Columns

Implications of economic growth performance in 2014

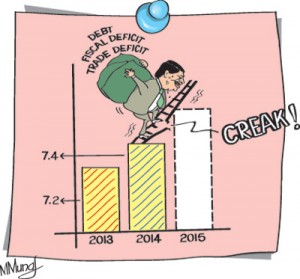

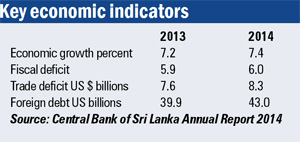

View(s):Last year’s economic growth of 7.4 per cent, as disclosed in the Central Bank Annual Report for 2014, is a continuation of the economic growth trend averaging 7.4 per cent in the last five years (2010 to 2014). It is also a continuation of the pattern of development in recent years. The sources of growth displayed weaknesses and serious fundamental fiscal and trade imbalances. Foreign indebtedness continued to increase to reach a new high.

Economic growth

Economic growth

Economic growth in 2014 was the highest in the last three years (2012-14) when the average annual economic growth was 7 per cent. It was slightly higher than the 7.2 per cent achieved in 2013.

The high economic growth of recent years was fuelled by large investments in infrastructure financed mostly by foreign borrowing. Although such investment generates GDP growth, the long-term benefits of such investment in infrastructure are too little in comparison with their costs. Consequently such growth creates serious fundamental weaknesses in the economy.

Growth in sub sectors

The sub sectors of the economy that grew were construction, import trade, public services (salaries) and services such as communications, banking and insurance. The growth in some of these is a positive development, but the growth in others, such as in construction, public services and trade related services are of lesser economic significance.

The growth in construction by 20.2 percent contributed 23.8 percent to the 7.4 percent growth. Factory industry that grew by 8 per cent last year owing to a buoyant export market contributed 8.5 per cent while agriculture grew by only 0.3 percent owing to bad weather conditions affecting most crops in 2014.

The services sector that grew at 6.5 per cent, slightly higher than the 6.4 per cent growth of 2013, accounted for 57.6 per cent of GDP. Services had both positive features as well as less beneficial contributions, such as growth in internal and export trade related services and excessive expansion of public services.

Growth was excessively reliant on infrastructure investment rather than on raising productivity for sustainable growth. Economic growth generated by large foreign-funded infrastructure investment with inadequate returns from such investment increases foreign indebtedness and weakens macroeconomic fundamentals.

Fundamental weaknesses

Three key weaknesses in the economy in recent years are the fiscal imbalance, the large trade deficit and the massive foreign debt. These weaknesses are detrimental to economic growth in the long run.

The fiscal deficit last year at 6 per cent of GDP was higher than the 5.9 per cent of 2013 and much higher than the targeted 5.2 per cent that the government repeatedly said it would achieve. The main reason for the increased deficit was a decline in government revenue to 12.2 per cent of GDP in 2014 compared to 13.1 per cent in 2013. This declining trend in revenue is a fundamental weakness.

The fiscal deficit last year at 6 per cent of GDP was higher than the 5.9 per cent of 2013 and much higher than the targeted 5.2 per cent that the government repeatedly said it would achieve. The main reason for the increased deficit was a decline in government revenue to 12.2 per cent of GDP in 2014 compared to 13.1 per cent in 2013. This declining trend in revenue is a fundamental weakness.

The fiscal imbalance must be reduced by taxation reforms that increase government revenue to about 18-20 per cent of GDP. While adopting a progressive tax structure that does not discourage investment, public expenditure must be properly prioritised and prudently expended by cutting ostentatious exorbitant wasteful expenditure and at the same time expending more resources on priority areas like education, health, research and beneficial infrastructure development. The Government has made this shift in public expenditure, but measures to increase revenue have to be put in place.

Debt

Debt

The rising public debt is a serious concern as it is 75 per cent of GDP and debt servicing costs absorbed 90 per cent of revenue. The foreign debt that increased from US$ 39.9 billion in 2013 to US$ 43.0 billion in 2014 is especially burdensome. The foreign debt as a percentage of GDP, however, decreased from 59.4 per cent in 2013 to 57.4 per cent in 2014 owing to the increase in GDP exceeding the increase in debt. There was also an improvement in the debt servicing cost of the foreign debt that absorbed 23.4 per cent of export earnings in 2013 decreasing to 20.2 per cent owing to a reduction in the repayment of principal and increased export earnings.

Despite these improvements, foreign debt that is more than one half of GDP absorbed one fifth of export earnings. It is a burden that must be reduced by restraint in borrowing and increasing the balance of payments surplus by reining in imports and expanding exports.

Trade deficit

Despite a high rate of economic growth of 7.4 per cent and export growth of 7.1 per cent over that of last year, the trade deficit increased by 9 per cent from US$ 7.6 billion to US$ 8.3 billion. The large infrastructure investment that has high import content is an important reason for this dent in the trade balance.

It is vital to reduce the trade deficit to strengthen the external finances by generating a higher balance of payments surplus that could be used to reduce the county’s foreign debt whose servicing costs are detrimental to long term economic growth.

Economic imperatives

The Central Bank Annual Report for 2014 has emphasised the need for a medium-term strategy for economic development. The economic imperatives for meeting the economic challenges that lie ahead are demanding. “The Government faces the enormous task of articulating a coherent medium-term policy framework, which enhances positive effects, while addressing possible shortcomings of previously announced policies as well as the challenges ahead.”

Furthermore, “Some of these challenges are, the urgent need to address the continued decline in government revenue as a percentage of GDP in order to achieve a better fiscal balance; increasing productivity of all sectors of the economy, including the public sector; raising resources required for sustained growth through non debt creating sources, in particular, foreign direct investments (FDI); developing appropriate pricing policies for public utilities; better identification of beneficiaries in implementing social safety nets and subsidy programmes; improving the equity and quality of health and education service provision; addressing the issue of public transportation; continuing physical infrastructure development on a sustainable basis; formulating policies to address the challenge of aging population including improving labour productivity and promoting the development of super annuation and insurance products; and, improving the doing business environment and policy predictability.”

The tasks are enormous and require political stability, leadership, political courage, a longer term perspective and a strong resolution to carry out reforms. Only a stable government committed to achieving sustainable high economic growth can ensure such sound economic policies.

Leave a Reply

Post Comment