Incentives for promotion and development of exports

With the 2016 budget round the corner it is time to think of fiscal and other incentives that could be extended or expansion of exports of goods and services.

Merchandise exports earned US$11.13 billion in 2014; service exports earned about US$2 billion from tourism, ICT/Business Process Outsourcing, transport, insurance and construction services; imports were valued at US$19.4 billion in 2014 on top of which Sri Lanka (SL) had foreign debts amounting to 32 per cent of GDP (which was US$75 billion in 2014), according to the Central Bank (CB). If SL were to pay for the imports and pay back the foreign debt, earnings from exports of goods and services may have to more than treble; this requires investment to expand the production of goods and services for export that are in short supply. The proposed CEPA (economic pact) with India is not going to solve this problem unless the emphasis is on investment.

Attracting investments

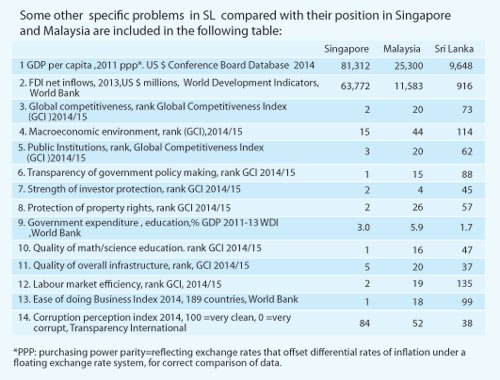

Acceleration of export oriented investments being the main strategy for development, SL needs to invest about 35 per cent of GDP to achieve a higher rate of economic/income growth of about 8-10 per cent per annum. However, SL does not possess sufficient resources to invest, the domestic savings rate being 21.1 per cent of GDP in 2014. Therefore it has to rely on Foreign Direct Investment (FDI) to fill the resource gap, particularly since they deliver not only the capital required but also the technologies which are all scarce in SL. In addition they provide world market access.What is seen from the table below is the poor performance of FDI inflows to SL compared to those of other Asian countries such as Singapore and Malaysia.

What are the reasons for it? There may be several risks to the investors – (a) the political risks like expropriation of assets, (b) the economic risk of the unpredictability of policies and incentives, (c) the institutional and social risk involving politicisation and the inefficiency of public institutions and the risk that the unresolved ethnic problem may flare up again. All these risks have been present in SL and may have discouraged investors. In addition there have been other barriers such as the acute inadequacy of technical and soft or behavioral skills (like creativity and communication especially in English) as well as the numerous public holidays and cumbersome procedures/documentation/regulations especially in labour matters. In other words it is the negative enabling environment that has discouraged investors. Fortunately this is improving after the elections in January and August 2015.

So could the addition of some fiscal incentives to an improving enabling environment alone overcome these barriers to investment? No they cannot as they do not reduce the above mentioned risks to any extent, besides the fact they may reduce revenue to the government in the context of significant budget deficits.

Role of international investment agreements

Role of international investment agreements

An UNCTAD article “The Role of International Investment Agreements in Attracting Foreign Direct Investment to Developing Countries” 2009, states that the solution could be for the latter to sign (Regional) Preferential International Investment Agreements (PIIAs) which are superior to Bilateral Investment Agreements (BITs) preferably where the members of the former include developed countries as in the case of NAFTA from which Mexico benefited enormously by way of FDI based in the USA. This is due to the PIIAs containing clauses for improving (a) investment protection against political risks, (b) the coherence, transparency, stability and predictability of investment, by listing rules of protection of FDI in a legal document along with a dispute settlement mechanism and (c) liberalising market access for trade as well and countering the small market size and the weak institutional quality indirectly. The BOI has signed a number of BITs and not Regional PTIAs.

What may be necessary is to convert any BITs to PTIAs where possible preferably by joining regional investment/trade groupings like ASEAN of South East Asia and APEC or the emerging Trans Pacific Partnership of the Pacific region and embed all such assurances in an improved economic policy/incentive framework of the country again to reassure the investors in addition to improving the enabling environment as PTIAs alone cannot do the job according to UNCTAD.

Fiscal incentives and policies

Since a new policy framework including fiscal incentives may have to be adopted the successful incentive package introduced by the Export Development Board (EDB) supported by the Treasury in the 1980s could be considered (some of them still continue); these incentives include a tax holiday which should be of less than 10 years in duration, preferably five years in view of the budget deficits starting with the first date of profit generation with provision for a half tax holiday (12 per cent tax) after expiry of the first period. Along with these tax holidays other incentives in the EDB/Treasury package such as Deduction of Promotional and R&D Expenses and Investment Tax Allowances on Capital Costs/ Accelerated Depreciation could continue. A Concessional Refinance Scheme by the CB that was available at the time to enable commercial banks to grant soft loans for export production, until an Exim Bank is set up for the purpose and a grant scheme like the Investment Support Scheme operated by the EDB then on the basis of net export earnings to compensate for fresh export related investments by local investors might also be useful. To complete the package the original dynamic project assistance, product development, simplification of cumbersome procedures/documentation and export promotion programmes of the EDB could be reconsidered with improvements to deal with the problems listed in the above table as well. It is to be noted, the level of tax incentives required may decline with a better enabling environment accompanied by some effective regional international investment agreements.

Promotion of export competitiveness

Another important strategy besides expansion of investment is improved export competitiveness including improvement of productivity and differentiation or value addition to goods and services to satisfy the needs of foreign customers, as the SL domestic market is too small to drive economic growth. This is basically a function of the private sector though the government has an indirect though significant role to play.

The major policy instrument that the government could use for this purpose is a substantial reduction of import tariffs uniformly across the board with some relief for essential products like food. Such a tariff reduction would increase competition among local firms even with foreign ones and pressurise them to adopt required measures (just because concessions on adoption of technologies are offered they will not accept it; one’ can take a horse to water but cannot make it drink’) to expand investment and improve productivity to lower unit costs. It will also compel them to introduce innovations to differentiate goods and services to meet special needs of customers in specific market segments. Such unique value addition qualities in goods and services would enable them make higher foreign exchange earnings. This is the only way that SL will be able to come to terms with global prices and engage on equal terms with foreign competitors in international trade.

Duty/tariff exemption schemes like the TIEP Schemes for direct and indirect exporters mentioned below will not be able to succeed to this extent according to the literature on the subject.

During the past anti competition among firms has happened. Protected by enormously high import tariffs, local firms have reduced exports as they were making enough profits by selling in the domestic market, while exploiting the domestic consumer as well by selling at high prices.

nder such circumstances if the government decides to lower import tariffs, it will meet with a number of problems – by how much to reduce the tariffs, by how much revenue will be reduced, which products to continue to protect and how to deal with the ensuing protests by those protected?

What the government could do in such a situation is to postpone the decision to lower tariffs by one year or so and set up a mechanism in the Treasury to study the extent of such problems and make a report with recommendations. In the meantime the government could continue with the Temporary Importation for Export Processing Scheme (TIEPS I and IV) initiated by the EDB in the 1980s for exemption of duties on imported inputs used by final/direct exporters and ‘indirect exporters’ mostly SMEs supplying inputs and the ‘Domestic Letters of Credit’ also for SMEs.

Branding Sri Lanka and the city of Colombo

A similar measure that could be undertaken to boost earnings from services like tourism, as in the case of Singapore and Dubai, is to brand the country and the city of Colombo in a professional manner to establish a unique image to attract high spending visitors and develop the required high quality social and physical architectural facilities. The allegation is that the authorities concerned have not done so up to date.Improving productivity.

In the meantime government could also take measures to improve Total Factor Productivity (TFP) in the various factors of production like land, labour, human resources, capital, physical infrastructure, information technologies, etc as average TFP during 2009-2014 has been minus 1 per cent, according to the Conference Board Database. Productivity of land/ agriculture has been so low in SL (agricultural value added per worker in SL having been $1,046 vs $10,127 in Malaysia, 2005 constant, World Bank 2014) that it is supposed to be the main cause of acute hunger and malnutrition in the peripheral areas as well as of low competitiveness and inadequacy of agricultural products of SL for export. Similarly the low productivity in labour, capital and other factors of production would have depressed export competitiveness in SL.

Central location and/restructuring of institutions

Finally one of the most effective measures would be the location of the public institutions responsible for development of exports under one ministry since promotion of investment and of global competitiveness are the two main strategies to be adopted for export expansion as mentioned in an article in the Sunday Times Business on 26/07/15 by this writer or just ‘the two facets of the same coin’.

The institutions responsible like the Board of Investment, the EDB and the Department of Commerce, those responsible for policies and incentives like the Treasury and the CB as well as the Tourist Development Authority responsible for promotion of tourism are now scattered in various ministries. Ideally they have to be restructured and located under one ministry/head preferably that of the Prime Minister for better co-ordination and thrust.