Columns

Budgets and ballots: Electoral politics widens fiscal deficit, weakens stability and growth

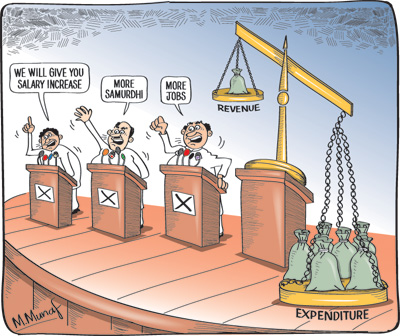

View(s):Electoral politics will dominate national life till a government is elected on August 17. Not only would economic concerns be put on the back burner for about six weeks, the election would also evoke many promises that would increase the fiscal deficit that threatens economic stability and long-term growth.

Sri Lanka has a history of “pork barrel politics”. Political parties pander to the electors with promises of concessions, subsidies, wage increases and other welfare measures. Sir Ivor Jennings called this “truckling to the multitude” and Lee Kwan Yew described Sri Lankan elections as ‘an auction of non-existent resources”. This year’s two elections within a few months will heighten this trend.

Sri Lanka has a history of “pork barrel politics”. Political parties pander to the electors with promises of concessions, subsidies, wage increases and other welfare measures. Sir Ivor Jennings called this “truckling to the multitude” and Lee Kwan Yew described Sri Lankan elections as ‘an auction of non-existent resources”. This year’s two elections within a few months will heighten this trend.

This phenomenon is well illustrated in the food subsidy policies of the past when competing political parties went to the extent of promising and providing one measure of rice free. In the 1970s, the rice subsidy cost nearly 5 percent of GDP, more than the expenditure on education or health.

Samurdhi

The subsequent Janasavia and Samurdhi programmes, too, are examples of such handouts that burden the public finances. At one stage, Samurdhi benefits were doled out to as many as 56 percent of households. In 2013, when the poverty count was less than 10 percent, about one third of households received Samurdhi benefits. Despite this large number receiving these benefits, most of those deserving it, do not receive it, while those who receive it do not deserve it. Poor targeting and politicisation of such welfare measures miss the avowed objective of the subsidy which is a financial burden to the government.

The November 2014 Budget and the Interim Budget of January 2015 gave handouts and increased wages that worsened the fiscal situation. In the current run -up to the parliamentary elections extravagant promises are most likely to be made once again in the party manifestos. Their implementation would ruin the public finances by expanding the fiscal deficit, distorting public expenditure priorities, weakening macroeconomic fundamentals that would threaten economic stability and growth.

The November 2014 Budget and the Interim Budget of January 2015 gave handouts and increased wages that worsened the fiscal situation. In the current run -up to the parliamentary elections extravagant promises are most likely to be made once again in the party manifestos. Their implementation would ruin the public finances by expanding the fiscal deficit, distorting public expenditure priorities, weakening macroeconomic fundamentals that would threaten economic stability and growth.

No free lunch

Voters in developed western democracies realise the truth of Noble Prize winner Milton Friedman’s famous statement that “there is no such thing as a free lunch”: that when a large benefit is promised, they themselves have to bear its cost through taxation of their incomes. In Sri Lanka, the majority think that the Government could keep doling out ‘free lunches’.

The severity of the fiscal problem requires to be underscored in the hope that the newly elected government would act responsibly and take steps to contain the fiscal deficit in 2016. This is imperative as large fiscal deficits create inflationary pressures, increase the costs of production of exports and reduce their competitiveness, worsen the livelihoods of wage earners and the poorer sections of the population.

In 2014, the fiscal deficit exceeded the target of 5.2 percent of GDP to reach 6 percent. The severity of the problem is such that government revenue has been barely adequate to meet debt servicing costs, or as in several recent years, debt servicing costs exceeded total revenue collection. In 2013 debt servicing cost was 103 percent of revenue. This means that the Government has to borrow for all its current and capital expenditures. This is a serious concern in the context of a declining revenue to GDP ratio to as low as 12 percent.

The resolution of this fundamental fiscal problem requires many strategies that in turn require a strong political resolve. Practical measures to increase government revenue and prudent measures to curtail government expenditure are imperative.

Increasing revenue

Government revenue must be increased significantly from the current 12 percent of GDP to at least 15-17 percent of GDP. Pragmatic measures that recognise the weak and inefficient tax administration of the country to reduce tax exemptions, tax evasion and tax avoidance are essential. Political interference in the tax administration has to be arrested.

At present there is high reliance on indirect taxes that yield around 80 percent of revenue. Such high reliance on indirect taxes is recognised as regressive as indirect taxes fall mostly on the poor. While this is broadly correct, it is possible to design direct taxes in a manner that targets the affluent and conspicuous spenders, who avoid taxation by various means.

Government expenditure must be contained by pruning down wasteful public expenditure. The interim government has taken some steps in the right direction. The costs and benefits of public expenditure on infrastructure must be considered before embarking on them. There must be a recognition that the Government’s financial resources are stringent and therefore expenditure must be only on priority needs and projects. In view of the limitations on revenue, it is vital that government expenditure is prudently spent.

Art of the possible

Politics is the art of the possible. In the context of the upcoming elections and the political culture of promising benefits, the political manifestos are likely to have promises that would be a strain on the public finances. This is inevitable. What is more realistic to hope for is that a stable government is elected for a full five year period that would have the political resolve to take measures on both the expenditure and revenue sides to contain the deficit in 2016 to about 5 percent of GDP and progressively reduce it thereafter.

The Pathfinder Foundation’s recent proposal that all handouts, subsidies and other welfare measures, included in the manifestos, should be costed and specific measures should be identified for financing the incremental costs involved, is unlikely to be adopted by any political party seeking election in August. All political parties are likely to promise more benefits to the people that would weaken the public finances further.

Last word

Will the election produce a stable and responsible government that implements fiscal policies that resolve this serious problem that hampers economic development?

Leave a Reply

Post Comment