Taxing Sri Lankans is essential but questions over proper use, BT-RCB poll shows

View(s):While there were strong views expressed on taxation and its ineffectiveness in a joint BT-RCB poll this week, a cross-section of respondents agreed that taxes are essential and the government has a right to tax the people. Given the attention to taxes, VAT included, and its management in recent months, the Business Times and the Research Consultancy Bureau took to the streets of Colombo and Galle (RCB) and through email to assess public opinion on taxes. The results – emails through BT and street views through RCB – were interesting.

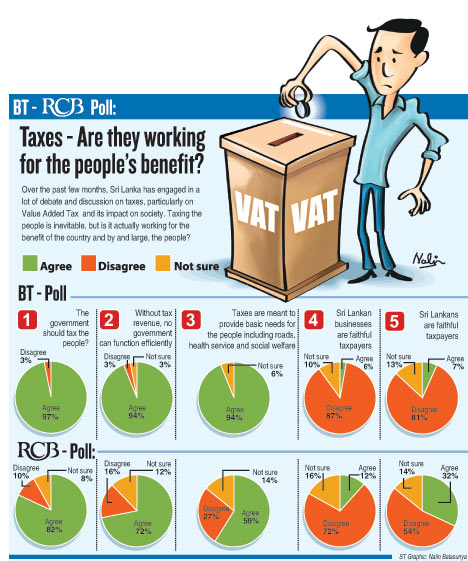

Asked whether the government should tax the people, 97 per cent of BT respondents said yes (or agreed) while 82 per cent agreed in the RCB poll. The second and third questions as seen in the graphic also displayed a similar response though not as close a result as the first question. 94 per cent in the BT poll agreed that tax revenue is important for a government to function while it was 72 per cent agreed (RCB). On taxes being used for basic needs, 94 per cent (BT) and 59 per cent (RCB) were in agreement.

To the question are Sri Lankan businesses faithful taxpayers, it was 87 per cent (yes) from BT and 72 per cent (yes) from RCB. There was a difference of opinion when asked whether Sri Lankans are faithful taxpayers. 81 per cent of BT respondents said ‘yes’ while it was just 54 per cent (yes) from RCB. RCB interviewed 354 respondents in Colombo and 300 in Galle in street interviews while the BT email poll drew nearly 200 respondents. Strong views emerged from street interviews while the degree of ‘yes’ or ‘agree’ responses also varied in Colombo and Galle. Here is snapshot of the comments:

From RCB -

- Big businessmen engaged in tax evasion should be nabbed

- Tuition masters earn a lot but they ‘misdirect direct earnings from classes by organizing additional classes and seminars to evade direct taxes’.

- Many companies don’t pay income tax. Some hire tax consultants to manipulate accounts. Government must regulate this tax evasion.

- While the state needs taxes it should stop harassing the poor and tax the rich.

- Stop finance companies from making profits on mortgages.

- It is not fair to tax people and maintain a huge exemption slab for Ministers and MPs.

- More transparency needed in the tax system.

- Taxes are against the poor while the rich remains silent. Tax men don’t do their job and help the rich manipulate the system.

- The state sector must transform profitable ventures rather than selling them.

- The public should not pay taxes to run political establishments. Rather it should go to the free supply of drugs at state hospitals. People are now forced to buy drugs from private pharmacies.

- Tax concessions to some liquor businesses should be reversed.

- Some companies maintain two books of accounts, as a means of tax evasion.

- No entrepreneur has shown proper accounts to the Tax Department for good reason. If any honest person does so he or she would have to wind up the enterprise.

- The Government has no national plan for the expected revenue. There is haphazard taxing of the people.

From BT Poll -

- Ordinary citizens are by default faithful taxpayers because they cannot extricate themselves from taxes like VAT. But, professionals like doctors/consultants, and richer people are constantly finding ways to evade taxes.

- Doctors, lawyers, consultants, politicians, pilots, airline cabin crew, public servants, etc do not fall into the category of ‘faithful taxpayers”. It is only the private sector employees who have PAYE deducted on all their earnings, who pay faithfully.