Columns

External finances fragile despite improvements in trade and services account

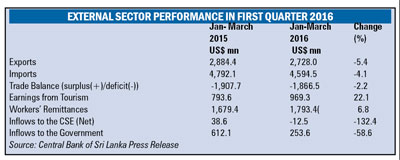

View(s):The external vulnerability of the country’s finances persists despite improvements in the trade and services account of the balance of payments in the first quarter of this year. This is owing to capital outflows, and large debt service payments this year. This is a fragile situation in view of the large debt servicing requirements this year.

Overall balance of payments

Overall balance of payments

Even though the current account of the balance of payments generated a surplus owing to a decrease in the trade deficit and increases in workers remittances and tourist earnings, the overall balance of payments is estimated to be in deficit to the tune of US$ 700 million in the first quarter of the year owing to capital outflows.

This balance of payments performance in the first quarter of the year renders the country’s external finances very vulnerable in the current global uncertainly and developments in the capital and foreign exchange markets. This is especially so due to the need to borrow from international commercial lenders to meet the large debt servicing obligations this year.

Trade balance

There are both favourable and unfavourable features in the external trade performance of the first quarter of this year. The trade deficit has been reduced by 2.2 per cent in the first quarter compared to the first quarter of last year owing to imports declining more than decreases in exports. This has been achieved despite a continuing decline in exports by 5.4 per cent owing to a decrease in imports of 4.2 per cent.

However this decrease in the trade deficit by 2.2 per cent to US$ 1867 million in the first quarter of this year is inadequate. The trade deficit for 2016 is likely to be around US$ 7.5 billion. There should be efforts to reduce the trade deficit to at least US$ 7 billion.

However this decrease in the trade deficit by 2.2 per cent to US$ 1867 million in the first quarter of this year is inadequate. The trade deficit for 2016 is likely to be around US$ 7.5 billion. There should be efforts to reduce the trade deficit to at least US$ 7 billion.

Exports

Total exports decreased by 5.2 per cent in the first quarter of this year. Agricultural exports decreased by 9.2 per cent with tea exports declining by as much as 6.6 per cent. Manufactured exports too decreased by 4.3 per cent, but exports of garments that account for 56 per cent of manufactured exports increased by 8.9 per cent. The decrease in manufactured exports was due to a sharp decline in the exports of transport equipment by nearly 72 per cent.

Admittedly much of the decrease in exports was due to global developments that were beyond the country’s control. This is particularly so in respect of tea exports, where international demand collapsed due to lower incomes of oil exporting countries such as Russia and importers of tea in the Middle East, as well as due to political turmoil in some Middle East countries.

Imports

The decrease in imports by 4.1 per cent is indicative of the impact that the depreciation of the rupee and monetary and tariff policies have had in curtailing imports. Particular significant has been the decrease in vehicle and fuel imports. Oil imports that used to absorb over 25 per cent of import expenditure accounted for only 11 per cent of imports in the first quarter owing to lower oil prices.

Services income

Increased earnings from services have improved the current account of the balance of payments to wipe out the trade deficit of US$ 1,867 million in the first quarter of this year. Tourist earnings of US$ 969.7 million and workers remittances of US$ 1,793 million totalling US$ 2.76 billion exceeded the trade deficit of US$ 1.87 by nearly US$ 1 billion.

There have been increases in these earnings after the first three months of the year. Tourist earnings increased by about 18 per cent in the first five months and the feared decrease in remittances did not happen. In fact workers’ remittances increased by 6.8 per cent to US dollars 1,793.4 million during the first quarter of 2016 in comparison to the first quarter of 2015. While these improvements would improve the current account of the balance of payments, the capital account is having a large net outflow.

Capital outflows

Capital outflows continue to cause a dent in the overall balance of payments. In the first quarter of this year there have been capital outflows from government securities amounting to US$ 572.3 million. The net outflow of investments from the stock market amounted to US$ 12.5 million. In addition, foreign investments have declined from an inadequate US$ 346.4 million in the first quarter of last year to a mere US$ 164.5 million in the same period this year.

Way forward

The external finances of the country remain weak and highly vulnerable to global developments. Despite the current account of the balance of payments generating a surplus, the balance of payments is estimated to be in deficit to the tune of US$ 700 million in the first quarter of the year due to capital outflows and the country’s massive debt servicing repayments.

In an economic situation where there are large debt repayments, the trade deficit requires to be reduced considerably more than the slight reduction of 2.2 per cent. Furthermore, this reduction was brought about by a reduction in imports rather than an increase in exports. Export earnings continue to be only about half the country’s expenditure on imports. Therefore it is imperative that there is a concerted effort to expand exports.

In an economic situation where there are large debt repayments, the trade deficit requires to be reduced considerably more than the slight reduction of 2.2 per cent. Furthermore, this reduction was brought about by a reduction in imports rather than an increase in exports. Export earnings continue to be only about half the country’s expenditure on imports. Therefore it is imperative that there is a concerted effort to expand exports.

The recent decrease in export earnings are to an extent beyond the country’s control. This is especially so with respect to tea exports that decreased mostly owing to the fall in incomes and disruption in oil exporting countries that form a high proportion of the export market for tea. An improvement in the security situation could boost tea exports.

The resumption of fish exports to the EU and the likelihood of the restoration of the GSP plus concession should enable higher exports. The garments industry that accounts for about half of the country’s exports has shown signs of being competitive in international markets. Exploring and expanding opportunities in global value chains is another avenue for increasing exports.

Leave a Reply

Post Comment