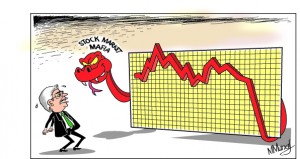

Ranil slams stock market mafia

View(s):Prime Minister Ranil Wickremesinghe on Tuesday slammed corrupt sections of Sri Lanka’s private sector to the extent of naming businessmen like Dilith Jayaweera and Nimal Perera.

“There are a number of allegations of violations of the Colombo Stock Exchange market rules and Securities and Exchange Commission regulations. The minor ones were compounded. Thirteen large cases were abandoned purportedly on a lack of evidence,” he told parliament. He noted that were not probed or were settled when it should have been probed further.

“I would like this to be recorded in the Hansard. I have requested the Securities and Exchange Commission to go into these cases. If necessary, I will bring legislation to permit such inquiry. I am also seeking the appointment of a Parliamentary Select Committee to inquire into these transactions. Since some of the issues raised are under consideration by the committee, I prefer to give an answer elaborately after the report is submitted. We plan to table this report in Parliament.”

He further said, “We have created a free and fair climate for the business community. They are free from fear and intimidation. This applies to the media in this country too. There are no threats, intimidation or trips in white vans.”

The Premier also said that ‘it’s high time they turn the searchlight into areas that have remained a virtual “no go zone” in the past.’

Nimal Perera unfit to head a bank

“Take for example the banking sector. Take the name of Nimal Perera at Pan Asia or Ranee Jayamaha of Hatton National Bank. Who are they and how did they benefit from certain political personalities of the previous administration? How can Mr. Perera head a bank given the large number of surveillance referrals made to the Colombo Stock Exchange?

The National Savings Bank purchased 13 per cent of The Finance Company at Rs. 50 per share. That is Rs. 20 above market value. The mastermind behind this was Ajith Devasurendera and Dinal Wijemanne. Today, The Finance Company has recorded accumulated net losses of Rs. 16 billion.”

He also added that former Chief Justice Shirani Bandaranayake’s private bank records were forcibly released by the then management of the National Development Bank (NDB) against all norms relating to confidentiality of client data. “It is for those in the banking industry to turn the searchlight inwards. They are not casinos or gambling dens. There are time-tested traditions and conventions.”

He said that similarly in the business sector a closer examination of some of the players becomes inevitable. “Take for example Dilith Jayaweera. His roles in the Colombo Land and Development Company and the Reef Comber have to be probed by the authorities. Another such instance is Scott Newman and Kosala Heengama. Similarly their roles in Environment Resources Investments require very close scrutiny. Take the case of John Keells – the Government’s decision to cancel the casino licences has resulted in shareholders dumping their shares. This is the only way to show their protest against questionable choices by the management.”

How much was spent for the country’s development and how much went to fatten the purses of those corrupt is slowly but surely unfolding, he said, adding that sooner than later, the people of this country will realise how their monies have been squandered.

“This sorry state of affairs came about against much touted claims of prosperity. The Central Bank had made losses for the past three years though self-acclaimed financial wizards, through devious campaigns, spoke of growth and gains,” he said, adding that millions of dollars were spent, without express approval by the Cabinet Ministers, on a string of public relations companies in an extravaganza of promoting Sri Lanka.