Columns

Reduction of massive foreign debt burden imperative in 2015

View(s): Irrespective of whether voters choose continuity or change on January 8, the economic challenges this year are formidable. Among the many economic challenges is the imperative to reduce the massive increasing foreign debt, whose servicing costs are a huge burden on the economy.

Irrespective of whether voters choose continuity or change on January 8, the economic challenges this year are formidable. Among the many economic challenges is the imperative to reduce the massive increasing foreign debt, whose servicing costs are a huge burden on the economy.

About 25 per cent of export earnings are needed to service the foreign debt that constitutes 43 per cent of the public debt. And the debt servicing costs of the public debt are more than the government’s revenue.

The severity of the problem is such that the country is closing upon a foreign debt trap. If external finances deteriorate due to a reduction of exports, reduced tourist earnings and increased costs of imports, the problem would worsen.

Increase in foreign debt

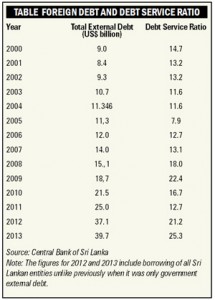

Foreign debt increased significantly in the last decade. It tripled between 2000 and 2012 and quadrupled between 2000 and 2013. Such a massive increase in foreign debt is a serious concern, especially as recent increases in foreign debt have been commercial borrowings at high interest rates.

By the end of 2012 foreign debt (that is now defined as total borrowings of Sri Lankan institutions) increased significantly to US$ 37.1 billion and its servicing was 21 percent of export earnings. In 2013 foreign debt reached US$ 39.7 billion and its servicing costs were 25.3 percent of export earnings. The use of such a high proportion of export earnings for servicing the foreign debt is a strain on the balance of payments and an emerging concern in foreign debt sustainability.

The foreign debt that reached a massive US$ 39 billion at the end of 2013, increased to US$ 42.5 billion by June this year. The latest figures indicate that it had risen further to US$ 44 billion by the end of November and is likely to have increased further to about US$ 45 billion by end 2014.

The foreign debt that reached a massive US$ 39 billion at the end of 2013, increased to US$ 42.5 billion by June this year. The latest figures indicate that it had risen further to US$ 44 billion by the end of November and is likely to have increased further to about US$ 45 billion by end 2014.

This includes debt incurred by banks that are a liability on the country’s foreign reserves. These proxy borrowings comprised three five year loans. The Bank of Ceylon raised US$ 500 million at a 5.3 percent interest rate in April: The NSB borrowed US$ 750 million at a higher interest rate of 8.875 percent in September: and $ 100 million by DFCC Bank at an even higher interest rate of 9.6 percent in October. Furthermore the government is expected to raise another US$ 1.5 billion by the sale of a Sovereign Bond in international markets this month.

The external debt servicing commitments in the 12 months ended November of this year (2014) is estimated at US$ 5.7 billion and expected to increase by US$ 1.2 billion to US$ 6.9 billion by October of next year. Consequently foreign debt servicing is a strain on the balance of payments, as around 25 percent of export earnings are needed to meet foreign debt servicing costs. Bringing down the foreign debt is a challenging task this year.

Increased commercial borrowing

Recent increases in commercial borrowings have tilted the debt profile more towards commercial borrowing from the earlier bias towards concessionary loans from bilateral and multilateral sources. This increases the debt servicing costs due to both higher interest rates and short term nature of such debt.

In 2012 the foreign debt profile shifted more towards commercial borrowing rather than concessionary loans from bilateral and multilateral sources and in 2013 commercial borrowing accounted for one half the foreign debt. This trend of increasing commercial loans will continue as Sri Lanka, as a low middle income country, is no longer entitled to concessionary loans.

Uses of foreign loans

Foreign borrowing is not intrinsically bad. Foreign borrowing can assist in resolving constraints in foreign resources for development, supplementing inadequate domestic savings for investment, and undertaking large infrastructure projects. Foreign borrowing can spur an economy to higher levels of economic growth than its own resources permit. However the extent, costs, terms of borrowing, and use of funds have significant implications for debt sustainability.

All infrastructure projects are not beneficial. There is a vital difference in investing on high cost infrastructure projects that are of economic benefit and others that are of doubtful economic benefits. Large investments in infrastructure without consideration of their costs and benefits have been a serious deficiency of the country’s economic development strategy. Infrastructure projects that either save or earn foreign exchange are the least burdensome. Investment in large infrastructure projects should be cost effective and spread out over time to lessen the debt servicing burden. Infrastructure development should be on the basis of their returns, especially their contribution towards the production of tradable goods. These considerations must guide future foreign borrowing to avoid getting further into a debt mire.

Although foreign borrowing has been for infrastructure development, such as for power and energy, ports, roads, bridges, water supply, agriculture, fisheries and irrigation that are beneficial, the high costs incurred and long periods of gestation are concerns for debt repayment. Besides this, all infrastructure development is not necessarily of benefit to the economy. Some high cost infrastructure development has been more a burden than a benefit as their economic returns are doubtful. The under utilized capacity of large infrastructure projects has been a serious economic blunder.

Although foreign borrowing has been for infrastructure development, such as for power and energy, ports, roads, bridges, water supply, agriculture, fisheries and irrigation that are beneficial, the high costs incurred and long periods of gestation are concerns for debt repayment. Besides this, all infrastructure development is not necessarily of benefit to the economy. Some high cost infrastructure development has been more a burden than a benefit as their economic returns are doubtful. The under utilized capacity of large infrastructure projects has been a serious economic blunder.

Warnings

In July this year the International Monetary Fund (IMF) cautioned Sri Lanka on foreign borrowings by the state and banks. At the time of the budget, the Central Bank too cautioned the government on financing the budget deficit through foreign borrowing.

In conclusion

At the end of 2014, the foreign debt is likely to have reached US$ 45 billion. This growing foreign debt burden, whose debt servicing costs are one fourth of export earnings, is a serious worry. Despite the huge foreign debt and its servicing cost being a severe burden on the economy, the government continues to increase its foreign debt.

The external finances of the country are often subject to external shocks, such as depressed demand for exports, sharp increases in import prices and volatile interest rates. Therefore more prudent foreign borrowing is essential. The government must restrain from further borrowing as well as reduce the debt with balance of payments surpluses.