Columns

Is Brexit grim news for world economy and Lanka?

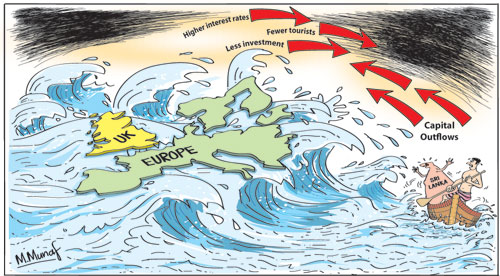

View(s):Will the British exit from the European Union (Brexit) have a recessionary impact on global economy and affect the Sri Lankan economy adversely? Most economists have viewed Brexit as unfavourable to global economy. Recessionary conditions, volatility in capital markets, higher interest rates and unfavourable trading conditions could be impediments to the Sri Lankan economy.

Immediate effect

Immediate effect

Brexit has given rise to a surfeit of uncertainty, speculation, exaggerated reactions and volatility in capital and stock markets. As is usual in such circumstances, markets overreact immediately to stabilise later. The medium term effects could however be different from the accentuated immediate responses that we have witnessed.

Financial markets reacted to Brexit with a massive plunge in the British pound against the dollar by over 10 per cent to $1.32: a 30-year low. It fell far more against the yen. Conversely the US dollar strengthened and investors began to move to the safety of US Treasuries. The main European stock indices and Asian markets fell by around 10 per cent. Both exchange rates and stock markets have recovered somewhat since then.

Asian markets

Asian markets

The falls in Asia’s equity markets are also attributed in large part to an early judgment about the impact on the world economy. However Britain accounts for just 3.9 per cent of the world’s output and is not big enough to shake the global economy in the way US or China can. Nevertheless, the US economy has been sluggish recently and there are grave worries about China’s growth.

British economy

Britain’s economy, the London Economist observes, “looms large in Europe, where it is a reliable consumer in an otherwise high-saving continent.” Britain imports about a fourth of her food needs. Any disruption to European growth could harm the rest of the world.

Exaggerated reactions

There have been exaggerated reactions in the markets as well as by commentators. Some commentators are overplaying the consequences. Brexit is not the end of the world for either Britain or Europe or the rest of the world. The outcome need not be as severe as indicated by many. This is especially so as the exit may take about two years, though Ministers of the EU has asked Britain to exit earlier.

Fundamentals

Nothing has happened to the productive capacity or economic fundamentals of the UK or the rest of Europe by this decision. The productive capacity, technical and research capacities, talents and abilities of the British citizens and its institutions have not been affected. Britain has both lost and gained.

India’s Response

India’s response to Brexit has valuable lessons for Sri Lanka. Arun Jaitley India’s Finance Minister said the country was well-prepared to deal with the consequences of Britain’s decision to exit the European Union. He reassured investors: “We are well-prepared to deal with the short and medium-term consequences of Brexit,” He added “Our macro-economic fundamentals are sound with a very comfortable external position, a rock-solid commitment to fiscal discipline, and declining inflation. Our immediate and medium-term firewalls are solid too in the form of a healthy reserve position.”

Mr. Jaitley did acknowledge that Brexit would affect economies around the world. On Friday India’s stock indices slumped in the aftermath of the referendum result. The BSE Sensex fell as much as 1,091 points, or 4 per cent, before recovering to close 2.2 per cent lower. Mr. Jaitley said of Brexit, “This verdict will, obviously, further contribute to such volatility not least because its full implications for the U.K., Europe and the rest of the world are still uncertain,” He said “All countries around the world will have to brace themselves for a period of possible turbulence,”. RBI Governor Raghuram Rajan said the country’s fundamentals were healthy and money would return after the initial bout of volatility. The Indian economy is resilient owing to its strong economic fundamentals and high external reserves.

Could we say that our macro-economic fundamentals are sound? Do we have a very comfortable external reserve position? Do we have “a rock-solid commitment” to fiscal discipline?

In a situation when our macroeconomic fundamentals are not sound, global financial market conditions could affect the economy adversely. This is especially so as the country requires to borrow to meet her debt repayment obligations. Strengthening our macro economic fundamentals is vital to brace ourselves in the emerging global situation of financial uncertainty.

Impacts on economy

Sri Lanka’s exports, tourism and investments could be adversely affected. The most significant adverse impact could be capital outflows and increased cost of foreign borrowing. The volatility of global exchange rates and interest rates will impact on us.

Cost of borrowing

Foreign borrowing could be more difficult and expensive and there could be some adverse effects in the flow of investment till the situation stabilizes. What matters most at present is proper management of the economy to ensure fiscal targets and prudent debt management. Certainly the country is not in a strong position like India, Reduced e capital inflows and higher interest rates could affect the economy adversely.

Exports

The EU is the most important region for the country’s exports. Ten per cent of the country’s exports are to Britain, while nearly 30 percent are to the EU. The EU is also important as a large source of tourist earnings. If incomes fall in the UK and EU, there can be a reduction of exports to these important markets and less tourists. Since the income adjustment in the EU will be less it would have a lower impact on our exports. The GSP plus concession the EU is expected to restore will not apply to Britain after it secedes from the EU. There is enough time to negotiate a trade agreement with Britain.

In conclusion

What happens globally is beyond our control. Our government and policymakers should focus on getting our economic management right. First and foremost there must be fiscal prudence. Economic policies that are conducive to investment and growth must be put in place and there must be good monetary management. This is where the role of an independent central bank matters.

Leave a Reply

Post Comment