Columns

Will IMF bailout be tipping point to external financial stability?

View(s):The much awaited IMF Extended Fund Facility (EFF) of US$ 1.5 billion was approved. It could usher in external financial viability and more prudent management of the country’s finances. If the government implements the concomitant reform program, the country could move towards fiscal consolidation and an improvement in the balance of payments. These are essential for economic stability and growth.

Extended Fund Facility (EFF)

Extended Fund Facility (EFF)

The IMF’s Extended Fund Facility (EFF) of approximately US$ 1.5 billion will be disbursed in six tranches (instalments) over a period of three years, with the final tranche expected to be disbursed in April 2019. The EFF is equivalent to 185 per cent of the country’s current quota with the IMF.

Its interest rate of 0.05 per cent per annum plus 100 basis points amounts to 1.5 percent per annum. It is significantly lower than the prevailing market rates. Its first tranche amounting to approximately US$ 168.1million will be made available immediately and the remaining amount will be disbursed in six tranches over a period of three years, with the final tranche expected to be disbursed in April 2019.

International confidence

The US$ 1.5 billion is a much needed support to the critical balance of payments position. It is also in support of an economic reform agenda that is vital to rescue the country from its poor state of fiscal imbalance.

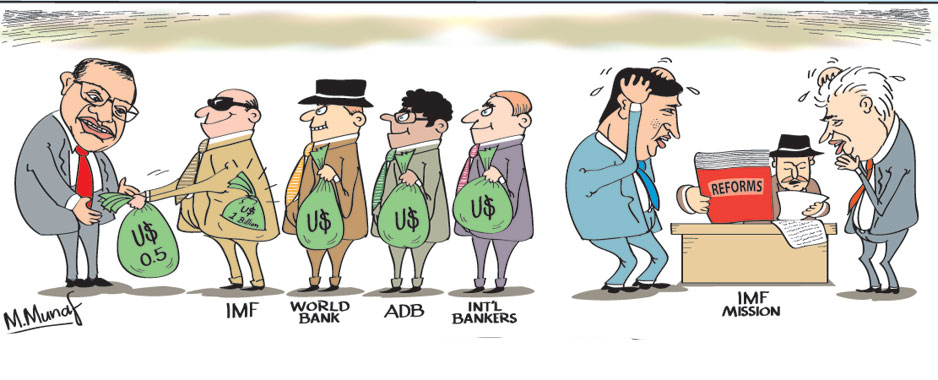

Although the first instalment of the loan is a modest contribution towards strengthening the external reserves, it brings with it international confidence in the country’s economic stability and management. The EFF is expected to attract additional funds from other multilateral and bilateral sources for the successful implementation of the reform agenda of the government. The IMF estimates that such assistance would initially amount to another US$ 0.5 billion.

Significance

Significance

The significance of the IMF facility is manifold. In the first instance, it is a valuable balance of payments support at a time of severe stress on the external reserves of the country. Its initial instalment of only 0.5 billion is certainly small in comparison to the debt repayment obligations of the country for this year. Nevertheless it is not insignificant as the IMF loan brings with it international confidence in the economy that would restrain capital outflows on the one hand, and could bring capital inflows from other international agencies.

Initially these are expected to be about another US$ 0.5 billion. Furthermore the interest rate of 1.5 percent per annum applicable to the loan is significantly lower than the prevailing market interest rates. And the repayment of the loan is over a long period.

Reform commitment

The significant feature of this borrowing is that the government is committed to a program of reform and prudent management of the government’s finances. The imprudent fiscal management over the years, with excessive borrowing to finance investments with low or no return, has been the bane of the country’s finances.

Reforms imperative

Although the conditions placed by the IMF are unpopular in the country and politically opposed, it is the fulfilment of these conditions that could bring the economy out of its current crisis. The commitment to increase government revenue by a new tax regime and more efficient tax administration, cutting losses of public enterprises and prudent public expenditure are vital for fiscal consolidation.

The commitment to reduce losses of state owned enterprises, some of which are huge amounts, is vital to reduce government expenditure. The government has already taken measures to reduce losses and proposed methods by which the losses in several very large loss making state enterprises would be reduced.

The commitment to a flexible exchange rate that contains the trade deficit is vital for an improvement in the trade balance that has been over US$ 8 billion in the last two years.

Reviews

The surveillance of the IMF to ensure that the reform agenda is implemented is important as previous governments have relegated their commitments. The IMF is expected to conduct regular reviews of the country’s economic performance commencing November 2016.

Economic stabilization

The conditions for economic reform by the IMF are desirable for the economy. Large budget deficits are injurious to the economy. Irrespective of the IMF conditions, the containment of the fiscal deficit is an essential condition for the stabilization of the economy.

The Central Bank has itself said this repeatedly. The Institute of Policy Studies has argued strongly for fiscal consolidation and Parliament itself passed the Fiscal Management Responsibility Act that stipulated a much lower fiscal deficit than the IMF at that time. Therefore the compliance with the conditions laid down by the IMF is not only desirable, but essential to bring the economy out of the current crisis.

The IMF has pointed out that the bailout also provides the opportunity for reform. “The new government’s economic agenda, supported by the EFF, provides an important opportunity to re-set macroeconomic policies, address key vulnerabilities, boost reserves, and support stability and resilience.”

Government commitment

It is imperative that the government remains committed to the reform conditions agreed with the IMF. Otherwise the economy would lapse once again to a crisis situation and people would face even more severe economic hardships: economic growth would be hampered and income and employment gains would be inadequate.

It is the responsibility of economists in high places to advise the government on the actual economic conditions and the need to implement the reform agenda proposed by the IMF. Fiscal consolidation through higher revenue collection, reduction of losses in state enterprises, curtailment of wasteful expenditure and prudent management of public finances are vital to consolidate the country’s fragile public finances. There is no other path for economic stabilization and growth.

Summing up

The intervention and assistance of the IMF at this point in time was essential to resolve the balance of payments crisis. However the function of the IMF is much more than the resolution of the crisis. Its insistence on a reform agenda to stabilise the economy is invaluable. Its significance could be summed up in the phrase ‘Reform or Relapse into Crisis’. Alternatively, it could be the tipping point to economic stability and growth.

Leave a Reply

Post Comment