Columns

Huge projects on launch pad, but Govt. stuck in VAT trap for daily revenue

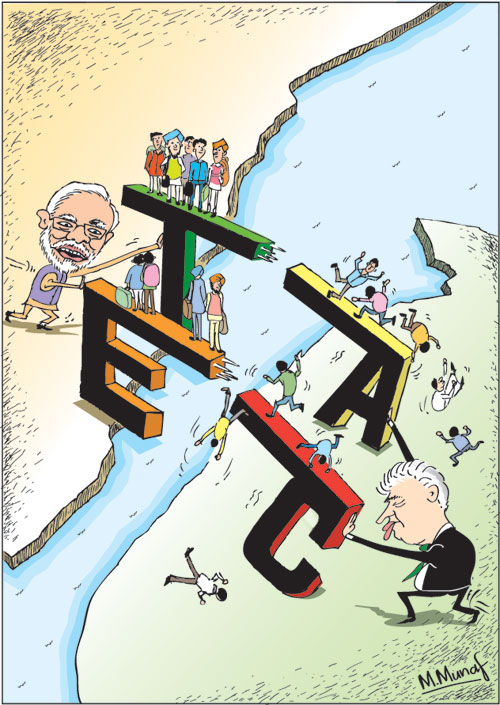

View(s):- Agreement with Chinese company for international financial centre while Japan offers to build Monorail and Light Rail Transport

- Costly mistake results in Supreme Court throwing out VAT Bill, acute embarrassment for UNP

By Our Political Editor

The Government’s controversial Value Added Tax (VAT) increase was mired in a further controversy this week.

The Supreme Court determined that the VAT Amendment draft Bill was placed in Parliament violating the mandatory procedure laid down in the Constitution. It is a Minister who should introduce Bills or Motions in respect of fiscal matters, the court said, noting that they are approved by the Cabinet of Ministers. In this instance, to put it plainly, the draft Bill did not bear a tag to say it has been approved by the Cabinet of Ministers.

After Friday’s signing of the new agreement for the Colombo International Financial Centre Project, the Megapolis and Western Development Minister Champika Ranawaka is seen having a tea-party dialogue with Chinese embassy Political Counsel Pang Chunxue. Pic by Amila Gamage

Yet, in reality it has gone before the ministers who approved it, argued Prime Minister Ranil Wickremesinghe in Parliament. In fact, a memorandum from him to the Cabinet of Ministers, seen by the Sunday Times, makes reference to an April 4 special ministerial meeting where it was decided to increase the VAT. The memo is headlined “Submission of Value Added Tax Amendment Bill for the Approval of Parliament.” Enclosing the draft Bill, the memo notes that it was “drafted by the Legal Draftsman which was referred to the Attorney General by letter dated 20.06.2016 has communicated that the draft bill is not inconsistent with the Constitution, it said. Approval of the Cabinet of Ministers is sought for the VAT bill before it is presented in Parliament.” However, the draft Bill that was gazetted and placed before Parliament still did not mention the fact that it was approved by the Cabinet of Ministers. That was a costly mistake.

The SC determination made clear that it did not examine the constitutionality of the draft Value Added Tax (Amendment) Bill per se. It had only referred to the procedural irregularities in presenting the Bill in Parliament, the first time ever it has done so. It was unclear to the Supreme Court whether the bill was, as required by the Constitution, approved by the Cabinet of Ministers.

For the United National Party (UNP) segment of the Government, the ruling, to say the least, is an acute embarrassment. The UNP is gifted with some of the best legal brains in the country. This is in addition to the state legal apparatus. To slip up over a simple issue such as this is a scathing indictment. Not when an enhanced VAT was imposed at the behest of the International Monetary Fund (IFM). The next tranche of an Extended Fund Facility from the IMF hinges on how soon it could be implemented. So are foreign banks through whom syndicated loans have been raised on the basis of assurances of enhanced revenue and thus a repayment capability. Of course, in respect of promises made to the IMF, no past Government had stuck to targets. For the current administration it would be a blessing of sorts to say it could not act because of the SC ruling.

Parliament Speaker Karu Jayasuriya read out the SC’s latest determination on Tuesday. Earlier, in July the SC had issued an interim order to suspend the enhanced VAT and NBT (Nation Building Tax). It put off further hearings until December 9.

The SC determination said that “….that after the draft legislation was prepared by the Legal Draftsman it was decided to send the said legislation to Parliament after obtaining the approval of the Attorney General. No evidence was placed before the Court to establish that the Bill was approved by the Cabinet of Ministers or authorised by the Cabinet before it was introduced in Parliament as provided in Article 152 of the Constitution. The Hansard of 8th July 2016, makes it clear that the Hon. Minister of Finance who introduced the Bill to Parliament, did not signify the approval of the Cabinet of Ministers as required by Standing Order of Parliament, before introducing the Bill. Provisions regulating the imposition, assessment and collection of taxes are to be given strict construction as they impose financial burden on the taxpayer. We are therefore of the view that the provisions contained in Article 152 of the Constitution have to be strictly complied with as it relates to ‘public revenue.’ “

Ministers met on Tuesday for the weekly ministerial session. Even before they heard the news officially, they appeared aware of the determination. Prime Minister Wickremesinghe had placed a cabinet memorandum where he adduced reasons to “strongly assert” Parliament’s supremacy vis-à-vis the judiciary. He cited an instance where one time Speaker, the late Anura Bandaranaike, had ruled on the supremacy of Parliament.

Ministers met on Tuesday for the weekly ministerial session. Even before they heard the news officially, they appeared aware of the determination. Prime Minister Wickremesinghe had placed a cabinet memorandum where he adduced reasons to “strongly assert” Parliament’s supremacy vis-à-vis the judiciary. He cited an instance where one time Speaker, the late Anura Bandaranaike, had ruled on the supremacy of Parliament.

That was in relation to a conflict between the Judiciary and Parliament over an interim order given by the then Supreme Court preventing Parliament from entertaining an impeachment motion against the then Chief Justice Sarath Silva. Speaker Bandaranaike, in a 25-page ruling said that Parliament was not bound by such an interim order and as it was finally responsible to the people, it was ‘supreme’. He said that his ruling would prevent an unending conflict between the Judiciary and Parliament.

That seemed a suggestion that the Government should go ahead with the draft bill notwithstanding what the SC has said. There was a detailed discussion and also a suggestion to re-introduce the bill with fresh amendments. The Premier appeared conscious that fresh legislation to introduce changes to VAT would entail delays. The draft Bill has to be gazetted and time given to allow for public representation. That would take at least three or more weeks. At the end, in the wake of little support from ministers, Wickremesinghe sought to withdraw his memorandum and the ministers chose not to proceed with it. The final outcome was to present fresh revenue proposals after consultations with the Sri Lanka Freedom Party (SLFP), the other main partner in the National Unity Government. Informal talks are now under way, but Wickremesinghe’s return from China is awaited before the two sides tackle the serious nitty-gritties.

This is while making plans for a broader set of revenue proposals in the Government’s budget in November. The Government wants to broaden the tax base. It is here that the UNP, which is keen to rush through proposals, is facing another major stumbling block. Its main partner, the SLFP, is strongly opposed to some main features in the VAT. One in particular is the threshold of one million rupees on retail traders, a figure that would work out to Rs, 33,300 a day. Some SLFP ministers and even parliamentarians are strongly opposed to the move. They sought a change in this provision amidst mounting reports that they would otherwise absent themselves during voting time. Even President Sirisena had to intervene this week to place on hold a countrywide shutdown of retail outlets when the Government planned a debate. In such a situation, leave alone mustering a two thirds vote to bulldoze the passage of the Bill ignoring the SC ruling, the amendments could not have been passed with support from the SLFP. The SLFP’s Special Assignments Minister Sarath Amunugama declared at a news conference that a team named by the Central Committee was now studying new measures for incorporation in the amendments. That makes clear that the SLFP wants new changes.

The complaint against long delays in implementing revenue proposals has come from Finance Minister Ravi Karunanayake. He circulated among his ministerial colleagues a list of 23 cases filed over different budget proposals, most of them relating to matters coming under the Department of Excise. In another note, he has said, that the VAT was first introduced on August 1, 2002. It had been a two band rate at first – Standard 20 per cent and Concessionary rate 10 per cent. In 2004, Karunanayake notes that the rate was 15 per cent whilst the following year (2005) it changed to a three tier system – Luxury rate 18 per cent, Standard Rate 15 per cent and Basic Rate five per cent.

In 2009, it was changed to a single rate of 12 per cent until 2014 and in 2015 it was placed at 11 per cent. It is only thereafter that the increase to 15 per cent came, he points out, “The threshold for registration of VAT,” Karunanayake pointed out had varied in the past year,” he told the Sunday Times. On Tuesday, Karunanayake told Parliament that the VAT Bill had been introduced in Parliament after the correct procedures were followed.

According to the Finance Minister, from 2002 to 2009 it had been Rs. 500,000 per quarter or Rs 1.8 million. In 2009 it changed to Rs. 650,000 per quarter or Rs 2.5 million a year. In 2013 the amount was Rs. 3 million a quarter or Rs. 12 million a year while in 2015 the amount was increased to Rs 3,375 million a quarter or Rs. 15 million a year. The threshold for 2016 was Rs. 3 million a quarter or Rs. 12 million a year with effect from May 2, 2016, he said.

At Tuesday’s ministerial meeting, taxing tobacco based items also became the subject of a lengthy discussion. Minister Rajitha Senaratne had sought a further increase in taxation – a move that met with counter proposals by Finance Minister Ravi Karunanayake. The latter said that an enhanced tax imposed at once would mean a loss of major revenue. He said that any increase should be phased over a period of time. Countering the argument was Minister Senaratne who argued that continued use of tobacco led to different diseases and caused heavy expenditure on medical bills. Reports with the Health Ministry, Senaratne said, showed that a large amount of money was being spent on medicine. A further discussion on the matter is to follow.

Revenue collection, no doubt, is affected by the delays involved in the increase in VAT rates. Yet, the move has not deterred the Government from embarking on a number of proposals, some of which are ambitious. One such case is to ease congestion in the City of Colombo and suburbs. The Cabinet Committee on Economic Matters recently met a delegation from the Japanese Ministry of Economy, Trade and Industry. The delegation expressed Japan’s interest to improve Sri Lanka’s urban transport system through the provision of “step Yen loan.” The available options and a comparison of Monorail and Light Rail Transport (LRT) were explained through a presentation by the Japanese side. The visitors explained that the Feasibility Study of the Monorail project has been completed and this project is “the most appropriate solution in considering the delivery time, cost and availability of Yen loan for the Monorail Project.”

They also explained that a “complete feasibility study should be undertaken before taking a decision on implementing the LRT system and the Japanese delegation has agreed to conduct a feasibility study on implementing the LRT system if the Government of Sri Lanka is interested.” The minutes of the meeting note that after a careful study “it was decided to recommend to the Cabinet to accept the Light Metro Light Railway option within a period of four years.” Feasibility studies are to be completed within one year with the assistance of JICA (Japan International Co-operation Agency). It was also decided to consider the land acquisition costs as well as costs of the project as it covers urban areas.

Another is the setting up of a joint company between the state and the private sector for a domestic airline. The contours of this project are not clear but the plans are to operate flights to different domestic airports that are being improved at Government expense. This is while Foreign Affairs Minister Mangala Samaraweera has sought the approval of the Cabinet of Ministers to provide duty free vehicles to those serving in Sri Lanka diplomatic missions at the completion of their service. Such importation of vehicles has been allowed since December 1963, he has told his ministerial colleagues. He has pointed out that those in the Foreign Service, officers from the Department of Labour to foreign missions, those from the Department of Commerce and the Foreign Employment Bureau had availed themselves of this opportunity.

The Foreign Minister has noted that at present those serving in diplomatic missions overseas were compelled to use private transport to attend to engagements. Another matter which has engaged the attention of the Cabinet of Ministers in the past many weeks is the Colombo Port City Project. On Friday three parties — the Project Company (CHEC Port City Colombo (Pvt.), the Ministry of Megapolis and the Urban Development Authority (UDA) — signed a tripartite agreement. This in effect has given the legal nod for the Chinese company together with its local counterparts to begin work.

A clause in the tripartite agreement where the Project Company was to be given an additional extent of two hectares, arguably in lieu of compensation, has been withdrawn. This was after the Chinese company heeded a request made by President Maithripala Sirisena. Prime Minister Wickremesinghe told his ministerial colleagues in his memorandum titled “Port City Development Project – Commercial Issues” that upon “signing the Tripartite Agreement, the Project Company commences discussions with the GOSL to evaluate the feasibility of setting up the Colombo International Financial Centre (CIFC) in the land area reclaimed first. Such discussions should also focus on the feasibility and viability of necessary infrastructure for the CIFC being built by the Project Company or any associated company no sooner it is technically feasible to build on reclaimed land on mutually acceptable terms.” This is clearly a misnomer to identify the project as CFIC and not the Colombo Port City Project.

One area where amendments to the Tripartite Agreement would be changed, according to Premier Wickremesinghe, is regarding the proposed Estate Management Company (EMC), which is to be 100 % owned by the Government of Sri Lanka, to manage, maintain and repair the common areas of the Port City by collecting management charges from investors on marketable lands. The Premier points out that “However, until such time the EMC is self-sustainable, the GOSL would have to inject funds for the operation of the EMC. In order to ease the GOSL’s obligation to fund such a venture, at the request of the Committee, the Project Company has agreed to consider establishing and operating the EMC in partnership with GOSL or any statutory entity nominated by GOSL. The Secretary, Ministry of Megapolis and Western Development should continue discussion with the Project Company on establishing such partnerships where the EMC would have the necessary funding and authorisation from the CMC (Colombo Municipal Council), the Western Province Provincial Council and other relevant statutory agencies to carry out its envisaged functions. When an arrangement acceptable to GOSL, as well as the Project Company is reached, necessary amendments could be made to the Tripartite Agreement.”

The Tripartite Agreement requires the Government to obtain the required permits, including the EIA, during the development phase of the project. A failure could result in compensation to the Project Company. The Attorney General had earlier recommended that obtaining reports be made the responsibility of the Project Company. The Company, however, has refused on the grounds that risk allocation between the two Parties had already been negotiated and agreed. Hence, the Project Company has agreed that it would assist the Government with documentation and funding required for obtaining the permits. The company has made clear it should not be exposed to any risk and the responsibility be placed on the GOSL/Ministry of Megapolis and Western Development.

The land reclaimed– an extent of about 269 hectares – will be declared as Development Area under the Urban Development Act. Since the reclamation comes within the Colombo Port area, rights of access to the Water Area and the South Port breakwater can only be given by the Sri Lanka Ports Authority. It has been agreed that since the SLPA is not a party to the Agreement, the Secretary to the Megapolis and Western Development and his counterpart in the Ministry of Ports and Shipping shall identify areas requiring SLPA co-operation and evolve a suitable mechanism to formulate such cooperation arrangements with the Project Company. An internal mechanism is to be worked out to compensate the SLPA for expenses it may incur to comply with contractual obligations of the GOSL.

Premier Wickremesinghe left on Friday night for a four-day visit to China. During the visit, he is to study some of the development projects and banking institutions among other matters. Also making a visit to China is Megapolis Minister Champika Ranawaka.

On the one hand, the Government is continuing to lose considerable revenue that was to accrue from the VAT increase. That has left a number of questions unanswered to Sri Lankan consumers. While some of the tax they paid cannot be reclaimed, there are areas where they could. This includes the telecom sector where the VAT was introduced. What the Government needs most is more funds if it is to keep to its targets. With the SLFP stalwarts determined to make changes in the VAT proposals, time has become an important factor. The longer they are unable to agree, the longer the economic woes of the Government will remain. Thus, the public who look for quick results would be in for more disappointment. After all, the grandiose plans will take years to bear fruit. Will the people show patience? That is the dilemma facing the Government.

Atul Keshap US Air Force strengthens historic American ties with Jaffna I am pleased to be visiting Jaffna this week, to participate in Pacific Angel and to meet with political leaders, civil society, the media and many others. The United States is committed to the future of all of Sri Lanka. Sri Lanka’s presidential election of January 2015 marked a historic shift in the country’s political direction and made possible a new relationship with the United States. Sri Lankan voters elected a new government built upon the pledge of good governance and national reconciliation and rejected an increasingly authoritarian rule by a government determined to erode democratic institutions. The Sri Lankan government has taken many important steps towards a brighter political and economic future, as well as improving relations among Sri Lanka’s diverse population. Recognising this, the United States and the international community are increasing our engagement in Sri Lanka. Most of you have noticed the increasing number of American visitors coming to Sri Lanka, a reflection of the promise by U.S. Secretary of State John Kerry that the United States will “stand with you as you build a stronger democracy and a future that is marked by peace and prosperity after so many years of suffering and hardship.” These visits highlight the full spectrum of U.S. support to bolster Sri Lanka’s international relations, economic growth, development assistance, and military professionalism. We all remember the horrors of the past, the violence of three decades and the anti-democratic governments. Operation Pacific Angel will work with the Sri Lankan Air Force in Jaffna to provide equipment and renovations requested by the local community. This is just one of many visits and programmes undertaken by the U.S. government as part of our commitment to walk by your side, strengthening relationships at all levels and with all of Sri Lanka’s diverse communities. With the democratic transformation, widespread international support has come roaring back because we all share the same vision as the Sri Lankan people: that Sri Lanka can be a shining example for peace, reconciliation, democracy, and prosperity in an increasingly troubled world. | |

Leave a Reply

Post Comment