Foreign banks to play greater role in local economy, Central Bank says

View(s):The CB said the Act to facilitate the proposed merger of the three banks, viz., DFCC Bank, National Development Bank PLC and the DFCC Vardhana Bank PLC, was enacted while the Ministry of Finance made arrangements to issue the Gazette Notification in relation to exemption of Stamp duty for issue of share certificates for mergers and acquisitions under the financial sector consolidation process.

Foreign banks in Sri Lanka are expected to play a greater role in economic activities and make a significant contribution to the economy, the Central Bank (CB) has said.

In its monthly update on the progress of the consolidation of the financial sector and its reforms, the CB said last week that “foreign banks expressed their commitment to operate as intermediaries of their entire international branch network to channel funds and expertise to several sectors of the economy”.

This came during ‘one-to-one’ meetings chaired by the CB Governor and held with foreign banks to discuss the progress made on their expected contribution under the financial sector consolidation process.

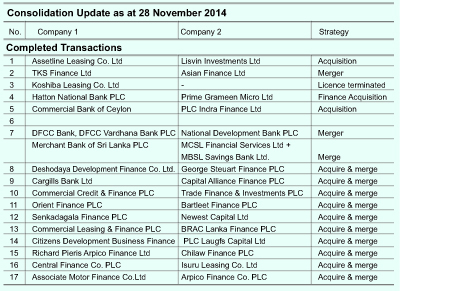

The CB said that in November further progress was made by banks and finance companies and leasing companies on the financial sector consolidation process.

“The proposed amalgamation of the Merchant Bank of Sri Lanka PLC, MCSL Financial Services Ltd and MBSL Savings Bank Ltd has reached the final stage of completion. The necessary shareholder approvals were obtained and the merged entity will operate as a licensed finance company from 2015,” it said.

The CB said the Act to facilitate the proposed merger of the three banks, viz., DFCC Bank, National Development Bank PLC and the DFCC Vardhana Bank PLC, was enacted while the Ministry of Finance made arrangements to issue the Gazette Notification in relation to exemption of Stamp duty for issue of share certificates for mergers and acquisitions under the financial sector consolidation process.

The statement also said that the consolidation process of seven NBFIs has been completed and another 22 NBFIs and four banks are in progress for completion in due course.