Columns

Consensual politics must ensure consensus on economic policies

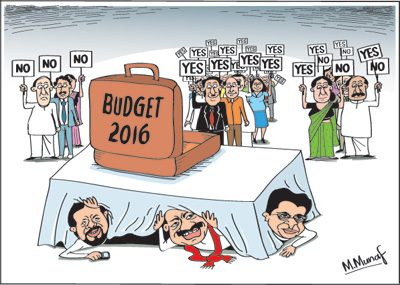

View(s):The two thirds majority by which the 2016 budget was passed was a reaffirmation of the political alliance between the two main parties. It did not signify an economic consensus on the budget. Some MPs who voted for the budget expressed concerns regarding several budget proposals and implied their disagreement with the fiscal and economic policies of the budget.

This lack of consensus within the government is a serious hindrance to the effective implementation of economic policies. Agreement within the government is vitally important to implement economic policies effectively. The changes in the budget, promises of further changes and ongoing discussions to change budget proposals makes this budget a most confusing and, perplexing one.

This lack of consensus within the government is a serious hindrance to the effective implementation of economic policies. Agreement within the government is vitally important to implement economic policies effectively. The changes in the budget, promises of further changes and ongoing discussions to change budget proposals makes this budget a most confusing and, perplexing one.

Overwhelming majority

The budget received 159 votes for it while only 52 noted against it giving the government a tidy majority of 107 votes in parliament. The leader of the opposition and the TNA voted for the budget, while the JVP and MPs belonging to the UPFA’s Joint Opposition voted against it. Thirteen MPs who absented themselves were opposed to the budget as they had made statements within and without parliament against it. Therefore 159 were for and 65 against the budget: a distinct two thirds or 94 vote majority.

Such an overwhelming majority would normally imply strong parliamentary support for the budget and the government’s economic policies and a consensus among those who voted for the budget. In fact it is not so. It is only a reaffirmation of the political agreement of forming a coalition government among the two main parties rather than an agreement among them on economic policies. This was evident from the speeches made by ministers and members of the coalition who dissented with some proposals but voted with the government.

No firm commitment

No firm commitment

Therefore, despite this parliamentary Vote, there is doubt that there is a firm commitment among many in the governing coalition to an agreed economic programme. Both the Prime Minister’s economic statement and the budget appeared to be UNP positions rather than ones with SLFP agreement. These were against the grain of traditional SLFP policies and certainly a strong deviation from the Rajapaksa SLFP policies. They were similar to the policies followed by the Chandrika Kumaratunga regime.

Fiscal policy in confusion

While the political resolve to implement a consistent fiscal policy is vitiated, the fiscal policy itself is in disarray. Changes, promises to make changes and u-turns in policies make the final fiscal policy package uncertain. There are uncertainties of what the finally implemented budget would be owing to policy inconsistencies, amendments and promises of changes. The budget proposals that would be ultimately implemented remains uncertain and unpredictable at present. A firm consensus on the budget by the governing coalition is vital for its effective implementation.

The future of the economy depends on containing the fiscal deficit and undertaking a wide range of reforms. It is therefore of utmost importance that the government works out an economic consensus among the entire coalition for the implementation of economic policies. The resolve and determination needed for economic reforms cannot be achieved without the support of all members of the government and the strong unequivocal support of the President.

Confused by changes

Changes agreed on during the budget debate and promises made to give further relief and concessions from those of the original budget would distort the budgetary figures significantly. From the very inception there would be revenue shortfalls and expenditure overruns. These would in turn require further adjustments in and changes in taxation to contain the fiscal deficit and find the fiscal space for increased expenditures. The final outcome of the budget remains in much more uncertainty than previous budgets.

Policy inconsistencies

The Prime Minister’s objective of lessening the fiscal deficit to 3.5 percent of GDP in 2020 is hardly realisable with this budget’s approach of extravagant expenditure and inadequate revenues. The budget as originally presented did not show signs of progress towards achieving this target as the fiscal deficit was estimated at 5.9 percent of GDP. With the proposed changes in taxation and additional expenditures, the fiscal deficit is likely to be higher. New fiscal measures that are agreed upon by the coalition partners would be needed to make a serious dent in the fiscal imbalance.

Another objective of the PM’s statement to reduce the proportion of indirect taxes to 40 per cent from 60 per cent of total revenue and to decrease direct taxes to 60 per cent from its current 80 per cent was not adhered to. Instead, according to tax experts, the reliance on indirect taxes was increased to about 85 per cent of GDP with direct taxes bringing in only 15 per cent. This regressive feature in taxation needs to be remedied by either increased direct taxation of higher incomes or indirect taxes that fall on affluent consumption.

Government policy of discouraging petrol usage by motor vehicles reiterated in the PMs statement of economic policy was flouted with high taxation on hybrid cars. The government must look at import duties on motor vehicles with not only revenue objectives, but the high import expenditure, environmental issues, petrol consumption and as a means of taxing high spending tax evaders.

Dangers ahead

The budget has not addressed the most serious problem of containing the fiscal deficit. The IMF Representative in Sri Lanka Ms. Eteri Kvintradze has expressed concerns about the 2016 budget not envisaging significant fiscal consolidation. The IMF has emphasized the need for steps to re-establish fiscal consolidation and reduce public debt, mainly by expenditure restraint and revenue reforms such as eliminating tax exemptions. Amendments to the budget appear to aggravate the fiscal deficit rather than reduce it.

The Prime Minister’s Economic Policy statement that preceded the budget had raised hopes among economists that this most fundamental economic problem would be addressed by the 2016 Budget. Instead the budgeted figures estimated the fiscal deficit to be only slightly less than the six per cent expected for 2015. One does not expect the PM’s fiscal goals to be achieved completely in this budget, but the budget has taken a contra course to it.

The inability to contain the fiscal deficit below five per cent of GDP would destabilise the economy, undermine the investment climate and retard economic growth and development.

Leave a Reply

Post Comment