Columns

Improving macroeconomic fundamentals vital to cope with global uncertainties

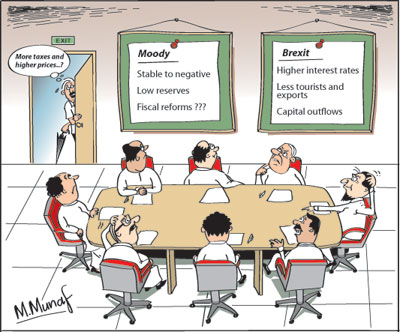

View(s):The adverse impact of Brexit on the economy may be overstated and will take time to manifest. Of more concern are the fundamental weaknesses of the economy highlighted by Moody’s and Fitch. The downgrading of the country rating by these international rating agencies just prior to Brexit compounded the economic anxieties of the country.

Improving the fiscal and trade balances and managing the foreign debt are absolutely important to stabilise the economy. Had Sri Lanka’s macroeconomic fundamentals been sound, Brexit would have only been a transitory set back, as is the case with India.

Improving the fiscal and trade balances and managing the foreign debt are absolutely important to stabilise the economy. Had Sri Lanka’s macroeconomic fundamentals been sound, Brexit would have only been a transitory set back, as is the case with India.

The weaknesses in external finances and the need for international commercial borrowing make the country vulnerable due to the immediate global uncertainties. The costs of borrowing are made more onerous owing to the volatility of capital markets and the latest downgrading of country risk.

Risk assessment

Moody’s Investors Service changed the country outlook to ‘negative’ from stable.It affirmed the Sri Lankan government’s foreign currency issuer and senior unsecured sovereign ratings at B1 and said that rising debt and less than expected fiscal reforms were lowering Sri Lanka’s economic performance.

Fiscal indicators

Fiscal indicators

Furthermore, Moody’s added that two key drivers underpinned the change in outlook. These were the expectation of a further weakening in some of Sri Lanka’s fiscal indicators in an environment of subdued GDP growth which could lead to renewed balance of payments pressure, and the possibility that the effectiveness of the fiscal reforms envisaged by the government may be lower than they currently expect, which could further weaken fiscal and economic performance.

Growth potential

However Moody’s also pointed out that at the same time, Sri Lanka’s B1 rating is supported by the economy’s robust growth potential and higher income levels than similarly-rated sovereigns. It said that with the effective implementation of some of the fiscal policy measures and other structural reforms planned under the IMF programme, the government would be able to tap a significant potential revenue base. The pertinent question is whether these reforms would be effectively implemented.

Respond to ratings

There has been a tendency for the government and the Central Bank to dismiss reports of international rating agencies as being incorrect or biased whenever such assessments were unfavourable. The last administration did so quite often. The current crisis is a consequence of not heeding these warnings.

Whatever the government may say about these reports, the international community would be guided by them. These reports are based on an analysis of the country’s own economic statistics and economic indicators. Instead of debunking or ignoring them a wise administration would look at the reasons behind such assessments and take their warnings and admonitions seriously and work out policies that would improve the economic indicators.

Reasons

The reasons for their assessments are even more important than the ratings themselves. Government policies must respond to their warnings. The latest international ratings cannot be ignored as the vital economic indicators on which they are based did not arise suddenly. They were a deterioration over the past few years and indicative of the country’s economic mismanagement.

Foreign debt

The country’s massive debt and its debt servicing cost, the low level of foreign reserves, the trade deficit and the weak balance of payments position and above all the fiscal deficit and the lack of prudent management of public finances are the underlying economic reasons for the lowering of the country’s risk ratings. The deterioration of the country ratings unfortunately compounds the problems as the country’s costs of international borrowing could increase owing to it.

Furthermore, owing to the large amount of loan repayments, government foreign borrowings this year are high. This would mean that the costs of borrowing would be high. The result is that the country’s debt would increase further this year. The foreign debt is likely to increase to about US$ 54 billion at the end of 2016 from US$ 49 billion at the end of last year.

Fiscal reforms

The possibility of the fiscal reforms envisaged by the government not being implemented could weaken fiscal and economic performance in the medium and long term. Fiscal consolidation cannot be postponed any further. The recognition of this must be backed up with effective tax reforms.

Economic growth

Despite the fiscal and balance of payments problems, the economy grew by 5.5 per cent in the first quarter of the year. According to the Department of Census and Statistics (DCS), economic growth was mainly supported by the expansion of Industry and Services. Industries grew by 8.3 per cent and services by 4.9 per cent during the first quarter of 2016 compared that of the same period last year. Agriculture grew by 1.9 per cent during this period. The economic growth rate in the first quarter was broadly in line with expectations for the year.

External trade

There have been some improvements in the trade balance and earnings from services that would improve the current account of the balance of payments. The trade deficit decreased by 2.4 per cent in the first four months of the year owing to imports declining more than decreases in exports.

Tourist earnings increased by about 18 per cent in the first five months and the feared decrease in remittances did not happen. In fact remittances increased by 4.1 per cent. While these improvements would improve the current account of the balance of payments, the capital account is likely to have a large net outflow.

Conclusion

In a context of global uncertainty, it is important to ensure careful management of public finances. The fiscal reforms must be implemented to increase government revenue, while considerably better management of public expenditure is vital. Achieving this year’s fiscal targets is vital to put the economy on an even keel.

Leave a Reply

Post Comment