Inflation pick-up worsens economic instability; monetary tightening on hold

View(s): Sri Lankan inflation shows an increasing trend in recent months as the demand pressures gather momentum. Year-on-year headline inflation based on the Colombo Consumer Price Index (CCPI) increased to 2 per cent last month from 0.1 per cent a year ago. Year-on-year core inflation, which remains higher, rose to 4.5 per cent last month from 1.4 per cent a year ago. However, the Central Bank (CB) is of the view that inflation would remain at low- to mid-single digit levels during the remainder of the year with its already adopted policy measures, according to the Monetary Policy Review for March 2016.

Sri Lankan inflation shows an increasing trend in recent months as the demand pressures gather momentum. Year-on-year headline inflation based on the Colombo Consumer Price Index (CCPI) increased to 2 per cent last month from 0.1 per cent a year ago. Year-on-year core inflation, which remains higher, rose to 4.5 per cent last month from 1.4 per cent a year ago. However, the Central Bank (CB) is of the view that inflation would remain at low- to mid-single digit levels during the remainder of the year with its already adopted policy measures, according to the Monetary Policy Review for March 2016.

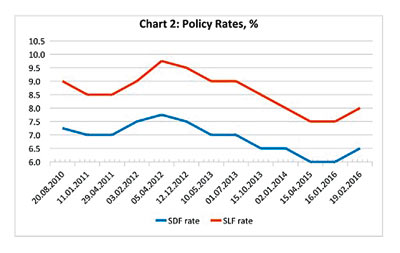

The CB states that the growth of monetary aggregates would decelerate gradually over the remainder of the year, reflecting the impact of the upward movement in market interest rates, while the envisaged fiscal consolidation path is expected to support the moderation of monetary expansion. Taking into account the above considerations, the Monetary Board, at its meeting held on March 29 decided to maintain the Standing Deposit Facility Rate (SDFR) and the Standing Lending Facility Rate (SLFR) of the CB unchanged at 6.5 per cent and 8 per cent, respectively.

Core inflation rising

Core inflation rising

Headline inflation, measured in terms of the CCPI which contains the entire basket of goods and services, is influenced by factors such as shortages of agricultural supply or fluctuations in international oil prices. Such supply-side shocks often cause volatility in CCPI, and hence headline inflation tends to move away from its underlying trend. As such supply shocks are beyond the control of the monetary policy, it is important for the CB to ascertain the underlying inflation.

For this purpose, central banks in many countries use ‘core inflation’ which measures the underlying trend of consumer prices excluding the temporary disturbances and shocks that cause price fluctuations, independent of monetary policy. Following the international practice, core inflation for Sri Lanka is computed by excluding food and energy items from CCPI. Core inflation shows an increasing trend since February last year, as shown in Chart 1. In fact, the core inflation has remained above the headline inflation since mid-2014. This indicates that the inflationary pressures are building up not due to price increases in food or energy, but due to factors within the purview of monetary policy.

Relaxed monetary policy fuels inflation

The rise in core inflation could be totally attributed to monetary factors. The CB has reduced its policy rates continuously since December 2012, as shown in Chart 2. The SDFR (rate applicable for placement of overnight excess funds of commercial banks) was brought down from 7.75 per cent in April 2012 to 6 per cent in April 2015. The SLFR (rate applicable for lending of overnight funds to commercial banks) was reduced from 9.75 per cent to 7.5 per cent during the same period. In February this year the SDFR and SLFR were raised by 50 basis points each to 6.5 per cent and 8 per cent, respectively. In line with the policy rates, market interest rates had remained low until they began to rise marginally following the recent policy rate hike and the increase in the Statutory Reserve Ratio. The money supply continues to expand despite these policy measures.

Low interest rates fuel inflation

Low interest rates fuel inflation

Interest rates were lowered with the anticipation of stimulating economic growth through increased private investments. But this has not realised due to many reasons. Apart from interest rates, entrepreneurs consider many other factors in their investment decisions. Investor expectations are influenced by factors such as the rate of return on inputs, term structure of interest rates, macroeconomic environment, technological changes, exchange rate volatility, capacity utilisation, aggregate demand, fiscal stability, inflation, political stability, business confidence, policy consistency, availability of credit and cost of production. Sri Lanka has low scales in most of these fronts, compared with the fast growing East Asian economies.

The share of commercial banks’ loans and advances obtained by the private sector was only 9 per cent for agriculture and 22 per cent for industrial sector by the end of last year. The balance 69 per cent of the loans was utilised for service-oriented activities, construction and personal expenses. Construction activities accounted for 19 per cent of loans indicating the construction boom driven by low interest rates. The loan composition reflects the preference of borrowers in diverting their funds. In a less favourable investment climate they prefer to put their borrowed funds in trading activities so as to earn quick profits rather than to engage in riskier production activities which take longer time horizons to generate returns. Personal loans and advances accounted for 23 per cent of commercial banks’ total lending by last December.

Reflecting the effects of low interest rates, loans obtained for consumer durables rose by a whopping 56 per cent last year. Most probably, a substantial proportion of such loans must have gone to purchase vehicles. Many banks and leasing companies have got together with vehicle importers and provided easy payment arrangements to prospective vehicle buyers. Numerous hire-purchase facilities are also available for domestic equipment such as TVs, furniture, refrigerators, kitchen apparatus, air conditioners, etc. The total amount of loans channelled through credit cards too rose by 12 per cent last year to reach Rs. 65 billion by last December. This shows the extent of addiction to credit card culture by households. The demand-pull effects of trading- and consumer-oriented activities driven by low interest rates are reflected in the increasing trend of core inflation.

Inflation gathering momentum

The rapid monetary expansion and rupee depreciation tend to further accelerate inflation. The year on year growth in broad money supply rose to 19.1 per cent last January from 12.6 per cent a year ago. This reflects the inadequacy of monetary tightening adopted thus far. The inflationary pressures emanating from the budgetary financing are substantial. No action has been taken to rationalise excessive government expenditure. On the revenue side, the recent increases in VAT and other taxes also have positive inflationary effects. Meanwhile, the exchange rate crossed the Rs. 150 mark against the dollar a few days ago reflecting fast rupee depreciation amid weakening external finance as elaborated in last Sunday’s column. The positive effect of currency depreciation on export competitiveness will erode again with high domestic inflation. This would necessitate further currency depreciation to restore export competitiveness. This vicious circle will continue until inflation is tapered-off with appropriate monetary and fiscal policies which are far from reality.

(The writer, an economist, academic and former central banker, can be reached at sscolom@gmail.com)