as much as possible to maintain apparent stability. In fact, such policies may take the economy away from that goal if the exchange rate is allowed to appreciate and interest rate ceilings prevent the “financialisation” of savings. Both these policies have a bearing on external finances as they create excess demand for foreign exchange and domestic credit and move the economy away from a stable growth path.

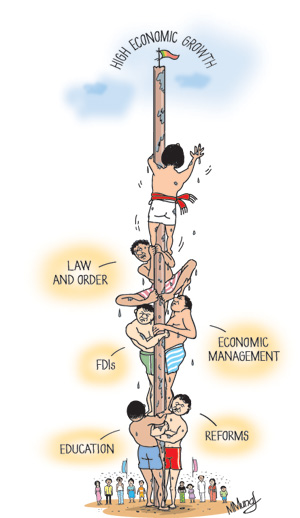

Prerequisites for growth

There is a difference in the achievement of short-term growth and longer-term economic development. The prerequisites for longer-term development are many and there are growing concerns that economic and non-economic developments are not conducive to growth. Communal tensions, the most serious debilitating factor in the country’s economic history, remain unresolved. The country’s political stability has not led to societal stability, national cohesion and communal and religious harmony. Law and order, the rule of law and the integrity of the legal system are essential prerequisites for development. These key elements for economic development are deficient. There are growing concerns in national disharmony and lawlessness that affect the economy.

Societal stability depends upon how well institutions provide a stable climate for ongoing, long-term investments that could be undertaken with confidence by investors. Protection of property rights is vital to encourage both foreign and private investment. Inadequate foreign direct investment into the country is symptomatic of the lack of these conditions for investment confidence. In contrast, Communist Vietnam and China are much friendlier to private enterprise than Sri Lanka and attracts huge amounts of foreign direct investment. Just as much as the government has made a clear statement that it would not privatise state enterprises, investment would have been boosted by enacting a law guaranteeing private property rights.

Education

Investment in education especially in the sciences, information technology and technical skills is vital for facilitating long-term economic growth. Government investments in technological education are a means to increase skills and productivity for long-term economic development. The fiscal constraints have resulted in inadequate investment in education as well as health.

Summing up

Longer-term economic development is much dependent on law and order, proper economic management, FDI in manufactures and services, economic reforms and better prioritisation of government expenditure. Investment in educational institutions, both private and public is an important factor in ensuring long-term economic growth. Reforms that enhance capacity utilisation and productivity are needed to ensure growth. Above all societal harmony and an investment friendly climate are vital for long-term development.