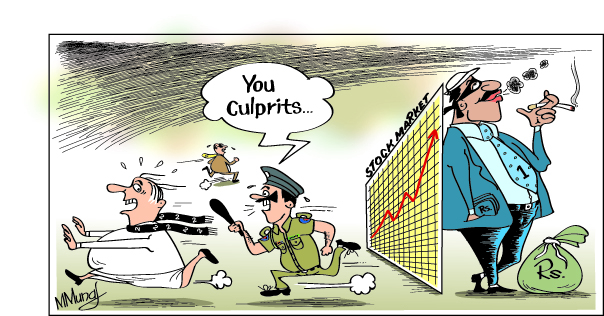

Stockmarket and bond market mafia in for a rude shock

Sri Lanka’s so-called stock and bond market mafia dons seem to have no bearing in the change in government, but they’ll wake up to a ‘rude shock’, a top government minister warns.

“This mafia whether in the stock or bond market seem to have no bearing to the change in government. Well, they’re living in false hope. They’ll wake up to a rude shock one day,” Harsha de Silva, Deputy Minister of Policy Planning and Economic Affairs, told the Business Times recently.

In this light, he said that probes on malpractices in related sectors are now on full speed.

Pertaining to the Securities and Exchange Commission (SEC) probes, Dr. De Silva added that delay in these investigations was mainly due to inadequate staff and some insider dealings’ of a unique kind. “The issue was with not having the right staff and also these probes were hampered by people within/inside (the SEC) who are connected to the stockmarket mafia,” he said, adding that, “Now with the new Director General at the SEC, share market manipulations are being investigated and the SEC chairman would have the ability to quickly move this process.”

On April 10, Vajira Wijegunawardane was appointed as the SEC Director General.

The SEC recently called for information from the Colombo Stock Exchange (CSE) on suspect transactions during 2011-2013, sources close to CSE said.

Dr. De Silva added that large scale and significant reforms in the financial markets are being done.

“We want to remove the conflicts of interests that the Central Bank (CB) has with Public Debt Department and the Employee Provident Fund (EPF).”

He reiterated that the country needs a good public debt management strategy.

“There were so many adhoc decisions in the past that may not have resulted in the optimum borrowing strategy for the country.” He added that now, some Rs. 672 billion worth of bills need to be settled for which no proper allocation seem to have been made in the earlier regime.

“There has been a window dressing of accounts. Despite the earlier regime saying that debt to GDP was falling, the actual debt burden hasn’t been captured. It’s outside of contingent liabilities.” He added that as a result, debt sustainability is different to what was said at that time.

“It’s in this context that we are trying to bring in a transparent, realistic and appropriate debt management programme,” he added.