News

Profit-making CEB ‘should drop fuel tax’

A consumer rights group is demanding that the Ceylon Electricity Board (CEB) reduce the fuel surcharge introduced more than 18 months ago given the steady rise in board revenue.

Bandula Chandrasekara

The demand follows a disclosure by CEB Chairman W. B. Ganegala to this paper that the board had been able to pay off arrears due to the Ceylon Petroleum Corporation by last November and to also settle most of its debts to banks.

National Electricity Consumers’ Movement (NECM) Advisor Bandula Chandrasekara said the government and CRB officials, including the board chairman, had assured the public that the surcharge would be lifted when the board gains profits.

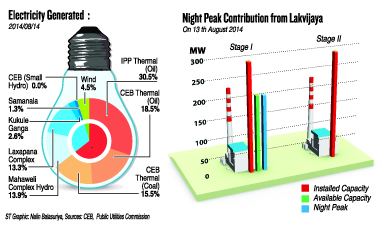

“It is high time that they kept their promise because since last year the board has been receiving profit. The profit for the year 2013 was Rs. 20 billion,” Mr. Chandrasekara said, adding that the Norochcholai coal power plant had been built in a bid to reduce the surcharge.

Officials had said at the time that the coal power plant would help the country to generate fuel at a lower price.

The fuel adjustment surcharge was introduced in February last year to compensate for the costs of thermal power generation.

Mr. Chandrasekara pointed out that phase one and two of the Norochcholai plants were currently functioning and the CEB had no reason to continue burdening consumers with the task of paying off losses.

He said if the coal plant was properly maintained the CEB would be able to increase profit further but the board was at fault on this matter.

He said if the coal plant was properly maintained the CEB would be able to increase profit further but the board was at fault on this matter.

“When the coal power plant was first set up, engineers warned of difficulties in importing coal between June and September as the seasonal winds made the seas rough and impeded transport. They suggested bringing down coal beforehand and storing it, which the CEB clearly did not do,” he said.

Power generation of the second phase of Norochcholai has been temporarily halted because of the shortage in coal supply, Mr. Chandrasekara said.

He said the lack of proper management and inefficiency of CEB officials had affected power generation.

“The CEB is getting enough profit. Last year with enough rain and the income gained by the fuel adjustment surcharges it was able to stabilise its position,” he said, adding that he could not understand why the board was focusing on buying power from the private sector at higher costs.

According to Mr. Chandrasekara the production cost of hydro-power unit is Rs. 3, coal power, Rs. 12 and thermal oil, Rs. 30.

“There is no reason for the CEB to buy power when it can generate power at a lower cost. This is only burdening the public. The board is not ready to remove the surcharge because it has to pay private plants. One can say that the CEB is affected by the oil mafia,” he alleged..

“We believe that another solution is the generation of renewable energy. The board is not ready to invest in projects to increase the production of renewable energy in the country. However, 9 per cent of electricity is generated this way and it is successful,” Mr Chandrasekara said.

Reservoir storage levels as at August 13 stood at 681.7 MWh and this time last year were nearly 1200 MWh. Though the reservoir levels were almost full the CEB did not make a move to remove the fuel adjustment surcharge.

This week the water level of Maussakelle was 94.7 per cent; Victoria, 37.8 per cent; Kotmale, 81 per cent; Castlereagh, 84.9 per cent; Samanalawewa, 20.7 per cent and Randenigala, 19 per cent.

Mr. Chandrasekara said although reservoirs were not full the CEB could not argue that this made it impossible to remove the surcharge.

“If the CEB is functioning efficiently and the Norochcholai coal power plant is working properly the country will not have to depend on hydro power,” he said.

The Chairman of the CEB said he was not available for further

comment.