Columns

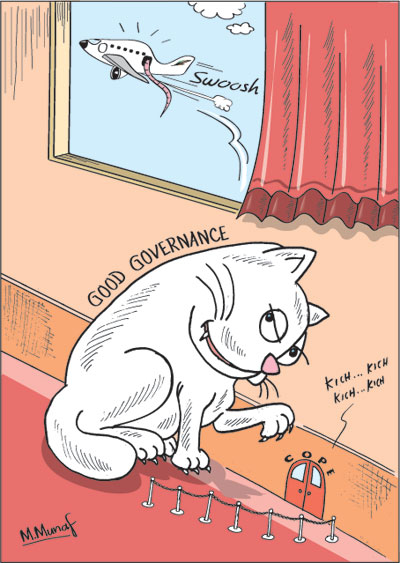

The dramatic bond issue: How COPE went beyond bioscope

View(s):- After some 18 months of strenuous debate and the UNP’s defence of former CBSL governor

- But footnotes added by UNP MPs as riders

JVP parliamentarian Sunil Handunetti, taking the centre stage as COPE chairman in probing the Central Bank bond scam is seen here at the Parliament complex corridor carrying the final draft of the widely awaited report. Pic by Indika Handuwela

By Our Political Editor

At no time before has the United National Party (UNP) used its might so strongly in Parliament to try and block what it perceived was a report not to its liking.

The first occasion was in June last year. The previous Committee on Public Enterprises (COPE) had completed its probe on the controversial Central Bank bond issue of February 2015. Its then Chairman, Communist Party’s D.E.W. Gunasekera was to table the report but the seventh Parliament was dissolved on June 26, 2015 by President Maithripala Sirisena. The Committee, like all other appointed parliamentary committees, became defunct and the report was rendered invalid. That report had already made some adverse findings on the Central Bank for the handling of the bond issue of 2015.

Yet, the 19-page 2015 COPE document which was not official, had received wide play in the media. The Sunday Times was even reported to the Speaker for breach of Parliamentary Privileges by Prime Minister Ranil Wickremesinghe on charges that it published the contents of that report. The report made indictments on the then Central Bank Governor Arjuna Mahendran and his son-in-law Arjun Joseph Aloysius. It said that Governor Mahendran and Perpetual Treasuries Limited, a company held by his son-in-law Aloysius (who resigned two months before the transaction) but was still co-owner of the holding company ‚Äúhad a related party transaction.‚ÄĚ However, President Sirisena did not grant an extension of service to Mahendran as Governor when his term expired in June last year amid high drama. The President had wanted the Deputy Governor appointed but the Prime Minister was insistent that Mahendran continue; then, there was a name sent from the Prime Minister‚Äôs Office (PMO) when the President was adamant he would not extend Mahendran; that name was sent back asking for more names and eventually the current holder of the post, Dr. Indrajit Coomaraswamy, was chosen as the compromise choice. Mahendran was thereafter inducted to the PMO and was a member of official delegations that travelled abroad with the Prime Minister and was introduced to heads of state in the glare of television cameras.

As criticism against the National Unity Government mounted, Prime Minister Wickremesinghe charged at a news conference on July 7 last year that the Gunasekera document was ‚Äúillegal and breached the Parliamentary Privileges Act.‚ÄĚ He charged that Gunasekera had committed ‚Äúa major fraud by distributing a document as part of a report.‚ÄĚ

The eighth Parliament of Sri Lanka, after the August 2015 parliamentary elections, picked the Janatha Vimukthi Peramuna’s (JVP) Sunil Handunetti as the new COPE Chairman. The task of probing the same Central Bank bond issue of February 2015 fell on him and the new members. For 14 long months they deliberated, examined evidence of Central Bank officials, Auditor General Gamini Wijesinghe among many others.

Their report was reaching finality. Tensions began to grow at COPE meetings as leaks in the media highlighted goings on. An internal report of the Central Bank, published in the media, came out with a bombshell stating that Perpetual Treasuries made an after-tax profit of Rs. 5 billion from the bond issues, the one under probe and others. The Bank reacted by trying to find out how its internal report leaked, but the damage was done. There was renewed public agitation to expose those involved.

Some of the UNP members in the Committee, some more than others, took on an aggressive posture after it became clear the emerging findings were going to embarrass the party. They had hoped that Chairman Handunetti would agree to go over the final draft paragraph by paragraph and delete what they wanted. They were strongly critical of the affable Auditor General Wijesinghe and declared his testimony could not be accepted. They were accused of using aggressive language, abusing their privileges as MPs on the AG who took things in his stride. One of the UNP MPs said it was merely a ‚Äúdebate‚ÄĚ they had with the AG. It was quite clear that the independent AG had done a critical, forensic study of the bond issue and faulted the former Governor.

However, eight of the 14 members present at a meeting (argued as the majority then) had already placed their signature on the final draft. The UNP members, particularly Ajith Perera, Harsha de Silva and Sujeewa Senasinghe — all deputy ministers — protested. They were to tell the Chairman that they would table dissenting reports. So much so, Handunetti told the Sunday Times last week he would have to allow even if all 26 members of the Committee were to present dissenting reports. At one point, the pressure from the UNPers was so high that he walked out in protest, said Handunetti. He was determined and tabled the report this week though the English and Tamil translations were not ready.

At this stage came a significant turn of events. It transpired that both in the case of the COPE and the Public Accounts Committee (PAC), there was no provision (in the Parliamentary Standing Orders) for members to present dissenting reports. Nor was there any provision for them to appoint an interim Chairman. Soon after Handunetti‚Äôs walk out, the UNP MPs had in fact named Abdulla Mahroof (UNP) as the interim Chairman. This, however, had no legal effect. Handunetti‚Äôs JVP referred to this as a ‚Äúbyescope‚ÄĚ (a cheap movie) punning on the word COPE, and said attempts to hijack COPE were futile. Harsha de Silva, however, told Parliament that he ran behind Chairman Handunetti and pleaded with him to return to the chair.

At this stage came a significant turn of events. It transpired that both in the case of the COPE and the Public Accounts Committee (PAC), there was no provision (in the Parliamentary Standing Orders) for members to present dissenting reports. Nor was there any provision for them to appoint an interim Chairman. Soon after Handunetti‚Äôs walk out, the UNP MPs had in fact named Abdulla Mahroof (UNP) as the interim Chairman. This, however, had no legal effect. Handunetti‚Äôs JVP referred to this as a ‚Äúbyescope‚ÄĚ (a cheap movie) punning on the word COPE, and said attempts to hijack COPE were futile. Harsha de Silva, however, told Parliament that he ran behind Chairman Handunetti and pleaded with him to return to the chair.

With the news that no dissenting reports were permitted, nor even an interim Chairman possible, public resentment (including ordinary UNP supporters) mounting and the media taking the message even overseas that it appeared the ruling UNP was filibustering, its members began to backtrack.

De Silva expressed regrets if there were any hurtful remarks against the Chairman. Ajith Perera went as far as to say the COPE had found fault with former CBSL Governor Mahendran but defended the Government. But what made this sudden turnaround from the UNP come about even if all the above factors were stacked against them?

The first indication emerged at the weekly ministerial meeting last Tuesday. Minister Rauff Hakeem paved the way for Prime Minister Wickremesinghe by raising a question. He wanted a discussion on where the Government stood on the CBSL bond issue. Wickremesinghe went on to make a statement. He said when the issue had first been brought out, Deputy Minister of Foreign Affairs (earlier deputy in the PM‚Äôs office) Harsha de Silva had written to the Central Bank asking for statistics on bond issues. The CBSL had replied providing those details only up to the end of 2008. The Premier said he believed that no approvals have been given by the Monetary Board of the CBSL for ‚Äúprivate placements‚ÄĚ during the period thereafter.

He said there was the danger of the entire issue (that would include transactions by Mahendran) becoming illegal if this was the position. Finance Minister Ravi Karunanayake was to point out that the amounts involved in the period after 2008 would be in the region of more than four trillion rupees. Wickremesinghe said he had asked the Attorney General to look into the matter and give his opinion. The idea was to regularise the issue. Thereafter, he would make a public statement, said Wickremesinghe. As a senior Sri Lanka Freedom Party (SLFP) Minister, who did not wish to be identified declared after the ministerial meeting, ‚ÄúWe want to see whether such a move is intended to absolve Mahendran. As far as we are concerned, the issue is not over and will not be over with the impending opinion of the Attorney General.‚ÄĚ Apart from those remarks, it also raises a question on why that lacuna was not detected when issues were raised last year. Another minister claimed that Nivard Cabraal, Governor of the Central Bank under the Mahinda Rajapaksa administration, had obtained written authority from the Monetary Board for bond issues even after 2008. He said he was in possession of a copy.

In this backdrop, a source said, the UNP consulted legal opinion. That led to their members agreeing to the COPE report subject to the inclusion of footnotes that placed on record their position. Thus, they have placed on record for future use, possibly during an investigation, what their position would be. During consultations that got under way thereafter, Chairman Handunetti agreed to the UNP stance on the matter. They would be incorporated as footnotes. The Committee‚Äôs own findings were further ‚Äėfine-tuned‚Äô to keep to legal parameters. Thus, Handunetti declared at a news conference on Friday, that all members of the Committee had agreed to the recommendations. All but one as anti-corruption crusader Ranjan Ramanayake of the UNP ducked the whole issue by saying he had just returned from Japan and was not able to study the final draft. Handunetti said no changes had been made to it. Some voted without the footnotes included whilst others did so after their inclusion, he pointed out.

“We carried out investigations under the powers vested in Parliament. This is a 55-page report. The annexures and documents being tabled have another 1,900 to 2000 pages,‚ÄĚ he told the news conference on Friday. He said the report covers the allegations about financial misappropriation that had taken place in the issue of Treasury bonds from February 2015 to May 2016 period. Handunetti revealed that the following 16 members accepted the report without the footnotes. Sunil Handunnetti (Chairman), Rauff Hakeem, Anura Priyadharshana Yapa, Dayasiri Jayasekara, Lakshman Senewiratne, Lasantha Alagiyawanna, Anura Dissanayake, Chandrasiri Gajadeera, Mahindananda Aluthgamage, Bimal Rathnayake, Weerakumara Dissanayake, S. Shritharan, Gnanamuthu Srineshan, M.A. Sumanthiran, Nalinda Jayathissa, Mavai S. Senathirajah ‚Äď from the SLFP, JO, JVP, TNA and the SLMC.

Those who accepted it subject to the inclusion of the footnotes, he said, were: Ravindra Samaraweera, Wasantha Aluvihare, Harsha De Silva, Ajith P. Perera, Ashok Abeysinghe, Hector Appuhamy, Sujeewa Senasinghe, Harshana Rajakaruna, and Abdullah Mahroof ‚Äď all of the UNP.

If the previous D.E.W. Gunasekera COPE document, which was never tabled in Parliament but widely publicised, concluded that Arjuna Mahendran and his son-in-law Arjun Joseph Aloysius were involved ‚Äúin a related party transaction,‚ÄĚ the official Handunetti report this week, some 17 months later, had a stronger conclusion. It said; ‚ÄúThe Committee observes that evidence has been disclosed that there has been reasonable doubt to the fact that the former Central Bank Governor Arjuna Mahendran made an intervention or used pressure in the transaction of bonds that took place on February 27, 2015, which were examined by the Committee.‚ÄĚ

The report adds: “The Committee observes that it has been disclosed there is reasonable doubt that some of the transactions lack transparency and the manner the transactions took place causes damage to the credibility of the Central Bank of Sri Lanka. Also, it is observed that one of the primary dealers, Perpetual Treasuries obtained large financial profits in the sale of bonds.

“Therefore: In order to recommend penalties and other directives against the Central Bank officials and Institutions responsible for the transactions and in order to recover the losses incurred by the public and Government, the Committee emphasises that legal action should be initiated against the persons and institutions responsible for the transactions.

“The Committee also recommends a post-supervision system to ensure that penalties and other directives issued are implemented. In order to ensure to prevent the recurrence of similar issues the Committee recommends that necessary checks and balances are maintained and other necessary steps are taken. To ensure that the Central Bank maintains the necessary checks and balances and to ensure the post-supervisory steps are implemented, the Parliament should directly intervene as it has the fundamental responsibility on public finance.

“The Committee emphasises that it is the responsibility of Parliament to recover the losses incurred by the Government and to act under existing laws and the Central Bank and related institutions should give an assurance to Parliament that a suitable mechanism is implemented to prevent the recurrence of such incidents. The Committee also recommends that the Executive should appoint a special supervisory team to observe the calling and awarding of tenders of the Central Bank to raise funds.

‚ÄúThe Committee recommends that a recognised institution with legal powers should investigate and necessary measures should be taken to prevent the recurrence of similar situations in which the credibility and transparency of the Central Bank was seriously affected by allowing a single institution ‚Äď Perpetual Treasuries gaining undue profit as a Primary dealer. The Committee recommends that state financial institutions should be given priority in raising funds through bonds and the Central Bank manual and other documents should include relevant clauses.

“The Committee strongly believes that it is the responsibility of the Central Bank as soon as possible to ascertain if the Government has suffered losses through this transaction and Perpetual Treasuries, as a Primary dealer has obtained large profits during a short period which should be investigated by a mechanism fully empowered to do so.

“The Committee recommends that a post-supervisory mechanism be established to supervise the markets of the primary dealers and secondary market to prevent financial irregularities in future. “The Operations Guide of the Public Debt Department which has not been updated so far, should be updated immediately with mention that state institutions should be given priority in raising funds by the sale of bonds.

“Former Central Bank Governor Arjuna Mahendran is directly responsible for the particular bond transaction and the Committee recommends that legal action should be taken against him and the relevant officials of the Central Bank. The Committee recommends that the Exchange Control Act and other laws should be amended in order to protect the credibility of the Central Bank and ensure transparency.

‚ÄúThe Committee believes that it is the firm belief that all documents, information and evidence (though some of the information is sensitive) should be submitted as soon as possible keeping with the Constitutional powers on control of state finances. Accordingly, the Committee is making these recommendations and submitting the recommendations of the Auditor General and his findings to parliament with the firm belief that there will be an open discussion in Parliament on this report.‚ÄĚ

Here are highlights of some of the footnotes given to COPE Chairman Handunetti and published in the report:

- The 9.48 percent interest was determined by the Central Bank interest rates and not determined independently based on market rates. (Ref. page 22)

- In the morning on February 27, 2015 (the day of the bond issue) the Operational Committee decided that the regulation that if a bank deposits money for more than three days in the Central Bank the interest rate will be reduced from 6.5 per cent to 5 per cent was removed. Thereby it was restored to 6.5 per cent. (Ref page 22)

- The time has been extended beyond 11.00 p.m. for one buyer. That is for the HSBC for Rs. 100 million until 11.04.26 p.m (Ref page 23)

- The evidence recorded shows that the Central Bank called up primary dealers on the previous day and checked with them about purchase of (bonds) for around Rs. 10 billion. Perpetual Treasuries too received a telephone call. Perpetual Treasuries auctioned for Rs. 3 billion at 12.5 per cent, Rs 5 billion at 12.75 per cent and Rs. 5 billion at 13 per cent and shortly before the auction instructions were sent on email to the Bank of Ceylon on February 27, 2015 at 10.48 am. The Bank of Ceylon sent out the bids at 10.57.22, 10.57.41 and 10.57.57 respectively to the Central Bank. According to records the HSBC bid was sent at 11.06 a.m. (Ref page 23).

- The decision to increase the sum to be raised from Rs one billion to Rs 10 billion was taken based on a professional decision by a team, according to Chairman of the tender committee P.Samarasiri. (Ref page 24)

- According to Superintendent of the Public Debt Department the former Central Bank Governor had not said ‚ÄėDo it‚Äô, but instead had given the idea ‚Äėwhy don‚Äôt you go for ten?‚ÄĚ Even in the Auditor General report it is mentioned that the former Central Bank Governor had told Ms Seneviratne ‚ÄėWhy don‚Äôt you go for ten ?‚ÄĚ and there is no other evidence contrary to that (Ref page 24)

- There is no evidence that former Central Bank Governor Arjuna Mahendran or Deputy Governors Dr Nandalal Weerasinghe and Ananda Silva made inquiries or intervened in the particular auction (Ref. Page 37)

As is clear, the thrust of these footnotes is to make clear that Mahendran has not been responsible of any impropriety.

The bond issue is undoubtedly one of the issues over which tensions between the SLFP and the UNP, the two principal partners of the Government, have grown high. The UNP is confident that it can, through the documentation Deputy Minister Harsha de Silva has received, prove its case that its man Arjuna Mahendran is not to blame. However, it is another story with the SLFP. Some of the frontliners have come out strongly calling for action against the former Central Bank Governor and the alleged irregularities in the transaction. At least in this, the pro-Sirisena and the pro-Rajapaksa groups in Parliament appear to be on the same platform.

‚ÄúWe are asking for a debate on the COPE report before the November 10 budget,‚ÄĚ ‚ÄėJoint Opposition‚Äô Leader Dinesh Gunawardena told the Sunday Times yesterday. He said the Opposition groups would not allow the ‚Äėbond scam‚Äô to be a forgotten issue. ‚ÄúWe are also writing to President Sirisena asking him to appoint a Presidential Commission of Inquiry to probe the matter,‚ÄĚ he added.

JVP leaders said that they would not permit the UNP to succeed in protecting Mahendran and sacrificing his son-in-law only. Others point out that COPE cannot give directives to a private company like Perpetual Treasuries so when the UNP tries to clear Mahendran and give the go-ahead to prosecute Aloysious only, there may be legal obstacles in that exercise.

As is clear, the COPE report is meant for Parliament. Any further action on the findings could see the emergence of a resolution. A country and its people await the next phase on a controversy that has gone on for over a year.

| Local company gets huge housing project without tendersA Rs. 1.2 billion project to refurbish the Nila Sevana Housing Scheme is being awarded to a local company on the basis of its reported past performance. No tenders have been called or expressions of interest sought from other parties. The move comes on the joint recommendation from Development Strategies and International Trade Minister Malik Samarawickrema, and Public Administration and Management Minister Ranjith Maddumabandara. Making a case for the award of the project to Walkers CML, the two ministers have said, ‚ÄúThe Nila Sevana Housing Project is a joint project entered into in 2003 by the Board of Investment of Sri Lanka (BOI), Ministry of Public Administration and Management Reforms (now known as the Ministry of Public Administration and Management) and a private company Wincon Development Ceylon (Private) Limited (now acquired as Walkers CML Properties (Private) Limited). The Chairman of Walkers CML is Azmil Khalil Bin Dato Khalil, a Malaysian national. Jehan Prasanna Amaratunga is the Group Executive Director and Deputy Chairman whilst Dian Jayasuriya is Managing Director and Chief Executive Officer. Pointing out that the project was intended to increase the ‚Äústock of affordable housing in the country,‚ÄĚ the two Ministers have noted that ‚ÄúSelected underutilised crown lands suitable for residential development were identified by the Ministry of Public Administration and Management and vested with the Board of Investment. These lands were then leased (zero value lease basis) to Wincon Development Ceylon (Private) Limited for the said purpose of development. The pilot projects, it has been pointed out, have been spread over two districts, Galle and Kandy, with the intention to cover all districts over time. In Galle District, 1,088 apartments were built across two sites ‚Äď 512 apartments in Wakunagoda and 576 in Habaraduwa. ‚ÄúUnfortunately, the initial developers (Wincon) were unable to complete both projects due to funding constraints and matters related to general lack of understanding on local documentation processes and regulations. The project lay idle from approximately mid-2011 to January 2015, the two Ministers have said in their joint memorandum. ‚ÄúIt is learnt that the Habaraduwa project was brought over for approximately Rs. 900 million and estimated that the apartment can be sold to buyers for a sum of approximately Rs 1.3 billion, after refurbishment, which makes it financially non-viable for refurbishment, as is, infusing a further sum of Rs. 600 million.‚ÄĚ The two ministers have claimed that ‚Äúmarket study shows that there is a lack of affordable accommodation for foreign and local tourists in the Habaraduwa area.‚ÄĚ They point out that ‚Äúmost places offering accommodation come in the form of high-end luxury vilas or ad-hoc guest rooms which are mostly homes that are temporarily converted. Hence, the duo wants the Cabinet of Ministers to allow Walkers CML ‚Äúto develop it as a residential cum tourism project with the infusion of Rs. 1.2 billion.‚ÄĚ | |

Leave a Reply

Post Comment