Columns

Will the 2017 “People’s Budget” heed the advice of economists?

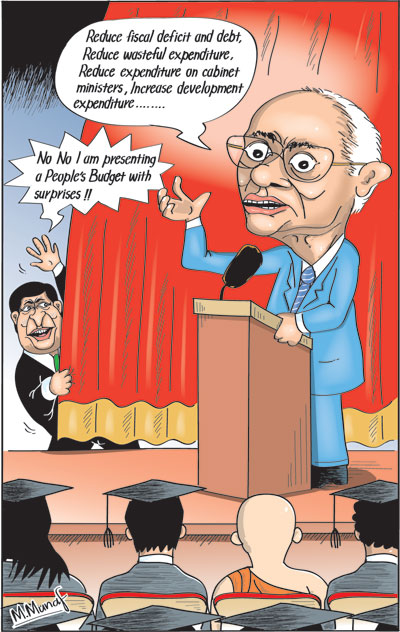

View(s):On the eve of the 2017 budget, it is pertinent to ask whether the Finance Minister would take the advice on fiscal consolidation of economists articulated at the Annual Sessions of the Sri Lanka Economics Association (SLEA) where the consensus was that fiscal consolidation was imperative to achieve sustainable high economic growth.

Keynote

Keynote

The comprehensive keynote address by W.A. Wijewardena, former Central Bank Deputy Governor, elaborated on the fiscal issues that Central Bank Governor Coomaraswamy and the Resident Representative of the IMF, Dr (Mrs) Eteri Kvintradze brought out. These were discussed in last Sunday’s column. Wijewardena added other significant dimensions to fiscal (See Ceylon FT of October 24). Wijewardena pointed out leaks in government expenditure such as the losses of public enterprises and excessive expenditure on cabinet ministers that should be contained. He argued that while increasing revenue was imperative, reducing wasteful expenditure was also necessary to achieve a lower fiscal deficit.

Volatile low growth

Wijewardena demonstrated that Sri Lanka’s growth since independence had a high level of volatility. From 1951-2015, the annual growth rate averaged 4.7 per cent and during this long 65-year period there were growth rates of above 7 per cent only in six years. “Even then,” he pointed out, “they are way apart from each other except for a brief period during 2010-2012.” In all other years economic growth was below 5 percent. Therefore achieving sustained high growth is a serious challenge.

Fiscal policy

Fiscal policy

Wijewardena contended that high growth has been attempted through expansionary fiscal and monetary policies thereby raising aggregate demand and causing an overheating in the economy. Consequently, it has resulted in above average inflation that increased the cost of production that eroded the country’s competitiveness and put pressure for the exchange rate to depreciate against major currencies.

At the root of this problem, Wijewardena pointed out, was a very poor fiscal policy track record: “Ministers of Finance come up with budgets with ambitious fiscal targets, hail their products as ‘development budgets’ and spend more time in criticising their predecessors instead of proposing strategies for the future.” Will the “People’s Budget” to be presented in four days time be a repeat this scenario?

Budget process

Wijewardena pointed out that “Budgeting is a process which requires continuous review, identification of deviations and making amendments to current strategies to address those deviations. If this process is not followed, the fiscal situation of the country begins to deteriorate year after year, reaching a situation where the country is unable to improve the conditions without making sacrifices on a massive scale or getting external support. Today, Sri Lanka’s fiscal situation is exactly in this condition.”

Fiscal problems

Wijewardena identified the main fiscal problems as the need to prune the government sector, which has grown beyond the country’s carrying capacity; decide on priorities carefully allocating funds for future growth generating sectors; reform of loss making public enterprises so that they would not be a burden to taxpayers; and improve government revenue base so that it would enable financing the ever-growing expenditure through revenues from taxes, profits and other sources. Furthermore, the government must stop unnecessary expenditure programs that have become a drain on scarce government resources. By these means “the budget has to be consolidated to reduce the ever-increasing public debt driving the country to an inescapable debt trap.”

Waste corruption and profligacy

Wijewardena emphasised that waste, corruption, and profligacy in expenditure have to be eliminated promoting thrift at every level. The current fiscal crisis should be recognised, communicated effectively to the electorate and the painful measures needed to be taken should be properly marketed.

Towards a debt crisis

Wijewardena observed that the high public debt levels have eaten up almost the entirety of government revenue for its servicing. Although the recorded public debt as a percent of GDP has declined from above 100 per cent in early 2000s to around 72 per cent over the last five-year period, there are a lot more debt issues to be reckoned, such as the rising commercial external debt raised at high costs for unproductive infrastructure projects without proper cost-benefit analysis. Maintaining such unproductive infrastructure projects and servicing such debt is a burden on taxpayers. In addition the total indebtedness of the public sector has not been recorded as a large segment of borrowings by public sector institutions on government guarantees has been left out.

Loss-making SOEs

An important fiscal issue raised by Wijewardena was that loss-making public enterprises could be turned around to enable them to contribute to the public coffers. The annual losses of leading loss-makers such as SriLankan Airlines, Mihin Air, Ceylon Electricity Board, Ceylon Petroleum Corporation, Cooperative Wholesale Establishment and Ceylon Transport Board have been more than Rs.100 billion. The implication of such loss-making for the budget has been that scarce resources have to be used to keep them going.

No concrete action

Although the Ministry of Finance had emphasised that public enterprises should deliver an adequate return to the Treasury on the investments it has made, no concrete action was initiated by the Ministry to force these enterprises to deliver positive returns. He was of the view that the progress on the initiative by the present Government to restructure loss-making public enterprises has been slow and in the interim, the Treasury has been forced to fund their losses so that they could keep their balance sheets clean to borrow from commercial banks. Wijewardena argued that one mistake made by the present government was the decision to amalgamate SriLankan Airlines and Mihin Air as both are sick enterprises and the Treasury will have to pump money to keep both going. This will increase the taxpayers’ liability rather than easing it.

Monetary and fiscal policies

A very important, issue raised in the keynote address was the need for coordination between fiscal policy and monetary policy. When the Central Bank tightens monetary policy to fight inflation, the Ministry of Finance introduces measures which weaken the Central Bank’s action. A good example was the tightening of monetary policy by the Central Bank in July 2016 by increasing its policy rates by half a per cent to curtail the expansion of aggregate demand. Almost immediately, the Ministry of Finance announced the granting of the duty free car importation facility to public servants stimulating demand and negating the action taken by the Central Bank.

Conclusion

The technical sessions that followed confirmed and elaborated on the need for fiscal reforms, the containment of the domestic and foreign debt and needed reforms in trade policies to enhance exports to bring down the trade deficit. Will these suggestions and proposals be taken into account in formulating the Budget for 2017 on November 10?

Leave a Reply

Post Comment