Weak SL Rupee 68 years after independence reflects economic setbacks

View(s): Having celebrated Sri Lanka’s 68th anniversary of independence a few days ago with much political rhetoric, it would be appropriate to look back the journey of the Sri Lankan Rupee (SLR) during the post-independence period. The local currency had been known as Ceylon Rupee before the country became a Republic in 1972. A country’s currency is a point of pride, seen essential to the identity of the nation, though it may not be so sacred as the national flag or the national anthem. Old coins and notes collected in museums and in other places are parts of the national heritage. There are dedicated currency museums in a number of countries including Sri Lanka reflecting the historical significance given to the domestic currency.

Having celebrated Sri Lanka’s 68th anniversary of independence a few days ago with much political rhetoric, it would be appropriate to look back the journey of the Sri Lankan Rupee (SLR) during the post-independence period. The local currency had been known as Ceylon Rupee before the country became a Republic in 1972. A country’s currency is a point of pride, seen essential to the identity of the nation, though it may not be so sacred as the national flag or the national anthem. Old coins and notes collected in museums and in other places are parts of the national heritage. There are dedicated currency museums in a number of countries including Sri Lanka reflecting the historical significance given to the domestic currency.

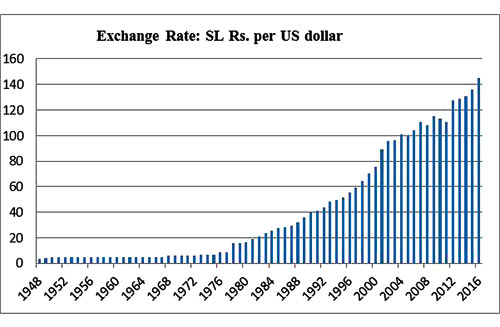

The domestic currency can also be treated as the mirror image of the economy showing its ups and downs. The stronger the currency, in terms of its purchasing power to exchange for goods and services as well as foreign currencies, the stronger the economy. Going by these yardsticks, it is doubtful whether we can be proud of the destiny of our currency, our economy or our nation. In nominal terms, the rupee is down by as much as 4,367 per cent or by 44 times vis-à-vis US dollar since independence from Rs. 3.32 per US$ in 1948 to today’s rate of Rs. 145 per $. Inversely, 1 Ceylon rupee was equal to $ 0.30 in 1948. This means that US cents 30 could buy one Ceylon rupee at independence. Today, a meagre US cents 0.007 is sufficient to buy one SL rupee.

If the local currency is the mirror image of the economy, the weakening of the rupee by such magnitude is a reflection of the economic downfall of Sri Lanka. At the outset, I must thank Nissanka Dias, an expert in Balance of Payments and my former colleague in the Central Bank, for inspiring me to re-examine our exchange rate in this column. The SL Rupee is one of the lowest valued currencies in the region, says Nissanka. He questions, what have we gained by continuously depreciating our currency? Let us attempt to address these critical issues.

Rupee is weaker among Asian currencies

Sri Lanka rupee is much weaker than the other currencies in the South Asian region. In 1960, one unit of Ceylon rupee, Indian rupee and Pakistan rupee was equivalent to $4.76. In other words, one Ceylon rupee was equivalent to one Indian rupee and one Pakistan rupee. But today, 1 SLR is worth only Indian Rs. 0.47 and Pakistan Rs. 0.72. The SL rupee’s story is worse in comparison with the East Asian countries which strengthened their currencies through sound external finances supported by high GDP growth. The rupee exchange rate for the Japanese yen has come down from Yen 75.63 per rupee in 1960 to Yen 0.82 per rupee by today. Thai Baht was much weaker than the Ceylon rupee a few decades ago. In 1960, one Ceylon rupee would buy Baht 4.45, but today one SLR would buy only Baht 0.25. In 1960, one Ceylon rupee was worth Malaysian Ringgit 0.64, but today it is worth only Ringgit 0.03.

Rupee depreciated faster in terms of PPP too

The computation at the top is based on the nominal values of the currencies which do not capture the price variations in each country. A popular method used to incorporate price differences is the Purchasing Power Parity (PPP) conversion factor which tells us the number of units of a country’s currency required to buy the same amount of goods and services in the domestic market as a US dollar would buy in the United States.

In PPP terms, SL rupee depreciated against the US dollar by as much as 13 per cent annually during 1990-2014, in comparison with depreciation of the Indian rupee vis-à-vis US dollar by only 8 per cent and Pakistan rupee by 15 per cent. In the East Asian region, the PPP Japanese Yen appreciated annually against the US dollar by 4 per cent during the same period while the Thai Baht depreciated only by 2 per cent and Malaysian ringgit by 3 per cent. Thus, even in PPP terms, the Sri Lanka rupee weakened at a much faster pace.

Rupee depreciated speedily after liberalisation due to reform failures

Rupee depreciated speedily after liberalisation due to reform failures

The rupee depreciation is much visible after 1977, as shown in the chart. The rupee fell down by 7.41 per cent per annum from Rs. 15.19/$ in 1976 to Rs. 145/$ by today, compared with a marginal depreciation of 0.55 per cent in the previous period of 1967-1976. When the flexible exchange rate system was introduced in November 1977 along with a broad package of economic liberalisation, replacing the fixed exchange rate operated hitherto, the then government rightly expected that market-determined exchange rates would eliminate the bias against exports, and facilitate export-led growth. But that did not happen due to two main reasons.

First, the envisaged economic transformation did not take place, and the export sector has continued to rely on low-tech, low-value added exports, mainly garments. In contrast, the East Asian countries accelerated their export-led economic growth to reach the high-income category globally by means of knowledge economy driven by science, technology and innovation. The Sri Lankan economy belonging to the lower-middle income category is still based on low-skilled, labour-intensive production structure. Sri Lanka has also missed the opportunity to engage in global product sharing, defined as the breakup of a production process into vertically separated stages that are carried out in different countries. These economic setbacks deterred export growth against rising imports, and thus, resulted in widening of the trade deficit which necessitated continuous depreciation of the rupee.

Second, the excessive budget deficits which persisted throughout the post-liberalisation period have contracted domestic savings, and the resultant savings-investment gap ended up as balance of payments deficits necessitating rupee depreciation further. The high budget deficits also led to increase market liquidity and to overheat the economy, thereby pushing import demand upward. Moreover, the budget deficits fueled demand-pull inflation causing price-wage spiral.

Brunt of economic misalignments falls on the rupee

All these policy-related deterrents led to deplete foreign reserves and to appreciate the real exchange rate, defined as the nominal exchange rate adjusted for inflation differential vis-à-vis trading partners. Hence, continuous rupee depreciation was inevitable in the post-liberalisation period. The rupee would have depreciated at a much faster rate, had the Central Bank not defended the rupee by releasing its foreign reserves to the market from time to time. This helped to prevent abrupt increases in import prices and the government’s debt service burden. However, the Central Bank’s intervention led to overvalue the currency, and thereby to encourage imports and to depress export growth. The low interest rate policy adopted by the Central Bank in line with the global trends in recent years has provided a further boost to imports and to weaken the rupee.

The successive governments including the present one have been reluctant to implement the much needed structural reforms fearing the loss of political power. It is essential to cut down the government deficits which pressurised the exchange rate, as explained above. This called for reduction in current expenditure. In contrast, heavy dependence on populist measures such as consumer subsidies, handouts and public sector employment creation raised the current expenditure. The government revenue, however, did not expand to commensurate with the expenditure hike, and resulted in persistent budget deficits. The IMF staff mission, which visited early this month, too has advised the government to urgently make a stronger effort to narrow the fiscal deficit and put the public finances on a sustainable path.

The fiscal deficits had domino effects of external finance imbalances, weaker rupee, high inflation and wage-price spiral in a vicious circle.

Given the poor fiscal management, the Central Bank has had little space to manage the exchange rate and interest rates freely so as to achieve its core objective, i.e. price stability and more recently, inflation targeting. The vicious circle has been propelled by the unfinished reform agenda which calls for fiscal discipline, independent central banking, market-determined exchange and interest rates, public sector restructuring, labour market flexibility, tax reforms, and targeted poverty reduction. In the absence of such reforms, the brunt of the economic misalignments will have to be borne by the exchange rate even in the future thus, prolonging the downward path of the rupee without resuscitating the export sector, as in the past.

(The writer, an

economist, academic and former central banker,

can be reached at

sscolom@gmail.com)