Columns

Gains from lower fuel prices frittered away by increased imports

View(s):The trade deficit expanding by 15.6 per cent to US$ 4 billion in the first half of the year has brought about a balance of payments crisis and the depreciation of the Rupee. The Rupee depreciated from about Rs. 135 to the US dollar a month ago to Rs. 142 this week: an inevitable outcome of this increasing trade deficit.

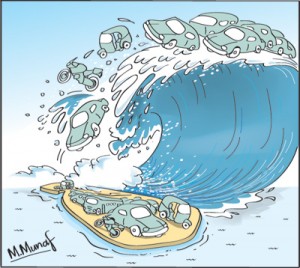

The irony of this year’s external trade performance is that the steep decline in fuel prices was frittered away by higher imports of motor vehicles, transport equipment and consumer and investment goods imports.

The irony of this year’s external trade performance is that the steep decline in fuel prices was frittered away by higher imports of motor vehicles, transport equipment and consumer and investment goods imports.

Higher trade deficit?

If the recent trends in imports and exports continue, the trade deficit is likely to exceed last year’s deficit of US$ 8.3 billion. The deterioration in trade performance in June, when the deficit increased by nearly 52 per cent compared to June 2014 to reach US$ 689 million, suggests an increasing widening of the deficit in the second half of the year. However the depreciation of the Rupee, fiscal measures that increase the cost of imports and monetary measures that restrain aggregate demand could arrest this trend.

Massive increase in imports

The underlying reason for increased imports is the increase in aggregate demand owing to the consumption boost given by the politically motivated Interim Budget of January this year and the pre-presidential election Budget for 2015 of last November. The reduced tariffs on categories of imports, low interest rates and increased incomes led to increased imports, particularly of motor vehicles.

Trade deficit

Trade deficit

There has been an increasing trend in the trade deficit. From a trade deficit of US$ 7.6 billion in 2013, it increased to US$ 8.3 billion in 2014. While the country was preoccupied in electoral politics with scant attention on good economic management, the trade deficit increased by 15.6 percent to exceed US$ 4 billion in the first half of the year compared to US$ 3.5 billion in the first six months of last year.

This year’s trade deficit was expected to be lower with oil prices dipping steeply. In fact, it has turned out to be higher than that of the first half of last year. While oil prices have dipped precipitously, increased expenditure on other imports has dampened the benefit. Despite a fall in oil imports by as much as 42 per cent in the first half of the year, total imports increased by 15.6 percent during this period. If the recent trends in imports and exports continue without corrective policies, the trade deficit is likely to exceed last years’ trade deficit.

Imports

Despite the volume of oil imports increasing due to increased consumption, expenditure on oil imports decreased due to the fall in prices by as much as 42 per cent from US$ 2.5 billion to US$ 1.42 billion in the first half of the year. Despite this, total import expenditure increased in the first six months by 5.7 per cent from nearly US$ 9 billion to US$ 9.5 billion owing to a 97 per cent increase in imports of motor vehicles, a 21 per cent increase in food imports, an increase of 15.5 per cent in machinery imports and a 135 per cent increase in imports of transport equipment.

Consumer goods imports increased 44.3 per cent from US$ 1.6 billion to US$ 2.3 billion. Intermediate goods imports declined by 11.7 per cent mainly owing to the 42 per cent decrease in fuel imports and decreases in the import of wheat, sugar and milk powder. Investment goods imports increased by a substantial 25 per cent from US$ 1.8 to US$ 2.3 billion owing to the increase in transport equipment.

Fuel imports have been the single largest import item and accounted for around one fourth of import expenditure in recent years. In the first half of this year oil imports fell to about 15 per cent of total imports.

Decreased export earnings

In contrast, total exports decreased by 0.6 per cent in the first six months of this year compared to that of the same period last year. Agricultural exports decreased by 8.3 per cent, industrial exports increased by only 2.6 per cent and mineral and other exports declined by as much as 51.4 per cent.

The demand for tea declined in oil exporting countries that are the country’s main tea markets. The decline in fuel prices also resulted in rubber prices too declining due to lower production costs of synthetic rubber.

Unfavourable global conditions coupled with an overvalued exchange rate resulted in a sluggish demand for industrial exports. The total increase in industrial exports by only 2.6 per cent was inadequate to compensate for the agricultural export decline of 8.3 per cent. All industrial exports, other than transport equipment exports decreased. Transport equipment exports increased 208 per cent from US$ 62 million to US$ 208 million. The country’s main industrial export, textiles and garments, decreased slightly by 0.6 per cent.

Policy implications

Although the balance of trade is unfavourable, the increase in imports would enhance the growth rate through a rise in import related activities. Furthermore, government revenue would have increased through increased import tax revenues. This conflict between fiscal policies and the balance of payments must be avoided. Balance of payments implications must be considered when fiscal changes are implemented.

The trade performance this year demonstrates how, despite a significant favourable development in international trade, there was a deterioration in the trade balance owing to inappropriate economic policies. For instance, had we not imported as many motor vehicles and transport equipment, the trade deficit could have been reduced and the current balance of payments problem averted. Instead we have succeeded in creating a crisis in external finances that require painful adjustment in the exchange rate.

The politically motivated fiscal policies of the 2015 Budget in November last year and the January 2015 Interim Budget and lack of mid course corrections, are responsible for this crisis. Both these budgets increased aggregate demand through reduction of import duties and the prevailing low interest rate policies increased consumption imports to accentuate the trade deficit.

Leave a Reply

Post Comment