Lion Brewery restructuring certain processes to combat profitability drop

View(s): The Lion Brewery Ceylon PLC (Lion Brewery) has restructured certain processes in the company to combat its dent on profitability in the wake of harsh taxation, officials say. ”We have re-thought certain things in the company and we won’t return to the same levels of profitability as in the month of September 2015, but it’ll be better than in December,” Suresh Shah CEO Lion Brewery told the Business Times. He said that in the first week of October during 3QFY15, the tax on mild beer was increased by 27 per cent and that of strong beer by 32 per cent. “In the third week of November strong beer taxes were increased by a further 29 per cent.

The Lion Brewery Ceylon PLC (Lion Brewery) has restructured certain processes in the company to combat its dent on profitability in the wake of harsh taxation, officials say. ”We have re-thought certain things in the company and we won’t return to the same levels of profitability as in the month of September 2015, but it’ll be better than in December,” Suresh Shah CEO Lion Brewery told the Business Times. He said that in the first week of October during 3QFY15, the tax on mild beer was increased by 27 per cent and that of strong beer by 32 per cent. “In the third week of November strong beer taxes were increased by a further 29 per cent.

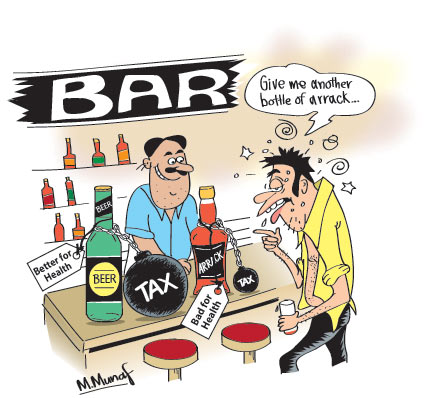

A relatively small reduction in the tax on mild beer was announced in November but was quickly reversed within a few days. Thus taken together, within a period of two months, the excise tax on strong beer was increased by 70 per cent whilst that of mild beer was increased by 27 per cent and arrack tax by 24 per cent.” These tax increases were ostensibly to increase Government revenue, but that wasn’t to be. Beer tax, which stood at Rs. 2.2 billion in September 2015 was down 18 per cent to Rs 1.8 billion by December 2015, the first full month after the double tax increase on the industry, he said.

In the same month, when consumers first felt the full impact of the double tax increase, the company experienced a significant drop in the both volumes and profits. Thus policy makers at the Finance Ministry have successfully deprived the Government of revenue and undermined corporate and shareholder value of a public quoted company with – literally – two strokes of the pen, he has said in a statement on the company’s results. “But that is not all. The volume lost by the beer industry has been picked up by the toddy and arrack sectors.

Toddy is thought of as a poor man’s drink which comes from coconut sap. It is certainly cheap since it is taxed at a mere Rs. 30 per litre (strong beer which has approximately the same alcohol content attract a tax of Rs. 315 a litre whilst mild beer with a lower alcohol content is taxed at Rs. 190 per litre). However, the extent of coconut sap in commercially available bottled toddy is anybody’s guess. Available information suggests that this so called toddy is made mostly of a chemical cocktail.”

The recent tax increase on beer has pushed a significant segment of consumers into a product that is unhygienic and into an industry that may not necessarily pay its taxes. Arrack is the other sector that has gained from the beer industry’s loss, the Lion Brewery CEO has charged in his annual statement. He has said that in Sri Lanka the tax per mililitre of alcohol is inversely proportionate to the alcohol content in the beverage. Thus in per ml of alcohol terms, mild beer attracts a higher tax than strong beer which in turn attracts a higher tax than arrack. In this modern day and age this is a shocking policy anomaly.

On both occasions referred to earlier the Ministry of Finance was briefed on the multiple concerns pertaining to the toddy industry, but nothing happened. The recent excise duty amendments have led to greater consumption of products which are either unhygienic or of a higher alcohol content, has enhanced returns in two sectors where tax evasion is perceived to be widely prevalent, has reduced government revenue and has destroyed value in the beer sector. “Thus in one swoop, consumer health, government revenue and industry profitability have all been compromised.”