Columns

Two successive annual trade deficits exceeding US$8 billion weaken BOP

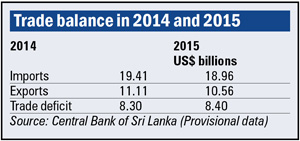

View(s): Trade deficits of over US$ 8 billion in 2014 and 2015 were primarily responsible for the current balance of payments difficulties. Despite the precipitous fall in oil prices and sharp decline in oil import expenditure last year, the trade deficit reached US$ 8.4 billion in 2015, exceeding the large trade deficit of US$ 8.3 billion in 2014. These large trade deficits eroded the country’s foreign exchange reserves to crisis proportions this year.

Trade deficits of over US$ 8 billion in 2014 and 2015 were primarily responsible for the current balance of payments difficulties. Despite the precipitous fall in oil prices and sharp decline in oil import expenditure last year, the trade deficit reached US$ 8.4 billion in 2015, exceeding the large trade deficit of US$ 8.3 billion in 2014. These large trade deficits eroded the country’s foreign exchange reserves to crisis proportions this year.

The large trade deficit in 2015 was brought about by an unfavourable export performance coupled with high non-fuel imports, especially motor vehicles. Capital outflows and sluggish worker remittances compounded the balance of payments difficulties, whereas growth in earnings from tourism and ICT services bolstered the balance of payments to some extent.

Fuel prices

For many years the ever increasing international oil prices were a heavy burden on the country’s trade balance. About 25 per cent or more of the country’s import expenditure was on oil imports. Last year was an exceptional year when oil prices fell sharply from about US$ 100 per barrel in recent times to as low as US$ 40 per barrel.

This fortuitous development, combined with ample rainfall last year that reduced thermal generation of electricity, reduced oil imports drastically by 41 per cent to only US$ 2.7 billion. This was only 14 per cent of last year’s total imports. Despite this, total import expenditure fell only slightly from US$ 19.41 billion to US$ 18.96 billion or US$ 0.45 billion owing to an increase in other imports.

Mixed blessing

Mixed blessing

The sharp fall in oil prices proved a mixed blessing, as it also affected international demand for several of the country’s main exports and slowed the increase in worker remittances from the Middle East.

Tea exports

The most seriously affected export was tea. Tea exports fell by nearly 20 per cent owing to the depressed demand from oil exporting countries. Russia, Iraq and Syria were among the key tea importing countries that were adversely affected by depressed oil prices. Apart from the decline in import demand for tea, imports by several Middle Eastern countries were adversely affected by the political disruption, war and trade embargoes.

These unfavourable developments not only reduced tea exports and the trade balance but also disrupted both tea plantations and small holder tea cultivation to crisis proportions. The exception to this was the organic tea exports that continued to fetch high prices in niche markets.

While tea exports declined by about 18 per cent, manufactured exports too performed sluggishly. Textile and garments exports declined somewhat, while fish exports continued to be low owing to the EU ban. Consequently total exports decreased by almost 5 per cent from US$ 11.11 billion to US$ 10.56 billion.

Exports of US$ 10.56 billion were much less than imports of US$ 18.96 billion last year. This resulted in the large trade deficit of US$ 8.4 billion. Export earnings last year were only 59 per cent of import expenditure and were woefully inadequate to finance import expenditure.

Gains lost

Imports of commodities, other than oil, increased to nullify the reduction in oil import expenditure. Imports of consumer goods, especially motor cars rose sharply. Car imports alone increased by a massive 41 per cent. One could say that the advantage in the fuel price decrease was frittered away by imports of cars. The fall in fuel import costs by as much as 46 per cent should have been a boon to the trade balance. Yet the decrease in fuel prices proved to be a mixed blessing as it affected the country’s exports adversely and resulted in a trade deficit that even exceeded the large trade deficit of US$ 8.3 billion in 2014 to reach a peak US$ 8.4 billion last year.

Earnings from services

Earnings from tourism increased by 18 per cent last year and contributed US$ 2.9 billion to the country’s foreign exchange earnings. Tourism is continuing to grow this year as well. In contrast, workers’ remittances that has been growth till 2014 declined by 0.5 per cent to US$ 6.9 billion in 2015 from US$ 7 billion in 2014 when it grew by 10 per cent.

Concluding reflections

As in recent years, exports were inadequate in comparison with imports. Exports were only 58 per cent of imports. This wide difference between imports and exports is the basic reason for the high trade deficits of recent years. Despite the sharp fall in fuel imports by 46 per cent, exports were much lower than imports.

Global conditions and a slow response to depreciate the Rupee that resulted in an overvalued real effective exchange rate compared to competitors accounted for this bleak industrial export performance. The depreciation of the Rupee since September last year coupled with credit controls are likely to stem imports. In the last two months of last year there were signs of such a slowing down. Unfortunately, there is no evidence of a resurgence of exports. Tea exports continue to suffer badly, while global economic conditions are not conducive to an expansion of manufactured exports.

Global conditions and a slow response to depreciate the Rupee that resulted in an overvalued real effective exchange rate compared to competitors accounted for this bleak industrial export performance. The depreciation of the Rupee since September last year coupled with credit controls are likely to stem imports. In the last two months of last year there were signs of such a slowing down. Unfortunately, there is no evidence of a resurgence of exports. Tea exports continue to suffer badly, while global economic conditions are not conducive to an expansion of manufactured exports.

There are a few favourable signs on the horizon. The restoration of fish exports to Europe and the expected restoration of the GSP plus in June could boost exports. The current more restrictive monetary policies of reducing credit growth and increasing interest rates could dampen imports.

Tourist earnings are continuing to grow at a healthy pace and prospect for earnings from ICT services would enhance the balance of payments. Despite these it is important for the country’s imports to be restrained in the current context of low foreign exchange reserves, bleak prospects for tea exports and industrial exports.

While the long term strategy should be to expand manufactured exports and services exports, a close watch on growing imports is essential. Monetary and fiscal policies must be geared to reducing aggregate demand and reducing selective imports.

Leave a Reply

Post Comment