Columns

Is our external debt sustainable?

View(s): Although the comments of the recent IMF mission were positive, there were a few words of warning about the country’s foreign debt. They cautioned the country about the rising commercial debt and advised it to invest borrowed money in high return projects that will make the economy and tax revenues to grow.

Although the comments of the recent IMF mission were positive, there were a few words of warning about the country’s foreign debt. They cautioned the country about the rising commercial debt and advised it to invest borrowed money in high return projects that will make the economy and tax revenues to grow.

This was sound advice. However it does not bring out the seriousness of the growing foreign debt and its increasing debt servicing costs. May be the IMF mission made a more forthright appraisal of the external debt position during its closed door consultations with the Government and drew attention to the seriousness of the problem.

Increasing foreign debt

Several Sri Lankan economists have pointed out the perils of the large increase in the country’s foreign debt in recent years and the consequent increasing foreign debt servicing costs. These have raised serious concerns about the country’s external debt sustainability. The sharp increases in debt servicing costs are due to the increased borrowing at higher commercial interest rates.

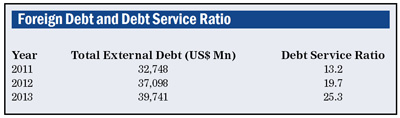

Foreign debt, now correctly defined as debt by all entities in the country, increased significantly since 2000. In 2012 total external debt reached US$ 37 billion and in 2013 it increased further to reach US$ 39 billion. There was further borrowing of US$ 1500 million early this year.

The foreign debt of US$ 39.7 billion was 60 per cent of the country’s GDP of US$ 65 billion in 2013. It was higher in 2012 at 62.5 per cent in 2012 but declined owing to the increase in GDP in 2013. More significant is the high debt servicing costs of this debt. The debt servicing costs absorbed 25.3 per cent of export earnings.

The increases in foreign debt have increased debt servicing costs, especially as most recent borrowing has been on commercial or non-concessionary terms. Commercial borrowing now constitutes one half of the total foreign debt. Consequently, foreign debt servicing costs that absorbed nearly 20 per cent of export earnings in 2012, increased to 25.3 percent in 2013. Expending as much as a fourth of the country’s export earnings to service the debt is a severe strain on the balance of payments and raises apprehensions on the country’s foreign debt sustainability.

Changing debt profile

Changing debt profile

Recent increases in commercial borrowings have also tilted the debt profile more towards commercial borrowing from the earlier reliance on concessionary loans from bilateral and multilateral sources. In 2013, commercial loans were as much as 50 per cent of foreign borrowing. This trend of increasing commercial loans will continue as Sri Lanka, as a low middle income country, is no longer entitled to concessionary loans.

Consequently further borrowing on commercial terms increases debt servicing costs due to both higher interest rates and short-term nature of such debt. Therefore there should be a cautionary approach to such borrowing. As the IMF advised, borrowed money should be invested “in high return projects that will make the economy and tax revenues to grow.”

Uses of foreign debt

Foreign borrowing is not intrinsically bad. Foreign borrowing can assist in resolving constraints in foreign resources for development, supplementing inadequate domestic savings for investment, and undertaking large infrastructure projects. Foreign borrowing can spur an economy to higher levels of economic growth than its own resources permit.

However, the extent, costs, terms of borrowing, and use of funds have significant implications for debt sustainability. Infrastructure projects that either save or earn foreign exchange are the least burdensome. The investment in large infrastructure projects should be cost effective and spread out over time to lessen the debt servicing burden. Infrastructure development should be on the basis of their returns, especially their contribution towards the production of tradable goods.

Although some foreign borrowing has been for infrastructure development, such as for power and energy, ports, roads, bridges, water supply, agriculture, fisheries and irrigation that are beneficial, the high costs incurred and long periods of gestation are concerns for debt repayment. Besides this, all infrastructure development is not necessarily of benefit to the economy. Some high cost infrastructure development has been more a burden than a benefit as their economic returns are doubtful.

Some economists are, however, of the mistaken view that all infrastructure projects are beneficial irrespective of their costs or benefits. The inability to discern between high cost infrastructure projects that are of economic benefit and others that are of doubtful economic benefits is a serious deficiency of the country’s economic development strategy.

Some economists are, however, of the mistaken view that all infrastructure projects are beneficial irrespective of their costs or benefits. The inability to discern between high cost infrastructure projects that are of economic benefit and others that are of doubtful economic benefits is a serious deficiency of the country’s economic development strategy.

Foreign direct investment (FDI)

In this context of high foreign indebtedness, reliance on higher foreign direct investment is the way forward. As we have pointed out before, the inability to attract adequate FDI since the ending of the war has been a constraint to higher economic growth. FDI not only increases investment, but also transfers technology and expands foreign markets. Such investment carries no costs or risks to the country.

Despite expectations of mobilising US$ 2 billion of FDI in 2013, less than one billion (US$ 915 million) was obtained. Although this is a small amount compared to what other countries in Asia have been able to obtain and a fraction of what is needed for the country, some economists in the Central Bank are content with it and delighted about the country’s ability to borrow large amounts at high interest rates.

Avoid debt trap

The increases in the external debt and high debt servicing costs have brought the country to the verge of an unsustainable external debt burden. The reduction of the foreign debt is particularly important as it has reached proportions when the debt servicing costs are a strain on the balance of payments. The increasing debt servicing costs could lead to a need to borrow more internationally at high interest rates to meet debt servicing needs, thereby increasing the foreign debt servicing costs further.

Containing the foreign debt as well as the careful use of borrowed funds in economically beneficial projects is imperative to avoid being enmeshed in a vicious foreign debt cycle and debt trap.