Columns

Bold unwavering policies needed to resolve current economic crisis

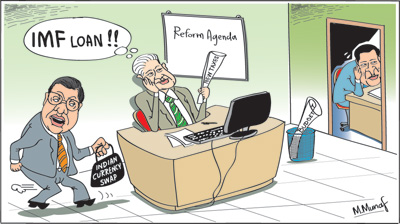

View(s):Confusion and uncertainty in economic policies are hampering the resolution of the current economic crisis. Palliatives such as the currency swap with the Reserve Bank of India is easing the strFess on the foreign reserves but not providing a solution to the balance of payments problem. The crisis in the external finances is symptomatic of fundamental weaknesses in the economy that require bold fiscal measures to resolve. The lack of consistent policies to address them is astonishing.

The downgrading of the country’s risk by rating agencies has compounded the problems as borrowing in international markets would be very costly. Foreign investors too would be discouraged from investing in the country.

The downgrading of the country’s risk by rating agencies has compounded the problems as borrowing in international markets would be very costly. Foreign investors too would be discouraged from investing in the country.

IMF

The only glimmer of hope is the prospect of an IMF bailout which is the best option in the present economic circumstances. The expected IMF loan of US$ 1.5 billion would give some space for correcting the economic fundamentals. The conditions attached to the granting of the loan should be the foundation for correcting the fundamental economic weaknesses.

IMF conditions

The depreciation of the currency, higher taxation to increase revenue, curtailment of public expenditure in certain areas, reform of loss making public enterprises and perhaps subsidies may be conditions of the loan. Irrespective of the IMF loan conditions (or “conditionalities” according to the IMF lexicon), these are much needed policies to correct the economy’s weaknesses. Without such policies economic conditions would deteriorate further and the country would be in dire straits.

These IMF conditions may result in economic difficulties and court political unpopularity, but they are essential remedial measures to ensure economic stability.

Corrective measures

Corrective measures

Admittedly several corrective measures to address the large trade imbalance have been implemented. The depreciation of the currency, higher tariffs, higher interest rates and credit controls have been put in place. New fiscal measures have been proposed by the Prime Minister to reduce the fiscal deficit by increasing taxation to enhance revenue. These revise the inept budget proposals with more effective taxation measures. The pertinent question is whether these measures are adequate to resolve the economic crisis.

Hopes

Meanwhile there is some hope of an improvement in the external finances due to the reasons discussed in last week’s column. The monetary measures that have made credit more expensive has moderated aggregate demand and reduced imports. Increased import tariffs appear to have also contributed towards reining in imports. These measures should reduce imports and thereby the trade deficit. However the government must continue to monitor import expenditure and take measures to ensure that imports are contained to bring down the trade deficit to around US$ 7 to 7.5 billion.

Exports

On the export side, if the GSP plus status is restored and fish exports are enhanced by the removal of the EU ban, there could be an improvement in export earnings that would contribute towards reducing the trade deficit. Not much improvement could be expected in either agricultural or industrial exports owing to global conditions.

Balance of Payments surplus?

A trade deficit of US$ 7 billion could result in a significant balance of payments surplus owing to increased earnings from tourism and ICT services. Although worker remittances are likely to remain at about last year’s level or slightly less, they would offset a high proportion of a reduced trade deficit of US$ 7.5 billion.

Public finances

The most fundamental change needed to resolve the economic crisis is in the public finances. Government revenues are woefully inadequate. They are inadequate to even meet debt servicing costs. All recurrent expenditure and capital expenditure have to be financed through further borrowing that increases the public debt and debt servicing costs.

The fiscal deficit of over 7.5 per cent of GDP that is likely in 2015 has to be reduced to below 5 per cent this year and reduced to 3.5 per cent of GDP by 2020 as targeted in the Prime Minister’s Economic Statement of last November. This can be achieved only by higher taxation, elimination of a host of tax exemptions, reducing tax avoidance, and higher effective taxation of affluent consumption.

Taxation

The government has been prevaricating on introducing a taxation system that rakes in about 20 per cent of GDP from the current revenue of only 11 per cent. Countries of Sri Lankan’s income level raise much more and developed countries raise over 35 per cent of GDP as revenue. It is only by raising revenues to such levels that the present economic crisis could be avoided, public debt reduced and adequate fiscal space made available for developmental expenditure and social welfare.

Taxation polices should eliminate or reduce tax exemptions, tax avoidance and tax evasion. Tax reforms must take cognizance of an inefficient tax administration and design taxes that can be collected. Ad hoc tax proposals aimed at particular sectors and types of firms and individuals and create uncertainty among investors must be replaced by comprehensive tax reforms that increase tax revenues to 20 per cent of GDP.

New taxes

The government has proposed a revision of the 2016 budget proposals with a new set of taxes that are expected to yield higher revenue. There would perhaps be further taxation measures during the year to enhance revenue. One of the difficulties that the government faces in increasing revenue is the weak revenue administration, corruption and mass scale tax avoidance by high income earners, including professionals.

How much the new taxation measures would yield this year and in the long run is uncertain. What are needed are tax reforms that are able to minimise tax avoidance and tax evasion and to rationalise tax exemptions. A more systematic tax structure that yields higher revenue is needed.

Imperative

Containing the fiscal deficit is vital for coming out of this crisis and enabling economic stabilization and growth. It is important that revenue is increased substantially and unproductive and wasteful government expenditure is pruned down to contain the fiscal deficit. Bold taxation measures that fall on the affluent rather than regressive indirect taxes on the poor must be adopted. The Prime Minister’s tax proposals are in the right direction but may be inadequate. On the expenditure side, there is a need to cut the huge losses in state owned enterprises and where reforms are unlikely to succeed the option of privatisation must be pursued.

Leave a Reply

Post Comment