Weak external finance aggravates economic hardships with no signs of countervailing strategies

View(s): Sri Lanka’s external finance is in a fragile position with the loss of US$1billion in official foreign reserves in just three months ending February 2016. The total amount of official reserves which currently stands around US$6 billion is hardly sufficient to meet foreign debt service payments and currency swap arrangements committed for the next 12 months. In the context of the widening trade deficit and capital outflows, the government is compelled to borrow from foreign capital markets to meet the debt service commitments resulting in continuous rise of the debt burden.

Sri Lanka’s external finance is in a fragile position with the loss of US$1billion in official foreign reserves in just three months ending February 2016. The total amount of official reserves which currently stands around US$6 billion is hardly sufficient to meet foreign debt service payments and currency swap arrangements committed for the next 12 months. In the context of the widening trade deficit and capital outflows, the government is compelled to borrow from foreign capital markets to meet the debt service commitments resulting in continuous rise of the debt burden.

The Central Bank (CB) offered four Sri Lanka Development Bonds this year to raise US$ 500 million at 6 month LIBOR rate plus margin to be determined through competitive bids. In 2015, the government raised US$ 2.15 billion through two sovereign bond issues. The CB has a currency swap agreement with the Reserve Bank of India for a drawing of US$1.1 billion raised in 2015. In addition, several SL Development Bonds were issued last year. In a further indication of the worsening situation, the CB on March 29, announced it planned to borrow US$3 billion in multiple tranches and invited proposals from banks/investment houses to be appointed as lead managers/book runners to these issues.

BOP crisis

The trade deficit widened from US$8,287 million in 2014 to US$8,430 in 2015. Export earnings were down by 5.6 per cent in 2015 as a result of lower earnings from both industrial and agricultural exports. The export sector, which still depends largely on garments and commodity exports, has failed to increase its share in the global market with innovative, knowledge-based products. Import outlays declined by 2.5 per cent in 2015 largely on account of a reduction in the fuel import bill by US$2 billion. However, such saving was offset by a 22 per cent rise in consumer goods imports, mainly vehicles and other consumer durables. The less stringent monetary policy that led to low market interest rates for a long time propelled effective demand for such imports.

There is a slowdown of worker remittances due to the fall in oil prices and the unsettled conditions in the Middle East countries. The external finance situation has worsened due to capital outflows following the US Fed rate hike last December and the global financial setback. Both the government securities market and the stock exchange continue to experience substantial capital outflows in recent months. In the absence of dynamism in the export sector and the weak macroeconomic fundamentals which hinder foreign direct investments, the balance of payments situation is unlikely to improve in the near future.

Rapid currency depreciation

Rapid currency depreciation

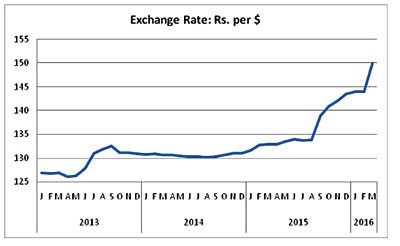

Reflecting the weak external finance position, the exchange rate crossed the Rs. 150 mark vis-à-vis US dollar for the first time last Wednesday. The rupee has depreciated by 13 per cent during the last 12 months. Undoubtedly, the rupee depreciation is essential to rectify the prolonged external imbalance. As the CB defended the overvalued rupee for a long time, the country missed a more comfortable gradual depreciation of the currency and possible recovery of the external sector. The rupee had appreciated in the first half of 2013 and began to depreciate thereafter for a short period, as shown in the chart.

The exchange rate remained within the range of Rs. 130 – 135 per dollar until mid-2015. It was possible to keep the exchange rate at such stable level due to the buildup of foreign reserves through foreign borrowings though the continuous trade deficits called for rupee depreciation.

The rupee has continued to depreciate since the third quarter of 2015, and the depreciation accelerated in recent months with dwindling foreign reserves. Although drastic rupee depreciation is unavoidable at this stage, it has adverse consequences on external debt commitments, balance of payments, government budget, price stability, cost of living and export competitiveness.

Exchange rate pass-through to inflation

The rupee depreciation obviously has positive effects on import prices and consequently on domestic consumer prices. This process is usually measured through the ‘exchange rate pass-though’, defined as the effect of exchange rate changes on domestic inflation. Empirical evidence (IMF, WP 08/78) suggests that a depreciation of the Sri Lanka rupee has an immediate and a positive effect on both wholesale and consumer prices with the maximum effect occurring in the second month of the shock on wholesale prices and between the second and the third month on consumer prices. Around 25 per cent of the variation in consumer price inflation could be explained by external shocks including exchange rate, oil price and import price shocks.

The exchange rate pass-through to consumer prices does not take place in full scale due to subsidies and administered prices enforced on essential consumer goods. The average monthly inflation as reflected in the National Consumer Price Index was only around 3.1 per cent during the three months ending February 2016. Inflation, however, is likely to go up in the coming months due to the rapid rupee depreciation. Needless to say that high inflation has adverse domino effects particularly on the living standards of low-income families.

Economic strategies lacking

In spite of the precarious economic situation, the government seems to be preoccupied with political agendas such as constitutionalism, devolution of power and reconciliation. Although the significance of these factors in the country’s future development could not be underestimated, adequate priority is not given to tackle the current economic crisis. The government is engaged in a fire-fighting exercise to tackle the day-to-day economic problems rather than addressing the problems with a comprehensive economic strategy based on a long-term vision. For instance, the recent tax revisions including VAT increases and Capital Gains Tax are not based on a broad framework of tax reforms, but introduced as quick solutions to raise the revenue.

The current economic turmoil has adverse effects on the proposed mega-infrastructure projects which are to be the major growth drivers, according to the government’s policy agenda. Specifically, the government’s flagship project Megapolis, which has been launched without much concern about the macroeconomic realities, will have enormous take-off problems in view of its impending difficulties in attracting the massive foreign investments amounting to over US$40 billion envisaged for the next 15 years. By contrast, foreign investment inflows were only around US$700 million last year. Given the recent downgrading of the country’s credit rating scales by the rating agencies coupled with the weak macroeconomic fundamentals, the potential to mobilise foreign capital, in the form of foreign borrowings or foreign direct investment, is extremely limited.

Thus, the country’s growth prospects will be severely constrained by the balance of payments difficulties. The increasing debt burden has disturbing effects on the external and fiscal sectors. In the meantime, the rupee depreciation resulting from the weak external finances exerts adverse effects on inflation, cost of living, debt burden and many other variables, as mentioned earlier. Restoration of economic growth and stability amid these multiple traps is a major challenge for the government.

(The writer, an economist, academic and former central banker, can be reached at

sscolom@gmail.com)