News

Agents warn Sri Lanka losing thousands of West Asian jobs

A controversial deal between the Sri Lanka Bureau of Foreign Employment (SLBFE) and a Dubai-based insurance company to provide additional insurance cover to Sri Lankan migrant workers has put the country’s West Asian job market in jeopardy.

The bad news could not have come to the Government at a worse time with the country facing a foreign exchange crisis while the West Asian job market is shrinking due to an economic recession linked to the drastic fall in oil prices.

Qatar recruitment companies warn if Sri Lanka does not drop the new insurance demand, they will recruit from India, Bangladesh and other countries

Besides, a policy decision by the Gulf Cooperation Countries (GCC) to recruit within the region and the opening up of the African market for recruitment are also threatening to take jobs away from Sri Lanka and other Asian markets, job agencies say.

They say no other Asian country sending workers abroad has heaped an additional insurance burden on the recruiting companies. Therefore the SLBFE's insistence that every worker is covered by a Dubai insurance policy places Sri Lanka in a disadvantageous position in the highly competitive West Asian job market, which attracts 94% of Sri Lankan migrant workers.

An official of a Qatar-based company, which recruits thousands of Sri Lankan skilled and non-skilled workers every year, said they were perplexed over the SLBFE’s new requirement, for which employers are asked to pay a US$ 100 premium and another US$ 10 as administration fee to the SLBFE.

The SLBFE says the decision to go for the Dubai-based Union Insurance Company's insurance scheme was taken in the interest of Sri Lankan migrant workers. It says the scheme, which is made mandatory for every employer, was introduced in Kuwait last year and is now being extended to Qatar and the United Arab Emirates.

But Qatari companies have questioned the need for additional insurance cover when they insure every worker – as required by a Qatari government rule -- under insurance schemes which are more comprehensive and worker-friendly than the Dubai-based company’s scheme.

Rejecting the SLBFE’s demand outright, an official of a leading Qatari recruitment company said his company was an ISO standard company and it insured every worker for Qatari Riyal 200,000 (Rs. 8 million).

Insisting his company was not ready to bear the additional financial burden by paying US$ 100 to the Dubai insurance firm, the official said his company had decided to stop recruitment from Sri Lanka and would turn its focus on countries such as Bangladesh, India and Ethiopia.

The Sunday Times learns that several other companies have also warned that they will look elsewhere unless the SLBFE drops its demand.

The Sunday Times learns that every Sri Lankan leaving for employment abroad is also covered by Sri Lanka Insurance's Sahana scheme. In terms of this policy, Rs. 400,000 is paid for the next of kin in the event of the untimely death of a migrant worker. The SLBFE says this amount is not enough. But questions arise as to why the SLBFE decided on a Dubai company instead of a Sri Lankan insurance company.

Akbar Kareem, proprietor of Formosas Communications Company, a 32-year-old pioneer Sri Lankan job agency, said the SLBFE’s move was certainly not in the national interest of the country.

He said he had got an order for 890 workers for a project in Qatar, but the recruitment process was in abeyance because the Qatari company which sought the workers was refusing to pay US$100 for the additional insurance cover.

“We are losing our job market. The Gulf countries are looking elsewhere. Some West Asian employers are telling us to pay the US$ 100 premium to the Dubai company, if we are so worried about losing our business. But we cannot do this because in terms of the SLBFE circular this money has to be paid by the employer,” he said.

If Mr. Kareem decides to pay the US$ 100 insurance fee and the US$ 10 to the SLBFE, the 890 job package will cost his firm US$ 97,900 or more than Rs. 14 million. If 300,000 Sri Lankans leave annually for West Asia to take up jobs and the local job agents are forced to pay the premium, this would mean a dollar drain of US$ 30 million at US$ 100 a worker.

Mr. Kareem said the job agencies would write to the President, seeking an appointment with him to explain the adverse effects of the scheme and the disadvantageous position the country and job agencies had been pushed into.

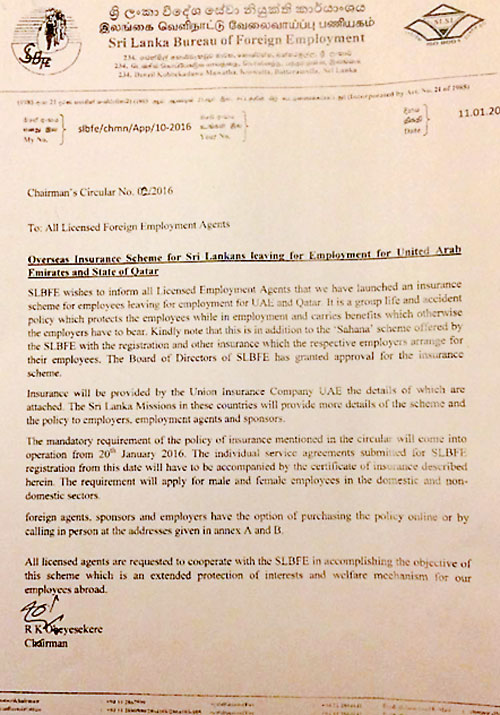

The controversial SLBFE circular

Migrant workers sent more than US$ 7 billion in 2014, and the Government wants to increase the inflow to US$ 10 billion this year. The money the migrant workers send, together with tourism earnings, helps the Government to bridge the balance of payments gap .

Faizer Mackeen, President of the Association of Licensed Foreign Employment Agencies (ALFEA), said most West Asian employers had rejected the SLBFE's new requirement because the workers were covered by much better insurance schemes.

“All workers, other than domestic workers, are covered by comprehensive insurance coverages and, therefore, employers have balked at the bureau’s insistence that they now pay for an additional insurance cover for Sri Lankans,” he said.

Mr. Mackeen said the association learned that the SLBFE had neither obtained approval from the Insurance Board of Sri Lanka nor followed tender procedures in picking the Dubai-based Union Insurance Company.

He said if the new scheme was aimed only at domestic workers, it would be welcome. In Kuwait, following protests, the new scheme now covers only domestic workers and the premium is paid by the Sri Lankan Manpower Welfare Association of Kuwait. However, the move to extend the scheme to all migrant workers in Qatar and the UAE is threatening to destroy Sri Lanka’s job market there.

Mr. Mackeen said his association had sent several letters to Foreign Employment Minister Thalatha Athukorale seeking a meeting with her to explain the situation and warn her of the negative consequences. “However, she is yet to respond to us. We believe she is being misled by some senior officials at the SLBFE.”

Also unhappy with the new scheme are West-Asia-based Sri Lankan activists. They took up the matter at a workshop convened by Sri Lanka’s ambassador at the embassy premises in the Qatari capital of Doha last month. Questioning the rationale behind the SLBFE’s Dubai insurance deal, officials of the Qatar-based Sri Lanka Coordinating Committee, an organisation working for the welfare of Sri Lankans in Qatar, says the whole exercise lacks transparency.

Sri Lanka Coordinating Committee treasurer Lakmal Ehelamalpe, who works in a leading bank in Doha, said the manner in which the Dubai firm's insurance scheme was being pushed had raised suspicions.

He said they could see a drastic reduction -- according to some sources, a 30 percent drop -- in the arrival of Sri Lankans in Qatar for employment in the last three months. He called on the Government to act fast to protect Sri Lanka’s job market in Qatar and immediately order the bureau to withdraw the circular.

“Most Qatari employers prefer Sri Lankan workers to workers from other countries. But now, because of the SLBFE’s new insurance condition, our jobs are going to India, Nepal and Bangladesh. We are losing the job market and this will adversely affect our economy,” Mr. Ehelamalpe warned.

The circular signed by SLBFE Chairman R. K. Obeysekera informs employers, job agents and sponsors that it is mandatory to obtain the insurance cover from the Dubai-based Union Insurance Company.

“The requirement will apply to male and female employees in the domestic and non-domestic sectors,” the circular says. (See pic). However, Mr. Ehelamalpe asks why this sudden decision to go for a new insurance cover when the Qatari government has a mandatory insurance scheme with a low premium of US$ 35 and a much higher compensation package -- Qatari Riyal 200,000 or more than Rs. 8 million in the event of death. The package offered by the Dubai company pays US$ 7,000 or little over Rs. 1 million.

Bureau says it wants to protect Lankan workers SLBFE Working Director Upul Deshapriya says the insurance deal with the Dubai company was reached solely to ensure the safety and security of Sri Lankan workers in West Asia. He said local job agencies should not get agitated as the insurance premium of US$ 100 had to be borne not by them but by the agency or the employer in the country to which the worker was being sent. “To say that local job agents will have to pay the premium and this will lead to a foreign exchange outflow is completely untrue and is being spread by some disgruntled local agents,” he said. Mr. Deshapriya said the insurance policy migrant workers obtain from Sri Lanka Insurance gave just Rs. 400,000 in the event of death. This was inadequate and therefore the bureau decided to make it mandatory for West Asian employers to cover every worker under the insurance scheme from the Dubai firm. Dismissing charges that the move lacked transparency, the SLBFE director said the deal with the Dubai firm was reached with Sri Lanka Insurance acting as an intermediary. “The agreement was completely transparent and has received all necessary approval,” he claimed. “We initiated the programme for Kuwait in September last year and have now expanded it to the UAE and Qatar. We will expand it further to include Saudi Arabia and Jordan in the coming months,” he said. Asked about the claims that Sri Lanka could lose jobs because West Asian employers are refusing to agree to the bureau’s condition, Mr. Deshapriya admitted that some employers may look elsewhere, but dismissed such concerns as “not the SLBFE’s problem.” If some companies in the host countries were refusing to pay the insurance premium, it was up to the agents to find alternatives, he insisted. “This move was taken to ensure the security of our workers and raise the standards. Our concern is the welfare of our workers. It is not our vision to send large numbers of workers with poor insurance cover,” Mr. Deshapriya said. |