Columns

Emergency Budget: Cabinet approves sweeping tax reforms

- PM presents 9-page document to meet global economic crisis and clean up colossal liabilities

- Capital Gains Tax to be reintroduced on higher echelons of society to balance direct and indirect taxation

- Intensified efforts to recover money plundered by previous regime; new high-level team going to Dubai again

Tough new measures to avert an economic crisis are now engaging the attention of the Government. The first of these was decided upon at a special meeting of ministers on Friday. The subject first came up for discussion at Wednesday’s weekly ministerial meeting. This was when they discussed a Cabinet memorandum by Finance Minister Ravi Karunanayake. In that, he had recommended certain fiscal measures including an increase in Value Added Tax (VAT), changes in the Nation Building Tax (NBT) and revising the threshold of those eligible to pay income tax.

Tough new measures to avert an economic crisis are now engaging the attention of the Government. The first of these was decided upon at a special meeting of ministers on Friday. The subject first came up for discussion at Wednesday’s weekly ministerial meeting. This was when they discussed a Cabinet memorandum by Finance Minister Ravi Karunanayake. In that, he had recommended certain fiscal measures including an increase in Value Added Tax (VAT), changes in the Nation Building Tax (NBT) and revising the threshold of those eligible to pay income tax.

President Maithripala Sirisena who chaired the meeting was not in favour of the memorandum being approved in that format. The wording in the memorandum had given the distinct impression that the measures were being sought to meet the demands of the International Monetary Fund (IMF). However, a Government source insisted Minister Karunanayake’s move was unintentional and he was being transparent with his colleagues. The fact that the Government was negotiating a one billion US dollar facility was revealed exclusively in the front page lead story of the Sunday Times last week. Sirisena insisted that the memorandum should not be adopted in that format.

Then an unusual move followed. He directed an official in attendance to go around collecting copies of the memorandum from the ministers present. Sirisena advised them not to speak outside about this issue. Perhaps the leak of the document would have been grist to the mill for the opposition and the media. The Government would run the risk of being accused of dancing to IMF dictates if the information reached the public domain. Prime Minister Ranil Wickremesinghe undertook to present another memorandum under his name. Since time was running short, it was decided to hold that meeting on Friday afternoon.

In a nine page note titled ‘MINIMISING THE IMPACT OF THE GLOBAL DOWNTURN ON THE SRI LANKAN ECONOMY AND CLEANING UP THE COLOSSAL AMOUNT OF REPORTED LIABILITIES AT PUBLIC SECTOR INSTITUTIONS,” Premier Wickremesinghe made some key observations.

He noted that the outstanding Government debt as at the end of 2015 was Rs. 8,475 billion, which was equivalent to 74.9% of estimated GDP. Total estimated debt service payments in 2016 amount to Rs. 1,209 billion, which consist of Rs. 647 billion of debt repayment and Rs. 562 billion of interest payments. He added that the Sri Lankan economy could have coped with the adverse developments, if not for the global economy taking a nosedive during the last few months adversely affecting the economy. Among the reasons he listed were the implications of falling oil prices, the economic slowdown in China, the continued dominance of the terrorist group ISIS in vast areas of the Middle East thus impacting on tea exports and Britain’s possible exit from the European Union.

In this context, he said, the Government would have to face the present global economic situation that had arisen particularly with the lack of confidence and the fall in oil prices. He emphasised that maintaining Government debt at prudent levels, with strengthened fiscal consolidation on a combination of sustainable revenue enhancing and expenditure rationalisation measures, would be a key priority for the Government. The reduction of the budget deficit to 3.5% of the GDP by 2020 will be the overarching target in this context. The revised budget, he said, has planned a 15.8% increase in the public investment in 2016.

Premier Wickremesinghe pointed out that unfortunately Sri Lanka was sadddled with a relatively high debt burden requiring a significant amount of resources to pay it back. He said this could be overcome only through a committed medium term fiscal consolidation programme embedded with appropriate reforms, and aimed at reducing the budget deficit and lowering the country’s debt burden. He emphasised that “this must be implemented on an urgent basis” and added that “this should be complemented by a new taxation system and enhancement of the revenue collection by 2017.” He said this would “enable us to maintain a higher level of growth required for the job creation.”

Here are the policy proposals recommended by Premier Wickremesinghe and approved by the Cabinet of Ministers on Friday:

VALUE ADDED TAX: The budget 2016 proposed to implement two VAT rates – 8% and 12.5% instead of a single rate of 11%

Implementing such complex multi rates in tax can result in a shortfall in revenue target further deepening the crisis. Therefore, the safer option is a single VAT rate of 15%. The exemptions on telecommunication, private education and private health will be removed. Furthermore VAT will also be imposed on selected retail and wholesale items excluding the essential items.

INCOME TAX: Non-corporate Income Tax and Corporate Tax: It is proposed to suspend the 2016 Budgetary proposals for one year and continue the 2015 tax rates for both sectors.

Corporate Income Tax: For all other sectors which were subjected to different tax rates earlier, it is proposed to impose 17.5% rate instead of 15% rate proposed in the Budget 2016. CAPITAL GAINS TAX: Capital Gains have not been taxed in Sri Lanka since 1987. The last decades have seen a massive increase in private capital in the country especially among the higher echelons of society. Increase on price of land and shares have enabled them to make massive capital gains free of taxation while the indirect taxes on the masses kept increasing. The last ten years have seen the rise of inequality. Fortunately the relief measures given in the Budget 2016 have enabled to aggregate demand to pick up. Therefore it is proposed to implement Capital Gains Tax.

NATION BUILDING TAX: Sri Lanka has two types of consumer taxes. One is the NBT, which is based on turnover. Therefore, increasing NBT rate from 2% to 4% as proposed in the Budget 2016 in the background of weakening global currency which may lead to cascading effects on the economy and to a marked increase in the cost of living. Hence, it is proposed to keep the existing NBT rate of 2% unchanged to ensure business development and prevent cascading effects. It is assumed that the new proposal to remove exemptions on electricity, lubricants and telecommunication will be implemented while reducing the threshold to Rs. 3 million from Rs. 3.75 million per quarter as proposed in the Budget 2016.

TITLE DEEDS FOR ALL: With these physical consolidations and with the intention of having asset-owned society, the people who are living under permits and tenancies will be empowered by bestowing freehold title deeds to more than one million individuals with immediate effect.

Now that these proposals have been approved, Premier Wickremesinghe has observed that the overall budget deficit will decline to 5.4% of GDP (Rs. 679 billion) from 5.9%. He has said that the Cabinet Sub Committee on Economic Management will where necessary determine further expenditure restraint on recurrent expenditure as to ensure that they will adhere to the targets. Furthermore, he has added, a committee of three, including the Secretary to the Treasury entrusted with implementing the new tax reforms and ensure that revenue agencies adhere to the targets.

In conclusion Premier Wickremesinghe has observed that the steps decided on Friday “will give confidence to the external and global economic community about Sri Lanka’s ability to weather the storm. The Rating agencies, IMF and multilateral lending institutions will have positive sentiments about Sri Lanka and Bonds and Funds could be raised without paying huge costs.”

Premier Wickremesinghe will make a statement in Parliament on Tuesday explaining the reasons why the new tax measures were necessary. He told the Sunday Times, “People asked why these measures were not reflected in the budget. These were not envisaged then. Today the global market rates are higher. The United States Federal Treasury may raise rates. In the short term, it is a big threat to us. The International Monetary Fund is working with us on tax collection.”

He said the IMF was helping Sri Lanka on tax policy to ensure the economy is in order. Towards this end they will carry out a forensic audit, he added. There would be 60 % direct and 40 % indirect taxation, he added. He noted that the current situation was a spill over from the Rajapaksa Administration and was hopeful there would be a turnaround soon. He cautioned that similar measures would have to be taken in other areas if it became necessary.

Whilst enhancing fiscal measures, the Government has not given up on its efforts to track down funds stashed away overseas by leading members of the previous Government. Towards this end, a delegation is due to leave for Dubai in the coming week armed with fresh evidence to confirm that monies held in their banks by these individuals were in fact amassed through illegal means. The delegation this time is to comprise top officials of the Financial Crimes Investigation Division (FCID) and the Attorney General’s Department. The Sunday Times learnt that a dossier on recent findings which include allegations of money laundering and other criminal activities has already been compiled.

After removing several Rajapaksa loyalists from electoral organisers' posts, President Maithripala Sirisena, who is also the leader of the SLFP, is seen here with the new organisers

This is said to include material obtained from e-mails exchanged by those concerned with different parties. The matter figured at a top level meeting recently. Earlier efforts, first by the Stolen Assets Recovery Task Force and thereafter jointly by the FCID and the Commission to Investigate Allegations of Bribery or Corruption (CIABOC) did not materialise. The Dubai authorities had declined to confirm such accounts were existent nor provide any other detail. FCID detectives have in the meantime amassed a wealth of documentary evidence with regard to what they claim are illegal activities including money laundering.

It was only in November last year that an FCID-CIABOC team made a plea to the Government in the Emirate of Dubai that the accounts in question be frozen. They also sought confirmation of balances held but the requests were then turned down. It was explained that such disclosures were made strictly on grounds of proof that the monies banked, if any, were earned through illegal or criminal means.

These attempts with Dubai authorities as well as ongoing local investigations are being intensified. In this backdrop, there is little doubt that President Maithripala Sirisena is wresting some form of control within the Sri Lanka Freedom Party (SLFP). This is notwithstanding his ability, so far, to gain full control of the party. He removed from the post of organisers some of the staunch backers of his predecessor, Mahinda Rajapaksa. They included Dilum Amunugama (Senkadagala), Prasanna Ranatunga (Minuwangoda) and Kanthi Kodikara (Maharagama). He replaced them with nominees who are his loyalists. The SLFP’s Central Committee which met thereafter empowered Sirisena to take disciplinary action against those who went against the Sirisena-led party line. This is notwithstanding the meeting ending up on an abrupt note after Kumara Welgama (Kalutara District), a pro-Rajapaksa group member, argued over some issues.

Four staunch backers of Rajapaksa — Dulles Alahapperuma, Kumara Welgama, Mahinda Yapa Abeywardena and C.B.Ratnayake — wrote to SLFP General Secretary Duminda Dissanayake against the appointment of new organisers. They said:

“SUDDEN CHANGES IN THE POST OF ORGANISERS

“We extremely regret the decision taken to remove several frontline party electoral organisers including two MPs namely Prasanna Ranatunga and Dilum Amunugama and we are of the view that this decision will widen the ongoing internal conflict of ideas within the party.

“Prasanna Ranatunga became first on the list in the Gampaha District in the last general elections having secured 384,448 votes as well as ensuring landslide victory in the Minuwangoda electorate. Dilum Amunugama secured 104,469 preferential votes and came third in the Kandy district and is a future asset to the party. Dhanasiri Amaratunga secured 33,784 votes and is on the threshold of gaining entry to Parliament. Kanthi Kodikara secured 27,976 votes and came ninth in the Colombo District list and was ahead of 13 other candidates on the list and has become a leading woman candidate. Attorney Senarath Jayasundera who was also removed as Colombo West organiser is the Chairman of the Colombo Magistrate Court Lawyers Association. In the elections held to the Bar Association Sri Lanka last month, he contested for the post of secretary and came in second and is an asset to our party which is lacking in professionals.

“We are not challenging the powers vested by the party constitution in the party leader to remove any party organisers and appoint new ones. As has happened on several occasions during the 66-year history of our party, the differences that are as far and widely spread from the village level party groups in far off villages right up to the Central Committee, we must act in a manner that the unity of the party is preserved and not further aggravated.

“We must not forget that all these organisers have never betrayed the party and are people who worked tirelessly for the victory of the party at all past elections. At a time when the local Government elections are close at hand, instead of creating a situation which will only be beneficial to our main political rival, the United National party, we call on the President and the Central Committee to reconsider this decision so that the victory for the SLFP can be secured.”

Compared to the rhetoric in the months ahead of the expulsion, it is noteworthy that the tenor of the letter is conciliatory. Is it borne out of any apprehension that the leadership would go a step further and expel them from membership?

In such an event, the ruling party, no doubt has the edge in the controversy that could follow. That is not the only fallout. Already, some are shying away from associating themselves with the MR group.

Loyalists of Mahinda have now planned a campaign titled “Mahinda Samaga Obey Satana” (Your struggle together with Mahinda). The first such meeting organised by Prasanna Ranatunga was held in Udugampola in the Minuwangoda electorate yesterday. Only selected invitees were allowed to take part in the meeting which was held at the Pradeshiya Sabha auditorium. The organisers were fearing that information was leaking. The next such meeting will be held today at the Mahindananda Aluthgamage Foundation in Nawalapitiya. Another one has been planned for in Iyagama in the Ratnapura electorate at the Urban Council hall on Monday.

These developments together with a delay in local government polls have prompted Rajapaksa to put off the formation of a new political party. He has gone back from the publicly stated position to insist that he would remain in the SLFP. Nevertheless he is spending more time in his new office in Battaramulla leaving the leader of the ‘joint opposition’ Dinesh Gunawardene to play a bigger role. Gunawardena said yesterday that he had already written to President Sirisena to summon a meeting of the UPFA Executive Committee to decide on a General Secretary for the alliance. It fell vacant after the death of Prof. Viswa Warnapala, who was named by President Sirisena recently in place of Susil Premajayantha. Those engaged in reconciliation of the feuding factions in the SLFP are now facing a new demand from the MR group. They say that ceding the post of General Secretary to one of their nominees and the formation of a Government of both sides (excluding the UNP) was one way there could be unity. Factions supporting Sirisena have already dismissed the suggestion.

Gunawardena told the Sunday Times the time frame for the announcement of elections, since the dissolution of the local councils, in terms of the law is March 31. He has conveyed this position to Elections Commissioner Mahinda Deshapriya during a meeting last Monday. “He only told us that we will be kept informed,” Gunawardena added. He said that according to an official of the Delimitation Commission, they had completed work in 18 districts and there were six districts remaining. “If this is so, why don’t they hold elections to the ones that have been completed,” he asked. The National Freedom Front (NFF) of Wimal Weerawansa, an ally of the ‘joint opposition,’ will hold a public rally at Hyde Park in Colombo on March 17, among other matters, to demand that local polls be held.

According to Premier Wickremesinghe, a Cabinet Sub Committee is now formulating electoral reforms. He said it would be ready by June the latest. Thereafter, when the other measures are in place, local council polls will be held. For an altogether extraneous reason, the delay in the local council elections had also come in Government’s favour. Recent developments have alienated the farmers in different parts of the country. They, together with Opposition politicians, were staging demonstrations in different parts of the country over the issue of fertilizer. There were protests yesterday in Wilgamuwa (Matale), Weeraketiya and Kaduwela. On Friday, similar protests were also held in Tambuttegama, Wellawaya and Ambanpola.

It was only a week ago that President Maithripala Sirisena directed that fertilizer be sold at a maximum price of Rs. 2,500 per bag. He also said the farmers should be entitled to Rs. 25,000 for fertilizer for an extent of one hectare irrespective of whether they had a larger extent. Farmers complain that they had earlier purchased fertilizer at a price of Rs. 1,300 per bag. Hence, they complain that they had to incur more money now. In the Government budget in November last year, a cash grant of Rs. 25,000 for Yala and Maha seasons was provided to farmers for a maximum extent of one hectare. For this purpose Rs. 37.5 billion was allocated for this year as against Rs. 35 billion last year.

The issue has been further exacerbated by bumper harvests paddy farmers are reaping in different parts of the country. This phenomenon is reflected in areas regarded as the rice bowls of the Wanni where farmers have blocked off one section of the road so they could spread the moist paddy and dry them before sale. These sights are a daily feature along the Trincomalee-Mullaitivu Road in the past days. The Paddy Marketing Board’s storage facilities are full with the stocks from the previous yield. With some 75 percent of the harvest being carried out, paddy in the market was fetching only anything between Rs. 17 to 20. The matter caused serious concerns at the highest levels of the Government. This is particularly in view of the upcoming national New Year where farmers will not have the money to celebrate.

The matter came up for discussion at Wednesday’s ministerial meeting. It was decided to introduce new amounts for procurements under the Guaranteed Price Scheme. Keeri Samba was to be purchased at Rs. 50, Samba at Rs. 41 and Nadu at Rs. 38. A maximum of only a thousand kilos will be purchased from every farmer. How the Paddy Marketing Board (PMB) will be able to cope with this new decision appears to be a cause for concern even among ministers. They say with the PMB’s warehouses full, and within a short timeframe of some six to seven weeks before the national New Year, whether they can purchase substantial amounts from farmers remains a critical question. Adding to that is the regular PMB complaint that the moisture content in the paddy they had been called upon to purchase was high. In the end, they fear the political fallout will be on the Government when farmers are unable to mark the most observed annual event. There is little doubt that such a development could have an adverse effect even if the local polls are held next year. The farming community, with no buying power due to lack of money, could easily turn hostile. As the ongoing protests indicate, they are already looking to Opposition parties to air their grievances — the Janatha Vimukthi Peramuna (JVP) now in the forefront of it because the National Government is both UNP and the SLFP.

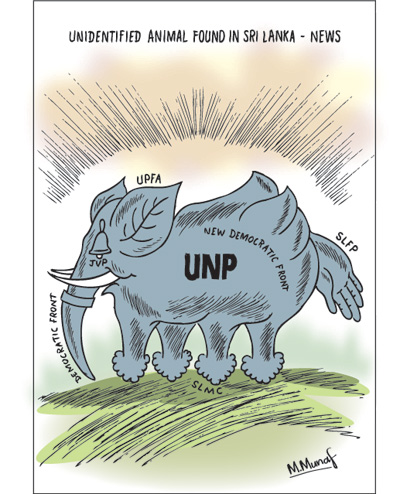

The entry of the International Monetary Fund (IMF) to help shape the country’s economy is significant in many ways. Particularly in the light of the Government’s budget proposals being changed periodically, revenue has to be generated. As Premier Wickremesinghe points out, the IMF is already working for tax collection. He also cautions that more measures to generate funds for the Government in the short term may become imperative. Yet, the Government is lucky in some ways. With an Opposition in tatters, it is unlikely they will be able to campaign against what would turn out to be a further spiral in the cost of living.

Yet, the Government has to be mindful. Any widespread discontent will come in the backdrop of the measures it would have to adopt in accordance with the US-backed Geneva resolution which it has co-sponsored. One such case is the alleged war crimes inquiry, with or without, foreign participation. With little or nothing being done to educate the public on the different aspects, doubt and suspicion have grown. Coupled together with calls for belt tightening would naturally lead to more discontent. It is still in the Government’s hand to ensure critical issues are addressed correctly. Being complacent on the grounds that the Opposition is in disarray would be no answer. Such a situation could only be avoided by a focused approach which seems sadly lacking at present. That a cohesive strategy would be required is no understatement to say the least.

Leave a Reply

Post Comment