Columns

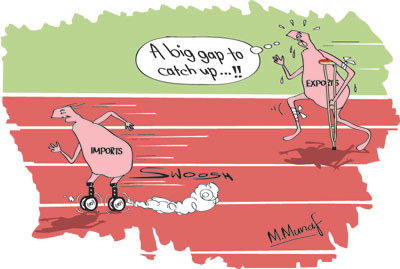

Trade deficit expands to unprecedented levels: Yet current account surplus likely this year

View(s):With the trade deficit reaching US$ 4.2 billion in the first half of the year, this year’s trade deficit is likely to reach a massive US$ 8.5 billion. Despite this large trade deficit, a current account surplus in the balance of payments of around US $2 billion is likely this year. Workers’ remittances, tourist earnings and income from other services are expected to bring in about US$10-11 billion to result in this surplus.

Trade deficit

Trade deficit

The trade deficit increased by 2.2 per cent to US$4.2 billion in the first half of the year. It was higher than in the first half of last year as exports decreased by 5.8 per cent in the first half of the year and was much higher than the decline in imports of only 2.4 per cent. While imports amounted to US$ 9.3 billion, export earnings were only US$5.1 billion.

Recent deficits

The country’s high trade deficits in recent years have been reasons for the balance of payments crisis and vulnerability in external finances. In 2014 the trade deficit reached US$8.4 billion and in 2015 it was slightly less at US$8.1 billion. An important reason for these deficits was the large import expenditure. In 2014 import expenditure reached US$19.4 billion and in 2015 it was US$11.1 billion.

The 2015 increase in import expenditure was despite a precipitous decline in oil imports owing to the sharp decrease in international prices. This advantage in lower oil prices was frittered away by a 97 per cent increase in motor car imports. Imports have been nearly twice the value of the country’s exports in recent years. This endemic imbalance between exports and imports continues to expand and result in large trade deficits year in year out.

The 2015 increase in import expenditure was despite a precipitous decline in oil imports owing to the sharp decrease in international prices. This advantage in lower oil prices was frittered away by a 97 per cent increase in motor car imports. Imports have been nearly twice the value of the country’s exports in recent years. This endemic imbalance between exports and imports continues to expand and result in large trade deficits year in year out.

Economic policies

Economic policies were adopted this year to contain aggregate demand and thereby imports. These have included increasing the cost and availability of credit, the depreciation of the rupee and fiscal measures. Though there was a response to these measures, the increases in imports in the last two months in particular, have resulted in a high level of non oil imports in the first half of this year.

Containing aggregate demand is vital to rein in import expenditure as export performance is weak. It is imperative that monetary fiscal and exchange rate policies ensure that imports are contained as export prospects continue to be bleak.

Exports

Export earnings were only 58 per cent of the country’s import expenditure in the first six months of the year. A significant decline in exports by 5.1 per cent was the main reason for this poor trade performance. Export earnings in the first six months of the year were only US$ 5.1 billion, compared to import expenditure of US$ 9.3 billion. Both manufactured exports and agricultural exports were lower than those during the first half of last year.

Export decline

The Central Bank notes that this is the sixteenth month in a row that Sri Lanka’s exports to the rest of world have declined. While current global conditions are a significant factor for the poor export performance, it is in fact part of the trend decline in exports over many years. This fundamental disequilibrium has to be corrected by policies that are conducive to export competitiveness. Expecting trade agreements to enhance exports when there are fundamental weaknesses in the economy and economic policies is unrealistic.

Global conditions

While the global commodity price slump has partly contributed to the fall in trade with other countries in recent times, our dismal external trade performance is caused by inherent issues. This is so in respect of our non traditional exports. Tea exports however have suffered much by depressed oil prices reducing tea consumption in oil exporting countries.

However the decline in manufactured exports, with the exception of garments, has been owing to fundamental weaknesses in the economy, uncertainty in economic policies, weak economic fundamentals and bad economic management. These are root causes for the inability to diversify and increase exports.

Imports

Despite a slight reduction of imports by 0.2 per cent, the 2.4 per cent decrease in imports was not adequate to compensate for the decreased export earnings. The country’s import expenditure of US$9.3 billion was 72 per cent higher than export earnings. This is indicative of an imbalanced export import economy that has persisted over many years.

In fact the country has had a trade surplus only in four or five years since 1950.The last year when there was a small trade surplus was in 1977 under strict import and exchange controls. The significant diversification of the economy since 1978 has not resulted in a substantial export capacity.

Current account surplus

Despite the large trade deficit of US$4.2 billion in the first half of the year, the current account of the balance of payments is in surplus by over US$1 billion in the first six months. The trade deficit is more than offset by workers’ remittances of US$3.6 billion and tourist earnings of US$1.6 that together amount to US$5.2 billion. In addition to this, receipts from other services of about US$1 billion could be expected for the year.

Services earnings

The trade deficit is likely to reach US$8.5 billion this year. Tourist earnings and remittances of about US$10 billion are likely to offset this and generate a current account surplus of about US$1.5 billion. Earnings from other services would boost the current account surplus to about US$2.5 billion. Therefore, despite the bleak trade performance this year, the balance of payments is likely to record a current account surplus of about US$3 billion this year.

Lessons and future directions

The current account surplus should not lead to complacency in correcting the trade deficit. In the current global market conditions where export expansion is not possible, reducing import expenditure is vital to reduce trade deficit. However the long term resolution of the balance of payments problem must be by increasing exports.

Instead of blaming our weak export performance on global conditions, economic policies must be put in place to increase exports by producing price and quality competitive products. The country has succeeded in a few areas of exports such as garments, but a wider range of competitive exports and export surpluses are needed to improve the trade balance.

Leave a Reply

Post Comment